Stamp Duty Rates

This article details current and historic stamp duty rates in England since 1972 and links to our Stamp Duty Calculator so that you can calculate the Stamp Duty you will have to pay and see how Stamp Duty Tax rates has changed cover the last 50 years and how the way Stamp Duty Tax is calculated has changed.

What is Stamp Duty?

Stamp Duty is a tax paid when you buy a property above a certain price. Above a certain threshold it is payable when you buy a freehold property, a new or existing leasehold property, buy a property through a shared ownership scheme or if you are transferred property in exchange for payment.

Stamp Duty History

Stamp Duty has been around for a very long time, it was introduced into England on 28 June 1694 during the reign of King William III (also known as William of Orange). It was established in parliament to last for four years and the tax was raised to help pay for the war against France and Louis XIV and was initially raised on Vellum, Parchment and Paper.

It was not a popular tax, the Stamp Act of 1765 attempted to raise Stamp Duty in the British colonies in America contributed to the outbreak of the American War of Independence. The arrival of ships bearing ‘stamped papers’ led to major rioting, the most well known being the riots of the Boston Tea Party

It was not until 1808 that Stamp Duty was first applied to housing in respect of conveyances on a home’s sale.

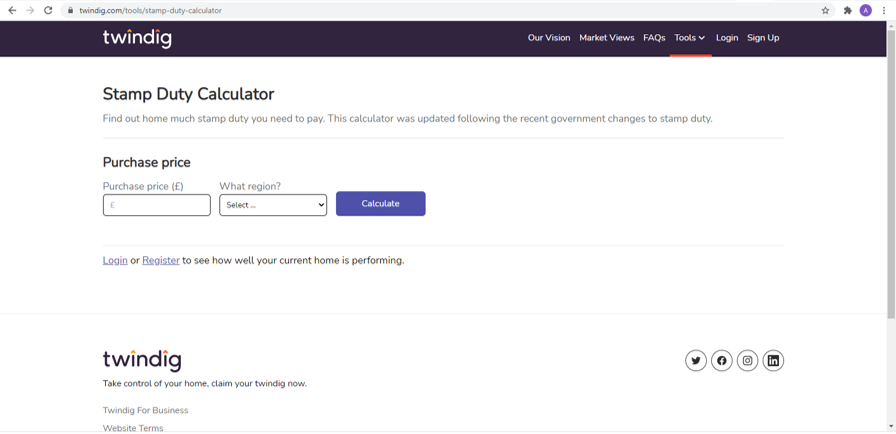

Stamp Duty Calculator

You can use our stamp duty calculator to work out how much Stamp Duty you will need to pay. Amounts vary depending on where the property is: England, Scotland, Wales or Northern Ireland, whether or not you are a first time buyer and if you are purchasing you main home or an additional property such as a holiday home, a holiday let or a buy to let property. Our Stamp Duty Calculator takes all of these factors into account

How is Stamp Duty Calculated?

The current method of calculating Stamp Duty was introduced on 3 December 2014. The amount of Stamp Duty that you have to pay is based on the purchase price of the property. Currently in England the Stamp Duty you will pay on your primary residence is:

- No stamp duty on homes costing up to £500,000

- 5% on the amount of the purchase price between £500,001 and £925,000

- 10% on the amount of the purchase price between £925,001 and £1,500,000 and

- 12% on any amount above £1,500,000

How was Stamp Duty Calculated before 3 December 2014?

Before the 3rd December 2014 Stamp Duty was calculated on a slab rather than a slice system. If the home you were buying fell into the £250,001 to £500,000 Stamp Duty Band you would pay the Stamp Duty rate for that band on the full price of your home.

For instance, if your house cost £265,000 and the £250,001 to £500,000 band was 3.0% you would £7,950 = £265,000 x 3%

Why was Stamp Duty changed from a slab to a slice system?

The main reason for the change was that the slab system led to a bunching of house prices around each Stamp Duty band threshold. Just before the change from slab to slice the difference in Stamp Duty payable on a house costing £249,999 was £2,500 whereas the Stamp Duty on a house costing £250,001 was £7,500 and increase of £5,000 between an increase of some 200%

Stamp Duty rates from 1 April 2021

First Time Buyers

Houses costing up to £300,000

- Up to £300,000 Nil

Houses costing between £300,000 and £500,000

- Up to £300,000 Nil

- £300,00 to £500,000 5.0%

Houses costing more than £500,000

- Up to £125,000 Nil

- £125,000 to £250,000 2.0%

- £250,001 to £925,000 5.0%

- £925,000 to £1,500,000 10.0%

- More than £1,500,000 12.0%

Primary residence Homemovers

- Up to £125,000 Nil

- £125,000 to £250,000 2.0%

- £250,001 to £925,000 5.0%

- £925,000 to £1,500,000 10.0%

- More than £1,500,000 12.0%

Additional properties and Buy to Let properties

- Up to £40,000 Nil

- £40,000 to £125,000 3.0%

- £125,000 to £250,000 5.0%

- £250,001 to £925,000 8.0%

- £925,000 to £1,500,000 13.0%

- More than £1,500,000 15.0%

Stamp Duty from 8 July 2020 to 31 March 2021

Primary residence

- Up to £500,000 Nil

- £500,001 to £925,000 5.0%

- £925,000 to £1,500,000 10.0%

- More than £1,500,000 12.0%

Additional properties

- Up to £40,000 Nil

- £40,000 to £500,000 3.0%

- £500,001 to £925,000 8.0%

- £925,000 to £1,500,000 13.0%

- More than £1,500,000 15.0%

Stamp Duty from 22 November 2017 to 7 July 2020

First Time Buyers

Houses costing up to £300,000

- Up to £300,000 Nil

Houses costing between £300,000 and £500,000

- Up to £300,000 Nil

- £300,00 to £500,000 5.0%

Houses costing more than £500,000

- Up to £125,000 Nil

- £125,000 to £250,000 2.0%

- £250,001 to £925,000 5.0%

- £925,000 to £1,500,000 10.0%

- More than £1,500,000 12.0%

Primary residence Homemovers

- Up to £125,000 Nil

- £125,000 to £250,000 2.0%

- £250,001 to £925,000 5.0%

- £925,000 to £1,500,000 10.0%

- More than £1,500,000 12.0%

Additional properties

- Up to £40,000 Nil

- £40,000 to £500,000 3.0%

- £500,001 to £925,000 8.0%

- £925,000 to £1,500,000 13.0%

- More than £1,500,000 15.0%

Stamp Duty from, 1 April 2016

Primary Residence

- Up to £125,000 Nil

- £125,000 to £250,000 2.0%

- £250,001 to £925,000 5.0%

- £925,000 to £1,500,000 10.0%

- More than £1,500,000 12.0%

Additional properties

- Up to £40,000 Nil

- £40,000 to £500,000 3.0%

- £500,001 to £925,000 8.0%

- £925,000 to £1,500,000 13.0%

- More than £1,500,000 15.0%

Stamp Duty from 3 December 2014 to 31 March 2016

- Up to £125,000 Nil

- £125,000 to £250,000 2.0%

- £250,001 to £925,000 5.0%

- £925,000 to £1,500,000 10.0%

- More than £1,500,000 12.0%

Stamp Duty: 21 March 2012 to 2 December 2014

Stamp Duty paid by strict band. If your home costs £275,000 you pay 3.0% on the whole £275,000

- Up to £125,000 Nil

- £125,000 to £250,000 1.0%

- £250,001 to £500,000 3.0%

- £500,000 to £1,000,000 4.0%

- £1,000,000 to £2,000,000 5.0%

- More than £2,000,000 7.0%

Stamp Duty: 1 January 2012 to 20 March 2012

- Up to £125,000 Nil

- £125,000 to £250,000 1.0%

- £250,001 to £500,000 3.0%

- £500,000 to £1,000,000 4.0%

- More than £1,000,000 5.0%

Stamp Duty: 6 April 2010 to 31 December 2011

First Time Buyers

- Up to £250,000 Nil

- £250,001 to £500,000 3.0%

- £500,000 to £1,000,000 4.0%

- More than £1,000,000 5.0%

All other buyers

- Up to £125,000 Nil

- £125,000 to £250,000 1.0%

- £250,001 to £500,000 3.0%

- £500,000 to £1,000,000 4.0%

- More than £1,000,000 5.0%

Stamp Duty: 25 March 2010 – 5 April 2010

First Time Buyers

- Up to £250,000 Nil

- £250,001 to £500,000 3.0%

- More than £500,000 4.0%

All other buyers

- Up to £125,000 Nil

- £125,000 to £250,000 1.0%

- £250,001 to £500,000 3.0%

- More than £500,000 4.0%

Stamp Duty: 1 January 2011 to 24 March 2010

- Up to £125,000 Nil

- £125,000 to £250,000 1.0%

- £250,001 to £500,000 3.0%

- More than £500,000 4.0%

Stamp Duty: 3 September 2008 to 31 December 2010

- Up to £175,000 Nil

- £175,000 to £250,000 1.0%

- £250,001 to £500,000 3.0%

- More than £500,000 4.0%

Stamp Duty: 23 March 2006 to 2 September 2008

- Up to £125,000 Nil

- £125,000 to £250,000 1.0%

- £250,001 to £500,000 3.0%

- More than £500,000 4.0%

Stamp Duty: 17 March 2005 to 22 March 2006

- Up to £120,000 Nil

- £120,000 to £250,000 1.0%

- £250,001 to £500,000 3.0%

- More than £500,000 4.0%

Stamp Duty: 28 March 2000 to 16 March 2005

- Up to £60,000 Nil

- £60,000 to £250,000 1.0%

- £250,001 to £500,000 3.0%

- More than £500,000 4.0%

Stamp Duty: 16 March 1999 to 27 March 2000

- Up to £60,000 Nil

- £60,000 to £250,000 1.0%

- £250,001 to £500,000 2.5%

- More than £500,000 3.5%

Stamp Duty: 24 March 1998 to 15 March 1999

- Up to £60,000 Nil

- £60,000 to £250,000 1.0%

- £250,001 to £500,000 2.0%

- More than £500,000 3.0%

Stamp Duty: 8 July 1997 to 23 March 1998

- Up to £60,000 Nil

- £60,000 to £250,000 1.0%

- £250,001 to £500,000 1.5%

- More than £500,000 2.0%

Stamp Duty: 23 March 1993 to 7 July 1997

- Up to £60,000 Nil

- More than £60,000 1.0%

Stamp Duty: 20 August 1992 to 22 March 1993

- Up to £30,000 Nil

- More than £30,000 1.0%

Stamp Duty: 20 December 1991 to 19 August 1992

- Up to £250,000 Nil

- More than £250,000 1.0%

Stamp Duty: 20 March 1984 to 19 December 1991

- Up to £30,000 Nil

- More than £30,000 1.0%

Stamp Duty: 22 March 1982 to 19 March 1984

- Up to £25,000 Nil

- £25,001 to £30,000 0.5%

- £30,001 to £35,000 1.0%

- £35,001 to £40,000 1.5%

- More than £40,000 2.0%

Stamp Duty: 6 April 1980 to 21 March 1982

- Up to £20,000 Nil

- £20,001 to £25,000 0.5%

- £25,001 to £30,000 1.0%

- £30,001 to £35,000 1.5%

- More than £30,000 2.0%

Stamp Duty: 1 May 1974 to 5 April 1980

- Up to £15,000 Nil

- £15,001 to £24,999 0.5%

- £25,000 to £29,999 1.0%

- £30,000 or more 1.5%

Stamp Duty: 1 August 1972 to 30 April 1974

- Up to £10,000 Nil

- More than £10,000 0.5%