UK housing market: 2020 ended on a high and 2021 will be a fun ride

We may not have been able to celebrate Christmas as usual or welcomed in the new year with as much fizz as we'd hoped, but whilst we remained muted indoors the UK housing market finished 2020 with a bang and much celebration. House prices at record highs, whichever of the main indices you look at. Mortgage approvals in November came in at their highest level since August 2007, their last hurrah before the Global Financial Crisis, let's hope the Global Pandemic has less impact on the UK housing market. In our view, the market will run at full speed until the end of March when the Stamp Duty stabilisers come off, but we don't think it needed the stabilisers in the first place. So put your helmet on, 2021 is going to be quite a ride.

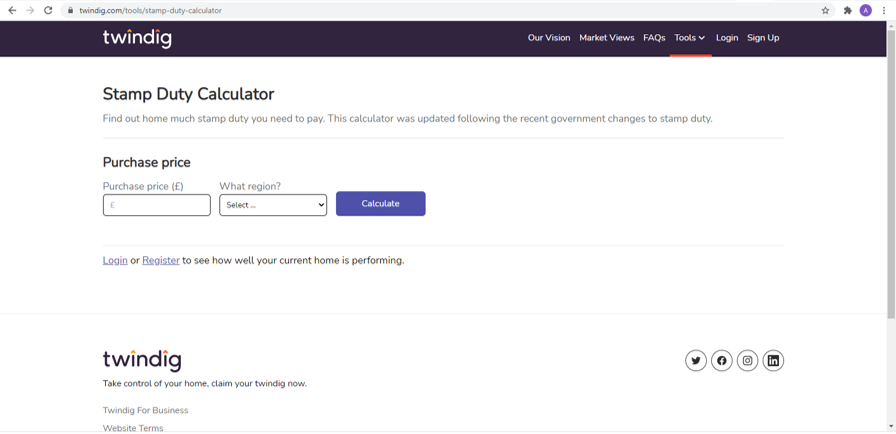

Halifax House Price Index

The Halifax released their house price index for December 2020 this week.

What they said

House prices end 2020 at a record high

House price growth slowing

Residual house price strength in near the term

Lockdown and unemployment may subdue house price growth

Twindig take

House Prices end 2020 at a new high in the Halifax House Price Index up 6% in the year to £253,374. 2020 saw a subdued first and strong second. Will 2021 be a mirror image of 2020 with a strong first half and a subdued second as the Stamp Duty Holiday ends and the possibility of increased capital gains tax on housing transactions takes the heat out of the housing market? Or will the vaccine cure COVID and heal our economy and keep the UK housing market-fighting fit?

The strength of house prices in the second half of 2020 took everyone by surprise and we believe that those in stable jobs had a financially strong 2020 seeing their savings rise as lockdowns reduced the opportunities to spend. As we get used to spending more and more time in our home it is not surprising that we want to improve their home environment and for many that will mean moving home. Those with firm financial foundations will be able to move and we expect house prices to rise by 5% this year even if the second half is a little bumpy.

Bank of England Mortgage Approvals

The Bank of England published mortgage approval data for November this week.

What they said

Mortgage approvals in November 105,000

Highest level since August 2007

Twindig Take

This is a very interesting milestone, in the middle of a global pandemic, we have the highest level of mortgage approvals since the Credit Crunch crunched - in the middle of a global pandemic. It might be chilly outside, but the UK housing market is hot. It is our view that the housing market was heating up before the Stamp Duty Holiday and did not need the Stamp Duty Holiday in the first place. You can read our All you need to know about Stamp Duty Holidays article for our full analysis.

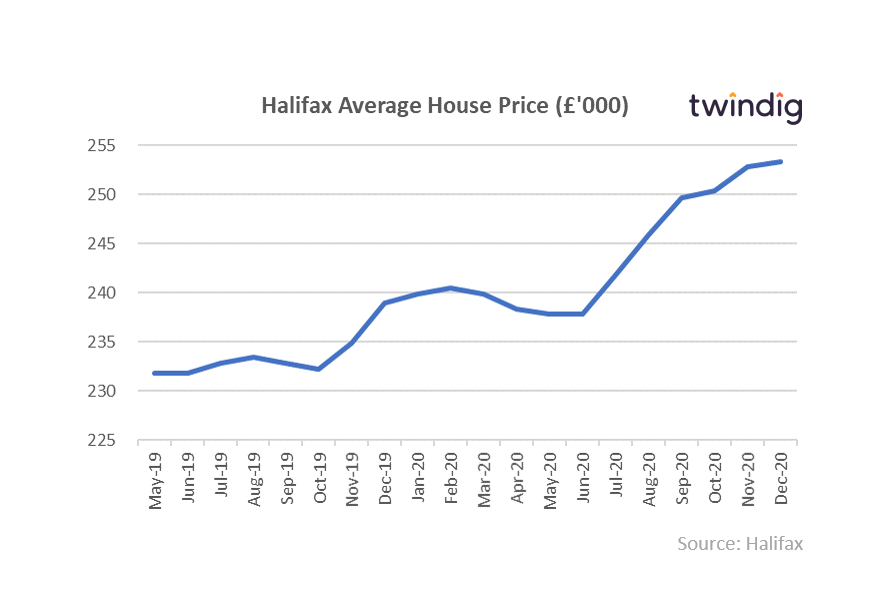

Average Mortgage Rates

The Bank of England also released data this week on average mortgage rates

What they said

Average Mortgage rates for New Business 1.84%

2 year fixed rate mortgage rates were, on average:

Average rate for 2 year fix 60% LTV 1.38%

Average rate for 2 year fix 75% LTV 1.83%

Average rate for 2 year fix 95% LTV 4.11%

Twindig Take

Mortgages continue to be cheap for those who can afford it but increasingly out of reach for those who can’t. Those with small deposits are penalised whilst equity-rich buyers are sitting pretty. This is no surprise, because the lower the Loan to Value, the lower the risk to the lender. The significant gap between 60% and 95% LTVs illustrates how nervous lenders are about UK house prices on a two-year view.

Barratt Developments

The FTSE 100 housebuilder issued a trading update on Friday about its performance over the last 6 months.

What they said

We have had an excellent first-half performance

Strong customer demand across the country

Demand supplemented by the Stamp Duty Holiday

Twindig Take

Barratt Developments reported strong underlying demand, strong pent-up demand and strong demand from the Stamp Duty Holiday, in what it is calling an ‘excellent first-half performance’.

Sales volumes were up 9.2%, private house prices up 2.2% and forward sales up 14.3% in volume and 19.4% in value.

Barratt handled the challenging conditions of the first half of its financial year (July to December) with aplomb. It is well set for the second half with a strong orderbook and cash in the bank, the fact that it is looking at a growing number of land opportunities is a bonus and bodes well for the medium-term outlook for the UK housing market.

Average UK house prices

This week we dug into the Land Registry data at a regional level to look at house price changes since COVID and since Brexit, as well as the usual annual and monthly changes. Can you guess which region has seen its house prices increase by 7.9% since the first COVID lockdown or which region has seen house prices increase by just over 22% since the EU Brexit Referendum? Read our article on Average House Prices by Region to find out

Stamp Duty Holidays all you need to know

There has been a lot of talk about Stamp Duty Holiday’s this week, the race to complete by 31 March 2021 and whether the Stamp Duty Holiday should be extended. If you want to know more about Stamp Duty Holidays we have put together an all you need to know guide which looks at – All you need to know about Stamp Duty Holidays - what happened in previous Stamp Duty Holidays and what is happening in this one.

As it stands the rates will change on the 1 April 2021 from:

Stamp Duty from 8 July 2020 to 31 March 2021

Primary residence (All buyers)

Up to £500,000 Nil

£500,001 to £925,000 5.0%

£925,000 to £1,500,000 10.0%

More than £1,500,000 12.0%

Additional properties

Up to £500,000 3.0%

£500,001 to £925,000 8.0%

£925,000 to £1,500,000 13.0%

More than £1,500,000 15.0%

Stamp Duty rates from 1 April 2021

First Time Buyers

Houses costing up to £300,000

Up to £300,000 Nil

Houses costing between £300,000 and £500,000

Up to £300,000 Nil

£300,00 to £500,000 5%

Houses costing more than £500,000

Up to £125,000 Nil

£125,000 to £250,000 2.0%

£250,001 to £920,000 5.0%

£925,000 to £1,500,000 10.0%

More than £1,500,000 12.0%

Primary residence Homemovers

Up to £125,000 Nil

£125,000 to £250,000 2.0%

£250,001 to £925,000 5.0%

£925,000 to £1,500,000 10.0%

More than £1,500,000 12.0%

Additional properties and Buy to Let properties

£40,000 to £125,000 3.0%

£125,000 to £250,000 5.0%

£250,001 to £925,000 8.0%

£925,000 to £1,500,000 13.0%

More than £1,500,000 15.0%

To see how much Stamp Duty you need to pay under the current rates you can use our Stamp Duty Calculator.