Housepresso 19 June 22

Rental Reforms a rebalancing of power

The Government hopes that the fairer private rented sector white paper published this week will ensure millions of families benefit from living in decent, well-looked-after homes as part of the biggest shake-up of the private rented sector in 30 years. But has the rebalancing of power gone too far?

Benefits to bricks

In our view, if carefully executed, the Benefits to Bricks initiative could lead to a watershed moment for all aspiring homeowners, and not just those currently living in social housing.

A safe and secure home is one of our biggest and most important needs. Homeownership takes away uncertainty, provides security and provides an opportunity for every household to accumulate wealth. The current model for buying homes is broken, in this article, we look at if 'benefits to bricks' might hold the keys to fixing our broken housing market.

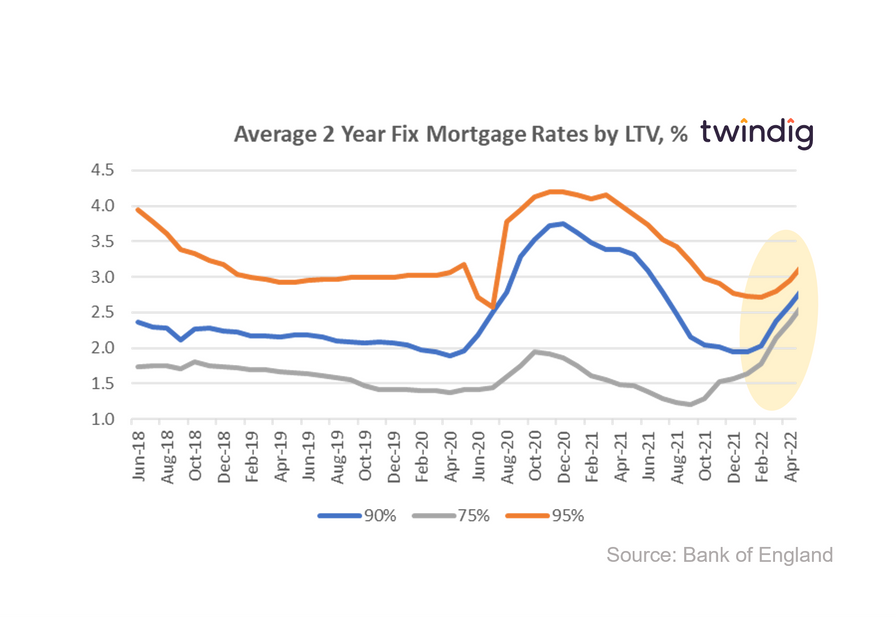

Mortgage rates rise in May

Mortgage rates continued to rise in May 2022. The average mortgage rate for a 2-year fixed-rate 75% LTV Mortgage increased by 11.4% in May to 2.63% and has increased by almost 80% since May 2021.

Interestingly although the average mortgage rates for 90% and 95% LTV 2-year fixed-rate mortgages increased by around 10% in May, both remain below the May 2021 levels.

Therefore although rates are rising it is still possible to secure a very attractive mortgage rate, but one might have to hurry...

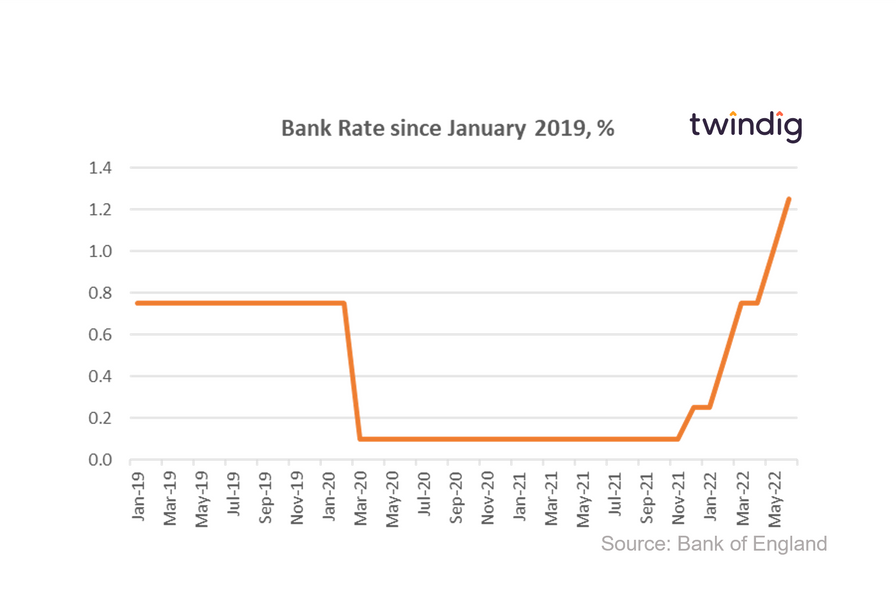

Bank Rate rises in June

Bank Rate increased from 1.00% to 1.25%

The MPC voted by a majority of 6-3 for a 25 basis point increase

The MPC members in the minority voted for a 50 basis point increase

Do interest rates drive the housing market?

Earlier this month I was interviewed by Iain McKenzie the CEO of the Guild of Property Professionals. We discussed the housing market and the interaction between interest rates and the housing market.

The link between Bank Rate (the main interest rate set by the Bank of England, which impacts all other UK interest rates) and the housing market is not as clear-cut as one may think.

We also discuss what our currently inflationary environment means for house prices, and

Is now a good or bad time to be buying and selling a home.

Twindig Housing Market Index

As the mercury rose this week, the Twindig Housing Market Index fell by 3.9% to 72.2, its lowest level since 13 November 2020. The rise in Bank Rate, and the heightened expectation of higher rates to come raised concerns about the future direction of the housing market, and led some to ask whether the house price party is over?