Housepresso 15 May 22

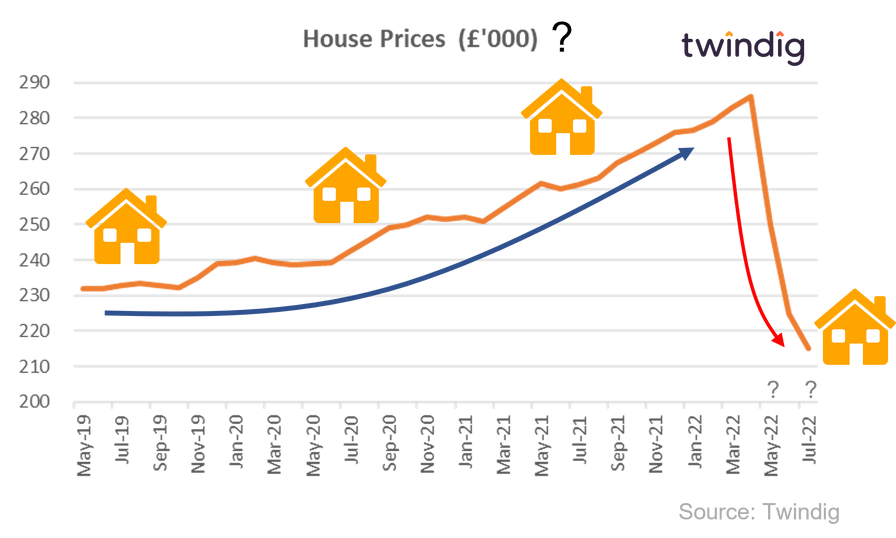

Will house prices fall as down valuations rise?

As mortgage brokers such as Alder Rose report that the level of down valuations are doubling, we look at what down valuations may mean for you.

Fertile ground for further house price growth

The latest RICSs Residential Housing Market Survey reported this week that new buyer enquiries increased for the eighth successive month. Demand continues to outweigh supply, which in turn will underpin house prices and provide fertile ground for continued house price growth

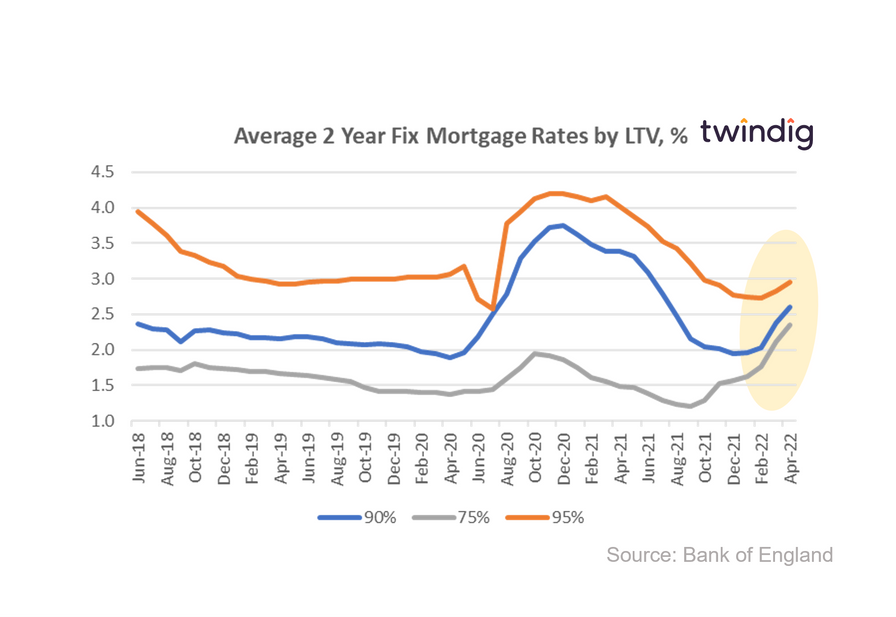

Average mortgage rates rise again

There can be little doubt now that mortgage rates are on the rise. The average new business mortgage rate for 75% LTV two year fixed rate mortgages has risen for the last seven months in a row, almost doubling, from 1.20% in September 2021 to 2.35% in April 2022.

We expect Bank Rate to continue to rise, and the Bank of England hs said that it could increase to 2.5% from its current 1.0%.

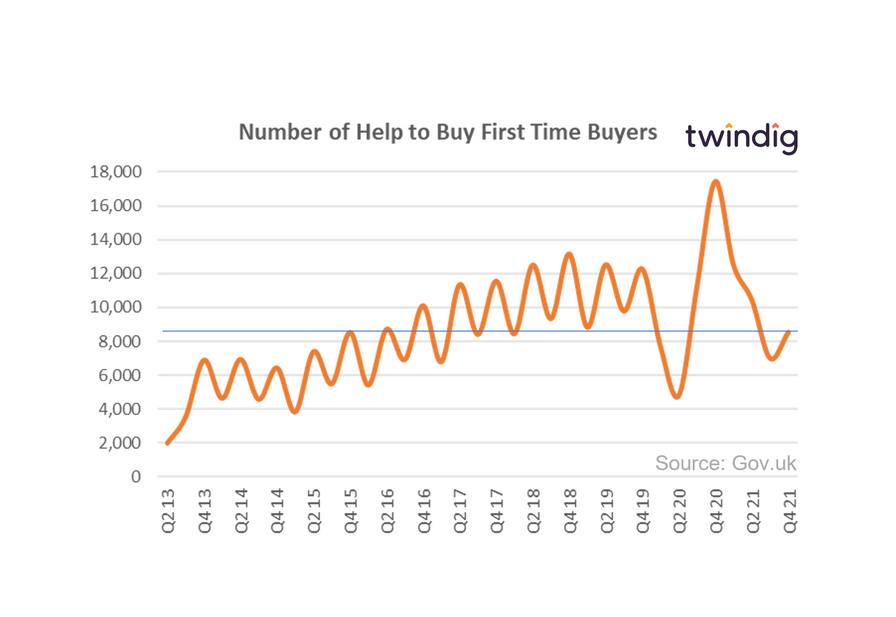

Is Help to Buy running out of steam?

The good news is that Help to Buy helped more homebuyers in the last quarter of 2021 than it did in the third quarter. However, the number of homebuyers helped and the number of first-time buyers helped remains significantly below pre-pandemic levels. This will not be pleasant reading for a Government keen to turn generation rent into generation buy.

Twindig Housing Market Index

The Twindig Housing Market Index fell by 2.4% to 73.4 this week as reports of increasing mortgage down valuations weighed on housing market investor's minds. After month after month of increasing house prices since the start of the pandemic, it seems that some lenders and some investors are asking how long can the house price party last?