Will house prices fall as down valuations rise?

What is a down valuation?

A down valuation is where the lender values a property below the price agreed between the homebuyer and the home seller. This means that in order to purchase the property at the agreed price the buyer will either need to find another source of finance to bridge the gap, agree to a lower price or, unfortunately, pull out of the purchase.

Speaking to the Daily Mail, Emma Jones of Alder Rose Mortgage Services claims that around one in five (20%) of her clients are facing down valuation, "around twice as many in the past few months".

Why are lenders downvaluing houses?

There are several factors weighing on lender's minds when it comes to the current level of house prices:

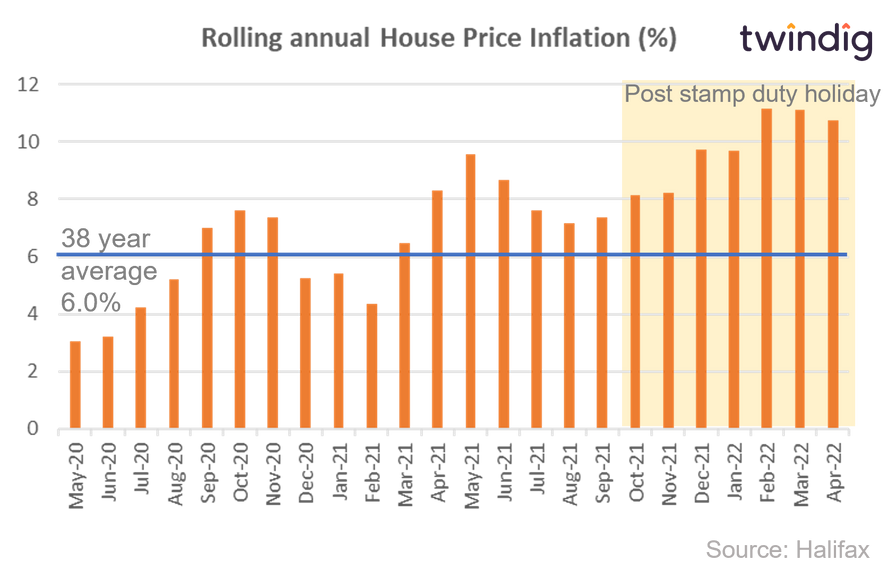

No one expected strong house price inflation during the COVID-19 lockdowns.

Many thought that the stamp duty holiday would fuel house price inflation.

Very few thought house price inflation would be so strong once the stamp duty holiday came to an end

The cost of living crisis is putting pressure on household budgets, which negatively impacts housing affordability

Rolling annual house price growth has been significantly ahead (at times almost double) the long term trend and this 'outperformance' is unlikely to be sustainable in the longer term

Basically, lenders don't want to risk lending today if they think that house prices may fall tomorrow. A down valuation provides them with some downside risk protection.

Are down valuation concerns justified?

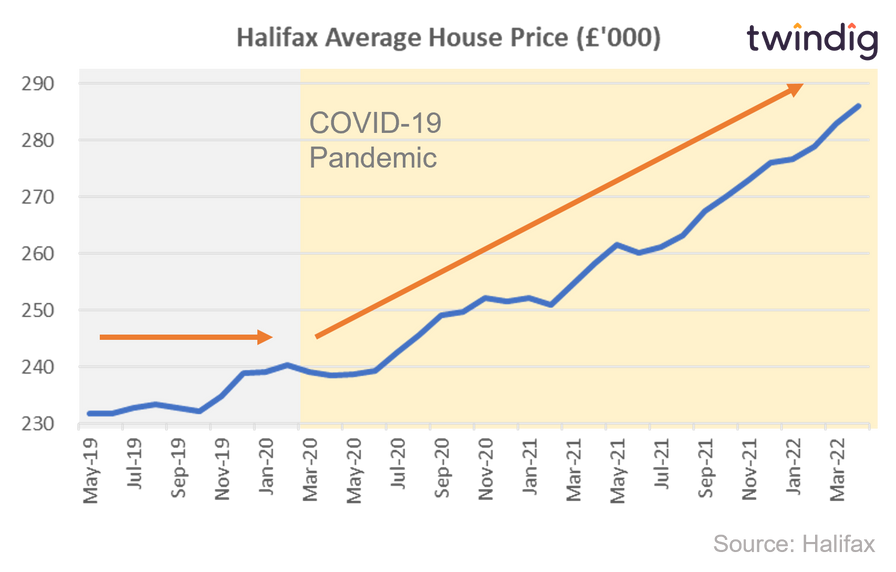

In the face of huge uncertainty at an individual level, a household level, a national level and a global scale the UK housing market had one of its strongest periods in living memory. We could understand if lenders were hesitant to lend in the face of uncertainty, but they embraced that uncertainty rather than shied away from it.

We must also remember household finances, for many, were bolstered during the pandemic. Lockdown severely restricted our ability to spend money, and if you were 'in-work' and not on furlough, your savings rose, and your Balance Sheet improved.

Add to this the revolution and widespread acceptance of working from home and the demand for bigger homes, and the so-called 'race for space' ignited the housing market into action. We wanted bigger homes, we had more money to spend, and as a result house prices rose.

The Stamp Duty holiday acted as a catalyst for households to move. Strangely house prices rose by significantly more than the stamp duty savings on offer. This perhaps shows just how much money households had to spend on housing.

It doesn't seem to us that the housing market is overvalued, rather that during a very unusual time in our history we saw a short term step-change in the amount of money being invested into the housing market. We, therefore, do not think a house price crash is just around the corner.

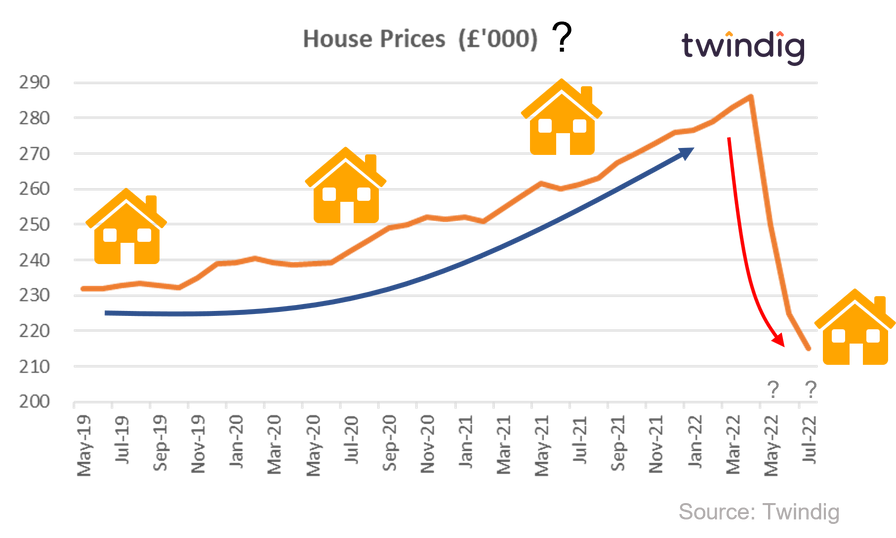

Why do lenders think that house prices will fall?

Rising mortgage rates and increases in the cost of living reduce the amount of money households have available to spend on a mortgage. Lenders are therefore concerned that as household finances are squeezed with less money to spend on housing house prices will fall and they don't want to get caught out lending at the top of the market.

Will house prices fall?

We do not expect significant house price falls this year. Mortgage rates and living costs have already started to rise and still, the demand for homes outstrips the volume of homes for sale, which puts upward pressure on house prices.

Demand for homes can therefore fall without impacting house prices. If demand is greater than supply house prices will not fall. If demand for homes falls below the supply of homes we would expect supply to step back, which would cushion or reduce the impact of house price falls.

If you think house prices are going to fall you are unlikely to sell your home, most people do not have to move right now, so why not wait.

During the credit crunch, we saw house prices fall by 20%, but housing transactions fell by 50% - housing transactions took a big hit so house prices didn't have to and we expect the same pattern to repeat again.

Down valuations, house prices and inflation

Rising costs of living and rising inflation do not necessarily lead to falling house prices. A period of inflation tends to lead to rising wages. As the costs of living rise workers demand higher wages to keep in step with the rising costs of goods and services. Broadly speaking, if inflation is 10% then having a 10% pay rise leaves you no better or no worse. However, mortgages are based on income multiples, so if your wages have increased your mortgage capacity also increases, allowing you to make an offer on a more expensive home.

In our view, on average, house prices move in line with inflation, we, therefore, believe that if inflation is rising house prices are more likely to go up than down.

Down valuations: Lenders are in the business of lending

We must also not forget that lenders lend. If they don't lend they will go out of business. Lender's business models are based on the premise that people will buy and sell homes. Therefore, if they take the theme of down valuations too far, they will be cutting off their nose to spite their face.

Down valuation Conclusions

Despite the rise in the number of down valuations being reported, it is our belief that housing market values and therefore house prices are looking up not down.