Houselungo 29 Jan 23

Headwinds or tailwinds for First-time buyers in 2023?

The First-time-buyer market was surprisingly robust in 2022, although the number of first-time-buyers was lower than it was in 2021, it was the next highest year since 2006. This is a very strong result given the active debate raging about housing affordability and the plight of the (perhaps not so) lesser spotted first-time-buyer, but will the picture be different this year?

How do we level up the housing market as incomes fall?

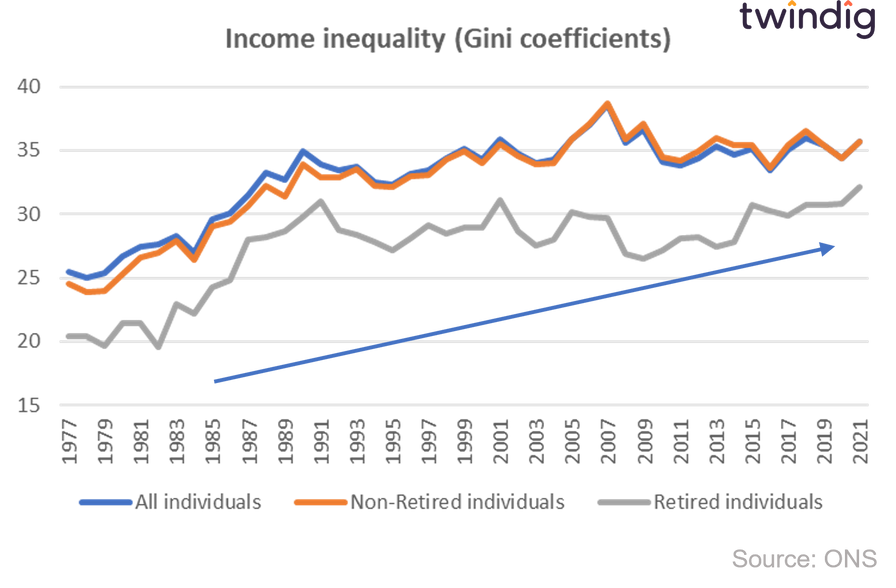

This week, the Office of National Statistics (ONS) reported that household disposable incomes are falling and that income inequality is rising.

We look at what this means for the UK Housing market

What the ONS said

The median household disposable income in the UK was £32,300 in 2022, a decrease of 0.6% from 2021

The median disposable income for the poorest fifth of the population decreased by 3.8% to £14,500

The median disposable income of the richest fifth increased by 1.6% to £66,000.

Income inequality for retired individuals reached a new high

Twindig take

Unfortunately, not only did median incomes fall, but income inequality rose. The median disposable income for the poorest fifth of the population decreased by 3.8% to £14,500, whereas the median disposable income of the richest fifth increased by 1.6% to £66,000. Growing income inequality has significant implications for the UK housing market.

Rising income inequality lowers the number of homebuyers

Income levels are key to determining how much you can borrow and, therefore, the size of your mortgage. The widening gap between the rich and poor will make it harder for many to get on the housing ladder, with those at the lower end of the income scale being shut out of homeownership.

Income inequality exacerbates the deposit problem: how to fill the gap between the price of the house you want to buy and the size of the mortgage you can secure.

Increasingly homebuyers are turning to the Bank of Mum and Dad to fill the deposit gap, but there is a problem. Income inequality is increasing among the retired population. Therefore, like incomes, access to the Bank of Mum and Dad is becoming more unequal.

Is there away to address the rising tide of income and therefore housing wealth inequality?

Foxtons rises to the challenges ahead

London-based estate agent Foxtons released a full-year trading update this morning

What Foxtons said

Revenues and adjusted operating profit ahead of expectations for 2022

Non-cyclical lettings and financial services revenues account for c.65% of Group revenue

The first half of 2023 is expected to be more challenging than 2022

Twindig take

Foxtons is a good bellwether of the London housing market, with a focus on lettings and lower to mid-market London property sales, it has its finger on London's housing market pulse.

As we saw from the housing transaction figures earlier this week, 2022 was a strong year, the second strongest since the Global Financial Crisis and London outperformed the country as a whole as the race for space waned and workers returned to their offices.

With a new boss at the helm and a root and branch operational review nearing completion, Foxtons has a spring in its step for 2023, although it notes that housing market conditions in the sales market, will be more challenging than they have been. However, with a strong and growing lettings book, Foxtons has a balanced business and is doing what it can to smooth the impact of the cyclical nature of the markets it serves.

Housing Market Podcast: Housing transactions

Earlier this week I caught up with Daniel Hamilton-Charlton to discuss all things housing transactions, where are the hottest (and slowest) markets and the outlook for 2023. I also had a big fail when trying to pronounce Welsh names....

Twindig Housing Market Index

In the week that we learnt that housing transactions in 2022 were at their second highest level since the Global Financial Crisis and that the average first-time buyer deposit is now £62,470 the Twindig Housing Market Index rose by 3.8% to 76.2.

Three strikes and your out?

This week another chapter was written in the book about the rise and fall of challenger online estate agents. Whilst initially they shook the foundations of estate agency to the core, they appear not to have stood the test of time as hybrid agency Strike (formerly known as Housesimple) announced it was letting a number of staff go as it 'adjusts to the market'. It seems that even in times of a cost of living crisis a cut-price estate agent cannot cut the mustard. Perhaps a case of three strikes and your out?