Twindig Housing Market Index 28 Jan 23

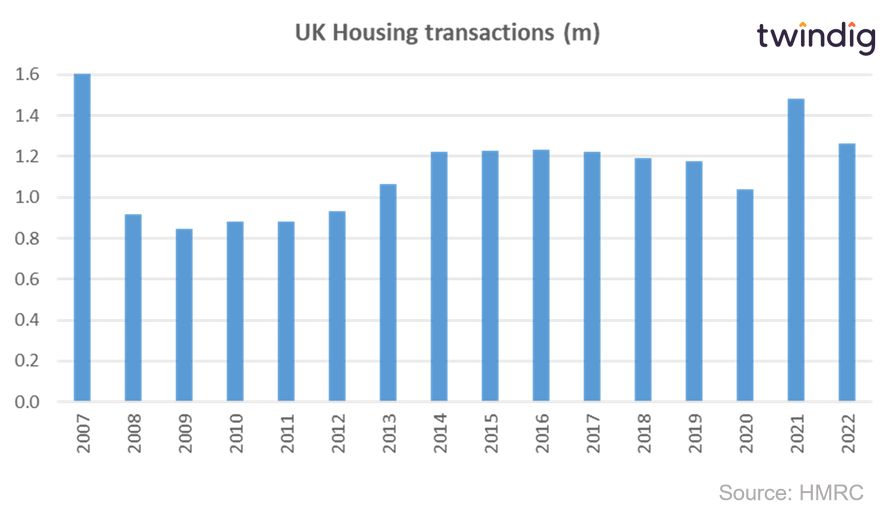

In the week that we learnt that housing transactions in 2022 were at their second highest level since the Global Financial Crisis and that the average first-time buyer deposit is now £62,470 the Twindig Housing Market Index rose by 3.8% to 76.2.

Housing transactions in 2022 came in at 1.26m, not quite the 1.48m of stamp duty holiday fuelled 2021, but the next highest since the 1.62m of 2007. However, 2022 is already old news and residential investors are focused on what will happen to housing transactions this year. Our best estimate at this stage is that they will be down about 20%, but that still implies housing transactions of around 1 million in 2023, so down, but by no means out.

We expect that 2023 will be a game of two halves, headwinds in H1 (as mortgage rates and costs of living rise) followed by tailwinds in H2 (as mortgage rates start to fall and the level of inflation reduces).

This week, the London based estate agent Foxtons also reported a strong finish to 2022 and whilst it expects the sales market to be challenging in the next few months, its strong lettings division and financial services arm will help it navigate the choppy waters ahead. It is also interesting to see that Foxtons is back on the front foot and investing in growth whilst the market takes a breather.

Three strikes and your out?

This week another chapter was written in the book about the rise and fall of challenger online estate agents. Whilst initially they shook the foundations of estate agency to the core, they appear not to have stood the test of time as hybrid agency Strike (formerly known as Housesimple) announced it was letting a number of staff go as it 'adjusts to the market'. It seems that even in times of a cost of living crisis a cut-price estate agent cannot cut the mustard. Perhaps a case of three strikes and your out?