Houselungo 28 November 21

Housing transactions: the hangover after the holiday

HMRC released provisional housing market transaction data for October 2021 on Tuesday

What they said

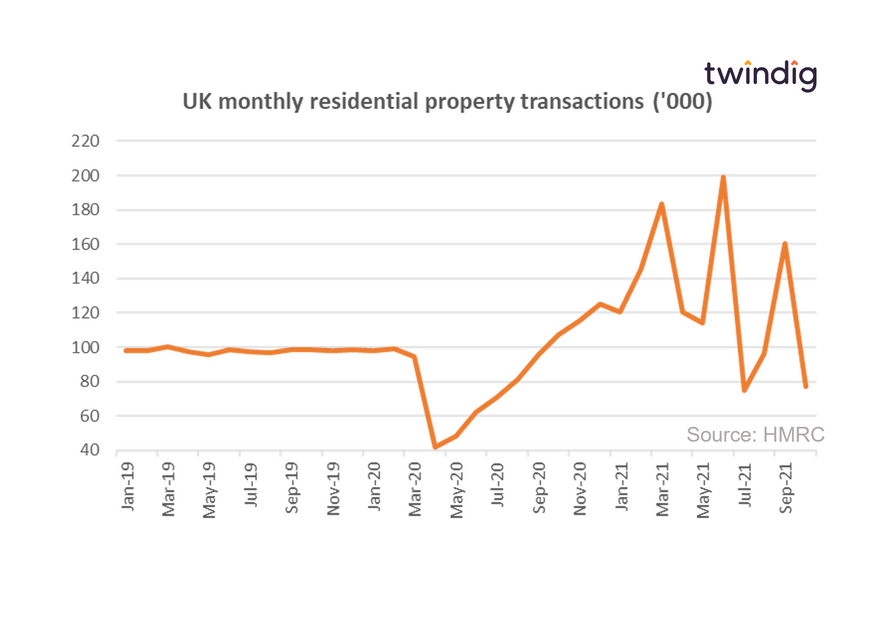

The seasonally adjusted figure for UK housing transactions in October 2021 was 76,930

This is 28.2% lower than October 2020

This is 52% lower than September 2021

Twindig take

As expected housing transactions tumbled in October as homebuyers no longer benefit from the Stamp Duty Holiday. Housing transactions in October 2021 were, ironically, at their lowest level since the start of the Stamp Duty Holiday in July 2020 when they numbered 70,780.

The current level is around 23% lower than its pre-pandemic average. However, the current level of housing transaction is somewhat distorted by the stop-start impact of the stamp duty holiday and its various deadlines and taperings.

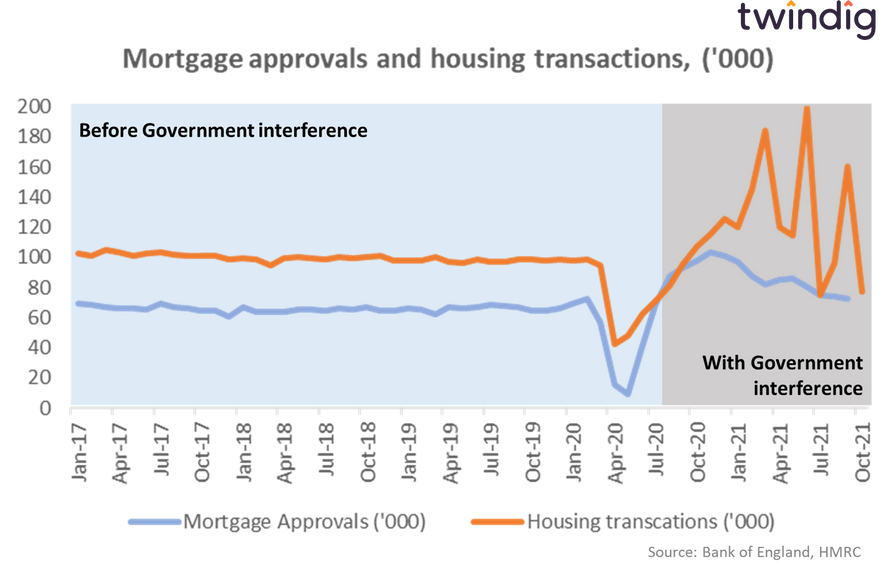

Did the Stamp Duty Holiday help or hinder the housing market?

This is a tough call, as we don't know what would have happened without the holiday. However, it is interesting to note how stable the housing market was leading up to the COVID-19 pandemic and how quickly it was bouncing back before the Government got involved. One might, perhaps, argue that the government policy caused volatility rather than stability of the UK housing market...

Deposit still biggest barrier for First Time Buyers

The Nationwide released a special report this morning reaffirming that raising a deposit was still the biggest hurdle for first-time buyers. If anything, the bar has been raised higher still as house prices have risen faster than wages over the last year.

Andrew Harvey, Nationwide’s senior economist said

House price growth has exceeded earnings growth over the past year and the ratio of house prices to average earnings (HPER) has increased to a record high. In the third quarter of this year, the UK First Time Buyer (FTB) house price to earnings ratio stood at 5.5, above the previous high of 5.4 in 2007, and well above the long-run average of 3.8.

Twindig take

In our view, rising house prices since the pandemic have only made a bad problem worse for first-time buyers. The Stamp Duty Holiday may have been launched with the best intentions, but unfortunately, it added fuel to the fire of house prices leading to a stampede of homebuyers set on beating the stamp duty deadline.

We show in the graph how house price inflation accelerated from a manageable 2.5% pa in the lead up to the COVID-19 pandemic to an annual run rate of 8.7% as the pandemic took hold.

The upshot of this rapid rise in house price inflation is that since the COVID-19 stamp duty holiday house prices in five regions of the UK have risen by more than the median full-time wage, and when mortgages are based on salary multiples that creates multiple problems.

Meanwhile, 17 housebuilders have now signed up to Deposit Unlock

Deposit unlock is a new 95% Loan To Value (LTV) mortgage product being offered to homebuyers of new build homes.

Why is deposit unlock needed?

Whilst there is an increasing number of 95% LTV mortgage products on the market, these are focused on existing or second-hand homes. Many lenders are wary of lending at 95% LTVs on new build properties because of the so-called ‘new build premium’. Just as a brand new car loses value once driven off the forecourt, many believe that the value of new homes has a high risk of falling compared to second-hand homes, because of the risk of many similar homes being on the market at the same time. During the Global Financial Crisis of 2008-09, many homebuilders heavily discounted the price of their homes to sell them, and this behaviour has made mortgage lenders nervous.

Deposit Unlock is the latest initiative launched by the housebuilding sector to help tackle the deposit gap. Deposit Unlock offers a 95% Loan to Value (LTV) mortgage where the mortgage indemnity is provided by the housebuilder on behalf of the homebuyer.

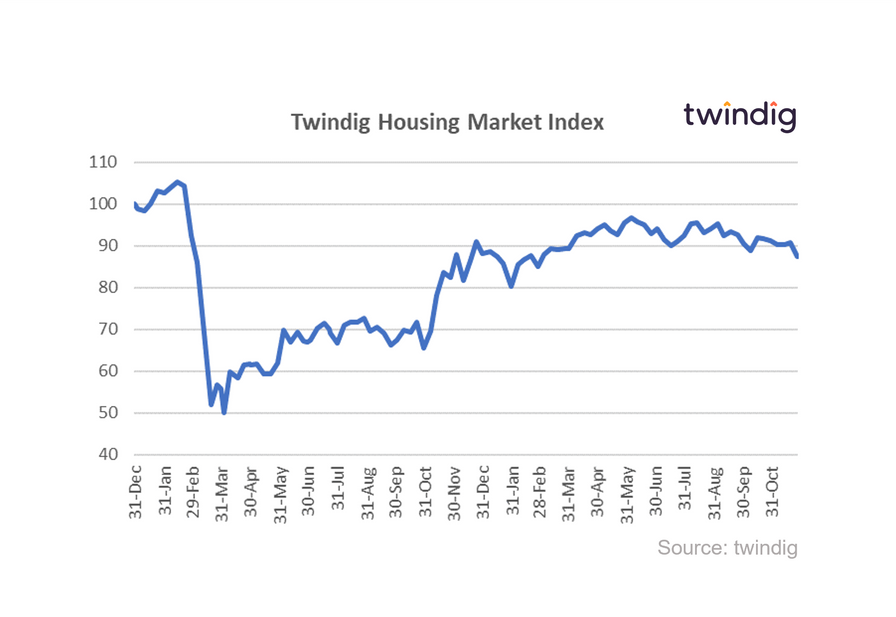

Twindig Housing Market Index

The new COVID-19 variant B.1.1.529 proved a sobering reminder that we are not out of the COVID woods yet, investors confidence was knocked by the news of the new variant and most reduced their appetite to invest in the UK residential housing sector. This had a knock-on effect on the Twindig Housing Market Index which fell by 3.7% this week, its biggest fall since 11 December 2020.