Houselungo 24 April 22

What do homebuyers want?

Whathouse is the leading new homes property portal and this week they released their 2022 New Home Buyer Survey. The survey asked homebuyers across the UK what the most and least important attributes of their next home would be, and you might find the results surprising.

First Time Buyers appear more interested in having a driveway than smart devices in their home

Next steppers were the most demanding, but it was all about space: spare rooms, a loft, a garden, a home office, but not a garage

Empty nesters appeared to be the most tech-savvy, the silver surfers wanted the smartest homes and those looking for their forever home had a very 'green' mindset, but were not very green-fingered...

Housing emergency on planet earth

Housing charity Shelter believes that we face a housing emergency, they describe our housing market as unaffordable, unfit, unstable and discriminatory.

Could more social housing boost homeownership?

At a social housing conference hosted by Shelter this week the Housing Secretary Michael Gove summarised the housing emergency or crisis in the following way:

There has been a failure to ensure that there are homes that are genuinely affordable for all

Homeownership is a noble thing, but housing is increasingly unaffordable to buy and therefore home ownership is falling

Rising rents make it difficult to save for the deposit required to get onto the housing ladder, and not all of the private rented stock is fit for purpose.

More social housing would provide safe, secure affordable homes for those unable to buy and allow those who do a better opportunity to save for a deposit for a home of their own.

He went on to say:

“That is why even the most – how can I put it – Thatcher-worshipping, home ownership-fetishising, capital-accumulating members of this audience … you want more social housing.”

It appears to us that Mr Gove is saying that if we increase the supply of social housing we will turn the tide on declining homeownership. We don't agree, do you?

Are house prices falling where you live?

Whilst we talk about house prices going up or down, it is not as simple as that. Whilst the latest house price data from the Land Registry reported that house prices overall increased, at the local authority level house prices fell in 88 of the 377 local authorities we track, around one in four.

Biggest house price falls last month

South Hams in Devon saw the biggest housing affordability gains last month as average house prices fell by 6.3%. (£26,070).

South Hams was followed by Islington, where average prices fell by £15,260.

Making up the podium was Ryedale, where house prices fell on average by 4.5% (£13,814). We show in the chart below the 25 housing markets with the biggest absolute house price falls or housing affordability gains

We hope that you don't own a home in one of these areas, but to find out the worst-performing 25 areas, click read more below:

Housing transactions rise in March

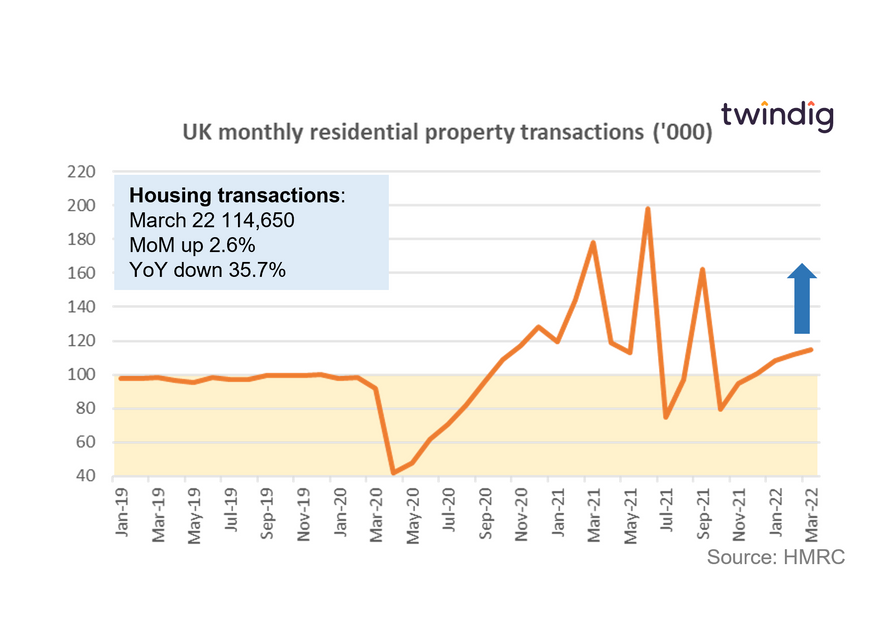

MRC released provisional housing transaction data for March 2022 on Thursday

What they said

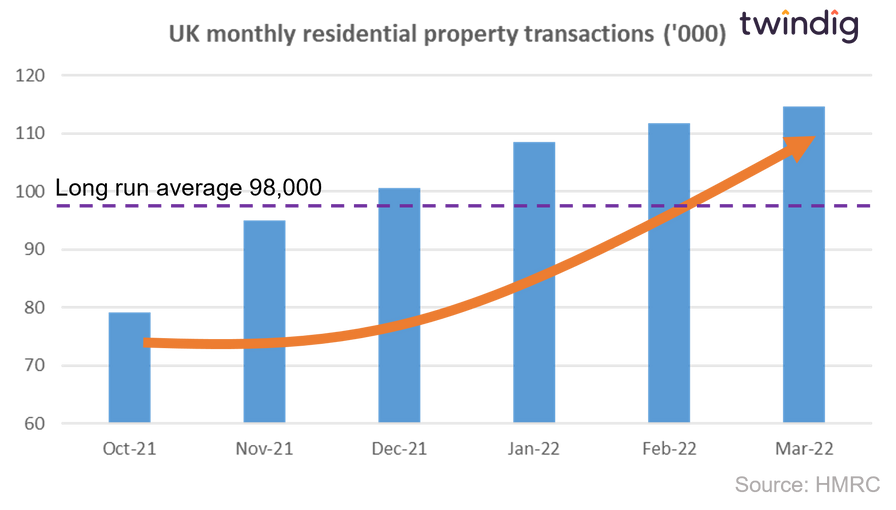

Seasonally adjusted housing transactions in March 2022 were 114,650

This is 2.6% higher than in February 2022, but

35.7% lower than March 2021

Twindig take

It is no surprise that housing transactions in March 2022 were significantly lower than they were in March 2021. The original plan was that the COVID-19 Stamp Duty holiday would end on 31 March 2021, and this led to a surge in transactions seeking to complete before the stamp duty holiday.

That housing transactions were higher in March than in February is comforting. So far, rising interest rates (and therefore mortgage rates) and cost of living increases have yet to dampen the enthusiasm and willingness to move of the UK's homebuyers and homeowners.

At 114,650 housing transactions in March were 17% ahead of their long-run average of 98,000 and the trend, for now, is up not down.

Twindig Housing Market Index

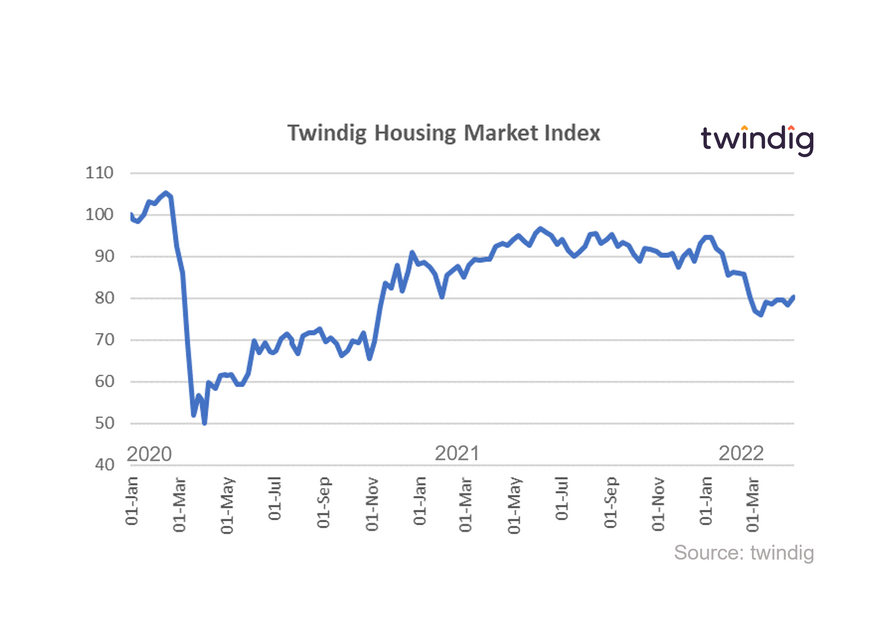

In the week that saw housing transactions rise again, for the fifth month in a row, the Twindig Housing Market Index rose for the first time in April this week, increasing by 2.3% to 80.2, its highest level since the 26 February 2022.

Estate agents Foxtons and LSL issued positive statements to the London Stock exchange. Foxtons said that it's under offer sales pipeline was 8% higher than last year and that its lettings business had grown (organically) by 10%. Meanwhile, LSL started a £10m share buyback programme which means it is confident it needs to hold onto less money for a rainy day.