Housing emergency on planet earth

The housing charity Shelter believes that a safe home is the foundation on which our lives are built. It opens the door to employment, health, education, and is the basis of strong communities. A home they say is a fundamental right.

Shelter believes that we face a housing emergency, they describe our housing market as unaffordable, unfit, unstable and discriminatory.

Could more social housing boost homeownership?

At a social housing conference hosted by Shelter this week the Housing Secretary Michael Gove summarised the housing crisis in the following way:

There has been a failure to ensure that there are homes that are genuinely affordable for all

Homeownership is a noble thing, but housing is increasingly unaffordable to buy and therefore home ownership is falling

Rising rents make it difficult to save for the deposit required to get onto the housing ladder, and not all of the private rented stock is fit for purpose.

More social housing would provide safe, secure affordable homes for those unable to buy and allow those who do a better opportunity to save for a deposit for a home of their own.

He went on to say:

“That is why even the most – how can I put it – Thatcher-worshipping, home ownership-fetishising, capital-accumulating members of this audience … you want more social housing.”

It appears to us that Mr Gove is saying that if we increase the supply of social housing we will turn the tide on declining homeownership

Twindig Take

We agree with many things Mr Gove said, but not all. We believe in the social good of homeownership (or as Mr Gove puts it the nobility homeownership), owning a home provides both security of tenure and an opportunity to build wealth.

We agree that rising rents make it difficult for aspiring homebuyers to save for a deposit and if we couple this with rising living costs the outlook for savings is bleaker still.

We agree that there has been a failure to ensure that there are homes that are genuinely affordable for all

Where we disagree is in what the provision of homes that are genuinely affordable for all looks like. It is not, in our opinion simply a case of building more homes. By all means, seek to use existing money more effectively, but please do not use all of that money to build more homes.

The housing crisis is a big issue that requires big thinking, and we would urge Mr Gove to think big and think outside of the box on this most important of issues.

Is it time for Mr Gove to think outside of the box?

As we argued earlier this week, we do not believe that house prices need to fall to solve the affordability crisis.

The answer isn’t to increase supply (build more homes) and hope that prices fall, the answer is to change the way we finance the purchase of property so that all can participate in the homeowning economy.

Why we can’t build our way out of the housing crisis

Do the math

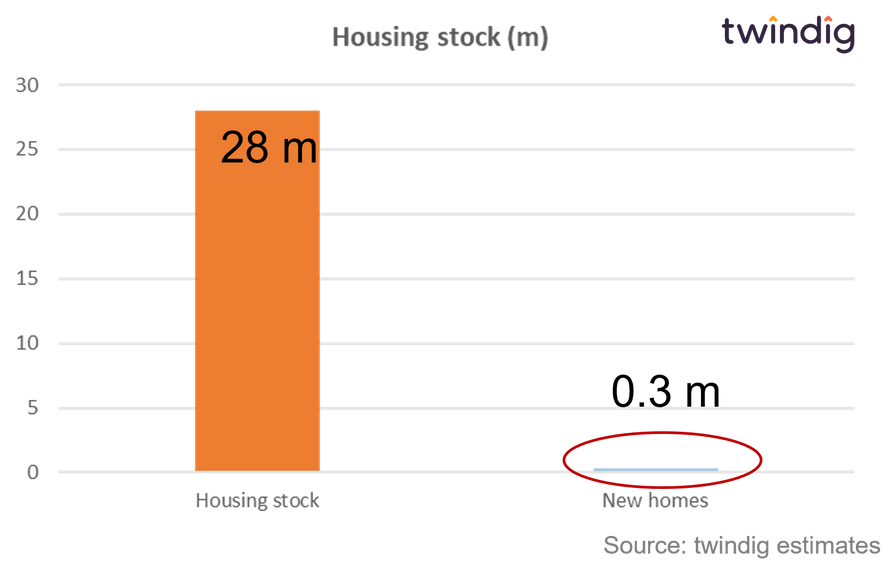

There are approximately 28 million homes across the UK and in a good year, we add around 300,000 homes to the existing housing stock. This means we can grow our housing stock by 1% per year. An additional 300,000 in one year doesn’t really move the needle of housing supply as illustrated in the graph below:

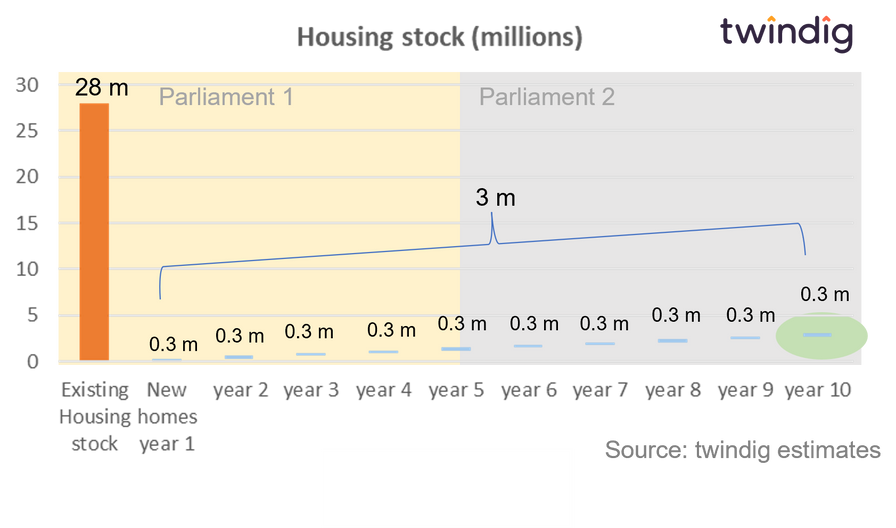

Even if we build at pace for 10 years in a row, we will have only added 3 million homes, or about 10% to the housing supply – one more home for every ten already in existence, and the 10-year view brings challenges of its own. A 10 year period will cover at least two electoral cycles, at least two parliaments, and, in our view, the chances of a consistent housing policy over ten years is very slim, especially given the speed at which housing ministers come and go. (the UK has had 11 housing ministers in the last 12 years…)

Do we need to build our way out of the housing crisis?

The argument that we need to build more homes is based on the assumption that we do not have enough homes, that the demand for houses is greater than the supply of houses and therefore house prices rise. However, it appears that this argument is built on a false assumption. We have a surplus of housing in the UK, we have more homes than households, therefore building more homes (when we already have more homes than households) may not solve the problem.

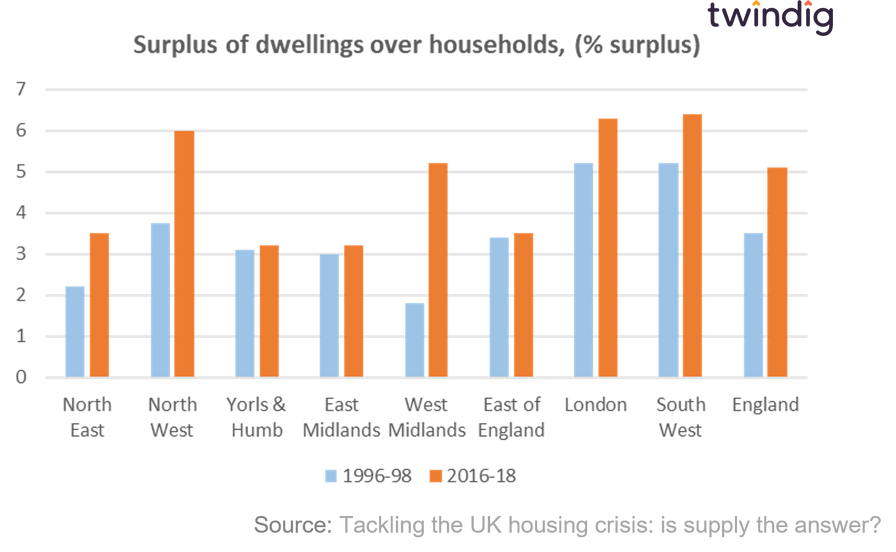

Economist Ian Mulheirn is an expert in housing supply and his 2019 paper ‘Tackling the UK housing crisis: is supply the answer?’ revealed that housing supply has outstripped household formation for many years and led him to conclude that simply building more homes will not solve the housing affordability crisis.

In 1996 there were 660,000 more dwellings than households in England and this surplus had grown to more than 1.1 million by 2018, Mulheirn asserts that there are similar surpluses in Scotland and Wales

Let’s end the banality of binary homeownership

In the UK home ownership is binary, you either own your home or you don’t. The barriers to entry into homeownership are high, you need a big deposit and typically have to take on a lot of debt in the form of a mortgage, to purchase a home and the size of mortgage available to you is linked to your wages and employment situation.

It seems odd to us that, most people will have to take on significant amounts of debt to buy a home and start to build up their housing equity. We believe that you should be able to build your housing equity as and when you can afford it, rather than being shut out of it until you can afford to buy the whole home.

Shared ownership points to the solution

The UK does have a shared ownership housing model, but this is a minority tenure. According to a UK Government paper published in December 2021, approximately 202,000 households are living in shared ownership homes in England, this represents less than 1% of households.

Why is the shared ownership sector so small?

Shared ownership homes are typically a subset of the homes owned by regulated housing associations or local authorities. Therefore, only a small number of homes are available to purchase through a shared ownership scheme and they are only for sale to a subset of homebuyers that meet the strict eligibility requirements.

Shouldn’t shared ownership be open to all?

Yes we believe it should, if you need help to buy a home, which Mr Gove (the current Housing Secretary) believes is a noble aim, we think a shared ownership option should be available

Should shared ownership be available on all homes?

We certainly believe it should be possible to buy an existing home in the open market through a shared ownership model rather than just the small number of homes controlled by housing associations and local authorities.

Fractional homeownership is the key

We believe that you should be able to build your housing wealth as and when you can afford to. We believe that fractional homeownership would dismantle the barriers to homeownership, reduce the inequality of housing wealth and increase the participation in the housing market at a time when the levels of homeownership are in decline.

Imagine if there was a true 'help to buy ISA', which rather than being a low-interest tax-free savings account was a saving product that actually allowed you to purchase shares in a fund that owned residential property. Your savings would then be inextricably linked to the housing market rather than divorced from the housing market.

You can read more about our Case for fractional ownership here

Why house prices don’t need to fall to solve the housing affordability crisis

It is a commonly held view that house prices need to fall to aid housing affordability, but we disagree. When the mortgage market was established, house prices were inextricably linked to wages, what you earned determined what you could borrow and what you could borrow determined house prices. Thinktank Positive money produced a very in-depth report on the housing market in March 2022 called Banking on Property they concur that building more homes is not the answer and recommend policies to curb house price inflation to bring the house price-earnings ratio back to more affordable levels.

We agree with Positive Money that over time house prices have divorced from wages, however, we do not think it is possible to reconcile the two sides. Intergenerational wealth transfers and the bank of mum and dad have created an equity-rich housing market with increasingly high barriers to entry. We believe the solution is to change the way we finance our homes rather than to try and manipulate their prices.

You can read more about our thoughts on house prices and affordability here