Housing transactions - March 2022

HMRC released provisional housing transaction data for March 2022 this morning

What they said

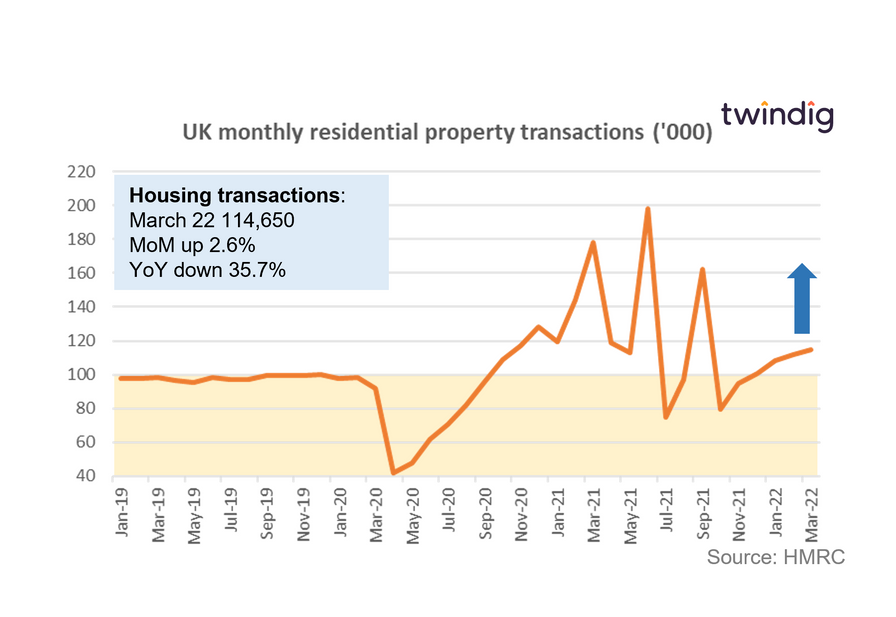

Seasonally adjusted housing transactions in March 2022 were 114,650

This is 2.6% higher than in February 2022, but

35.7% lower than March 2021

Twindig take

It is no surprise that housing transactions in March 2022 were significantly lower than they were in March 2021. The original plan was that the COVID-19 Stamp Duty holiday would end on 31 March 2021, and this led to a surge in transactions seeking to complete before the stamp duty holiday.

That housing transactions were higher in March than in February is comforting. So far, rising interest rates (and therefore mortgage rates) and cost of living increases have yet to dampen the enthusiasm and willingness to move of the UK's homebuyers and homeowners.

At 114,650 housing transactions in March were 17% ahead of their long-run average of 98,000 and the trend, for now, is up not down.

Anecdotally, the outlook suggests that transactions will continue to rise in the coming months. London based estate agent Foxtons reported today that it entered April this year with a sales (under offer) pipeline 8% higher than it was one year ago.

We had thought that as the economy opened up UK households would turn their attention away from housing towards holidays and rebuilding their social calendars, but the pull of property appears stronger thna we had thought.