Houselungo 9 October 22

How to lower your mortgage payments

Normally, during times of market stress, there are only two ways to lower your mortgage repayments: switch to an interest-only mortgage, or extend the length of your mortgage.

Switch to an interest-only mortgage

If you currently have a repayment mortgage you can ask to switch to an interest-only mortgage. This is likely to lower your monthly payments, although you will end up paying more money overall as you are no longer paying off any of your mortgage debt each month, and therefore, you will pay more mortgage interest over the life of the mortgage.

Extend the length of your mortgage

Secondly, you can ask to extend the length of your mortgage, i.e. pay it back over a longer period. This will lead to a reduction in your monthly mortgage payments, but you will end up making more of those monthly payments, and therefore, the overall cost will be higher due to the higher number of payments.

Reduce your mortgage payments with fractional homeownership

However, fractional homeownership offers a third way, which we believe will be attractive to many homeowners that leads to lower monthly mortgage payments and paying less on your mortgage overall.

House prices channelling the Grand Old Duke of York

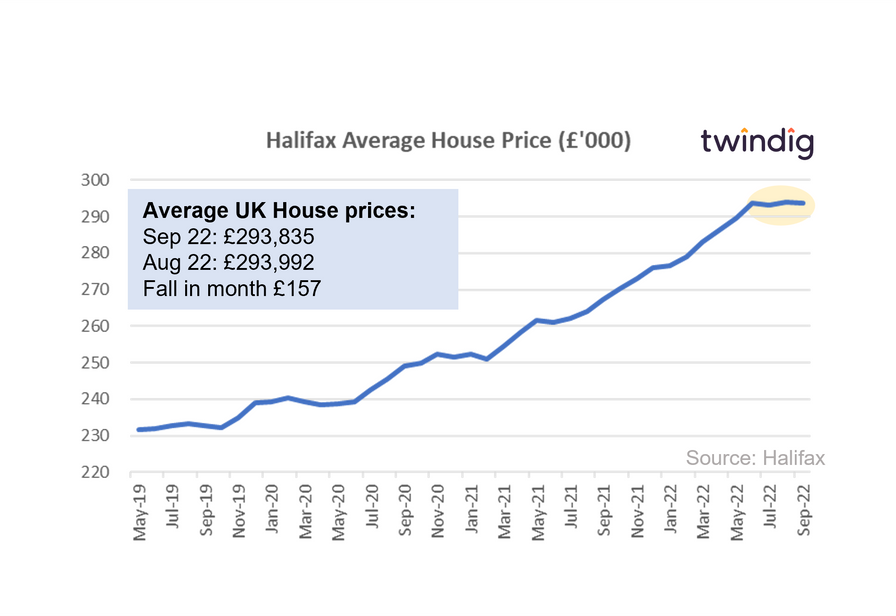

The Halifax released its house price index for September on Friday

What the Halifax said

Average house price £293,835

House prices fell by 0.1% or £157 in September

Annual house price inflation 9.9%

Twindig Take

House prices fell by £157 in September according to the latest Halifax house price index.

It seems that UK house prices are channelling the Grand old Duke of York, rising in June, falling in July, rising in August and falling in September, they don't seem to know whether they are going up nor down. The average house price in September was £249 higher than it was in June

So far house prices seem to be following our expectations, in July we said that:

If history repeats itself, the house price growth may plateau whilst a new Prime Minister is found and perhaps until we have had an election to confirm the incoming PM's mandate to lead and govern our country. Many will forecast house price falls, but we expect house prices to neither move significantly up nor down whilst the current political storm calms down and the dust settles.

Mortgage rates moving on up (and nothing can stop them)

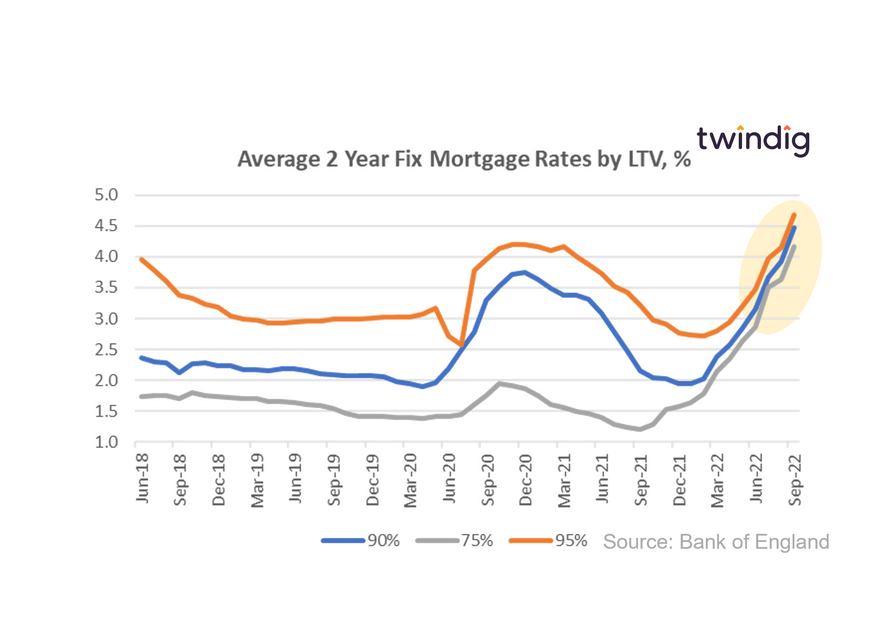

The Bank of England released average mortgage rates by Loan to Value on Friday

What they said

Average mortgage rate for 75% LTV 2-year fixed rates mortgages 4.17%

Average mortgage rate for 90% LTV 2-year fixed rates mortgages 4.47%

Average mortgage rate for 95% LTV 2-year fixed rates mortgages 4.68%

Twindig take

Whilst house prices are dithering, not sure whether to go up or down, the same cannot be said for mortgage rates. To quote the often, and recently quoted song by M People they are 'moving on up' and 'nothing can stop' them.

In September 95% LTV mortgage rates increased by 13% to 4.68%, whilst 90% LTV and 75% LTV mortgage rates increased by 14% and 15% respectively. We had to increase the scale on our chart to accommodate the recent rises.

If we look at the rises over the last year, 75% LTV mortgage rates have increased by 250%, 90% LTV mortgages by more than 100% and 95% LTV mortgage rates have increased by 45%. The long days of cheap credit are long gone.

Where house prices are falling the most

Whilst house prices may be going up or down at a national level, at a local level the house price dynamics are much more complicated. There is no such thing as the UK housing market, rather it is a collection of hundreds if not thousands of local markets operating independently. A couple buying a three-bed semi-detached home in Margate does not impact house prices in the market town of Marlborough.

Biggest house price losers last month

The biggest house price losers last month were in Shetland Islands where average house price dropped by 7.7%.

In second place came Na h-Eileanan Siar where house prices fell by 4.2%, and in third place with house prices down by 3.1% was City of London.

As house prices begin to wobble we look at the 25 areas in the UK where house prices are falling the most.

Twindig Housing Market Index

Liz Truss, Kwasi Kwarteng and the rest of the cabinet did little to calm the nerves of residential investors this week. The messages of 'growth growth and growth' and 'movin on up' did not have the desired effect, more a case of 'nothing can start me' rather than 'nothing can stop me' as the Twindig Housing Market Index nudged up by the tiniest of margins, rising 0.2% to 61.7.

It seems that first impressions are important and those first impressions last. Following a clumsy start, the new Prime Minister and Chancellor have a mountain to climb to win back the confidence of residential investors. We had further confirmation this week that mortgage rates are on the rise, and the Nationwide and Halifax house price indices reported house prices fell in September (investors prepare those metrics to move in the opposite direction). This is not the start the 'new' Government had hoped for.