Houselungo 4 September 22

Why Generation Rent not Baby Boomers hold the keys to Number 10

The Prime ministerial hopefuls may have had to pander to homeowning baby boomers to secure the keys to Number 10, but to keep hold of them they will have to win over Generation Rent.

Apart from scrapping housing targets and championing the green belt, housing was largely absent from the leadership debates, it seems that the only things Liz Truss and Richie Sunak could agree on was to not upset existing homeowners, and when it came to housebuilding, both were quick to get on board the ‘good’ ship HMS NIMBY

However, as Boris Johnson found out, winning the keys to Number 10 is one thing, but holding on to them is quite another, the rungs on that property ladder can be very slippery even for a political heavyweight.

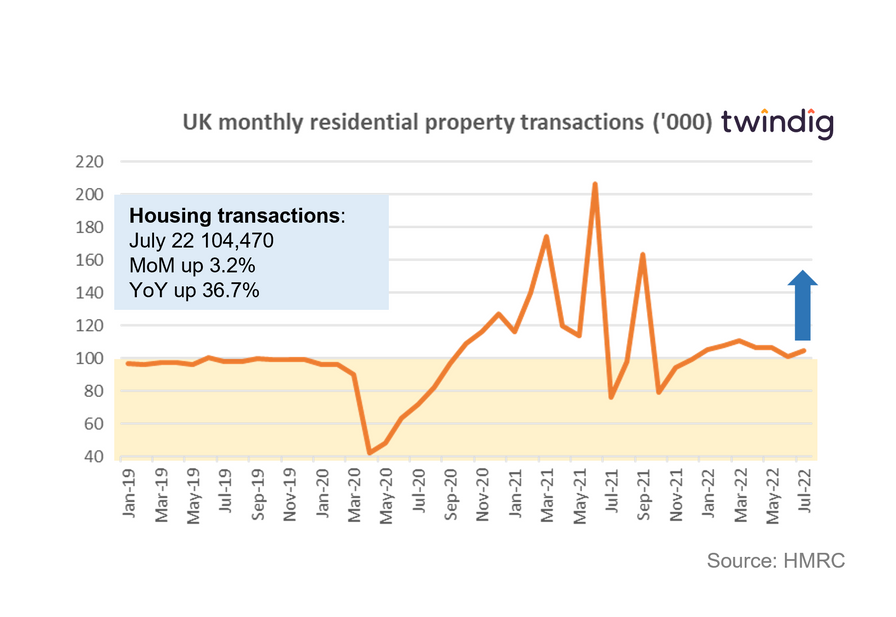

Housing transactions move up

Housing transactions in July 2022 were 104,470

This is 3.2% higher than in June 2022

This is 36.7% higher than in July 2021

Twindig take

We were pleasantly surprised to see (seasonally adjusted) housing transactions rise in July 2022 following three months of decline and at 104,470 housing transactions were comfortably ahead of their long-run average of 98,000. Those that are calling time on the upbeat housing market appear to be out of step with what is actually going on at the coal face. Mortgage approvals, due out next week will provide a better view as to the future direction of housing transactions, but the fact transactions rose and were above the long-run average shows that cost of living increases and mortgage rate rises have yet to cause the housing market any significant pain.

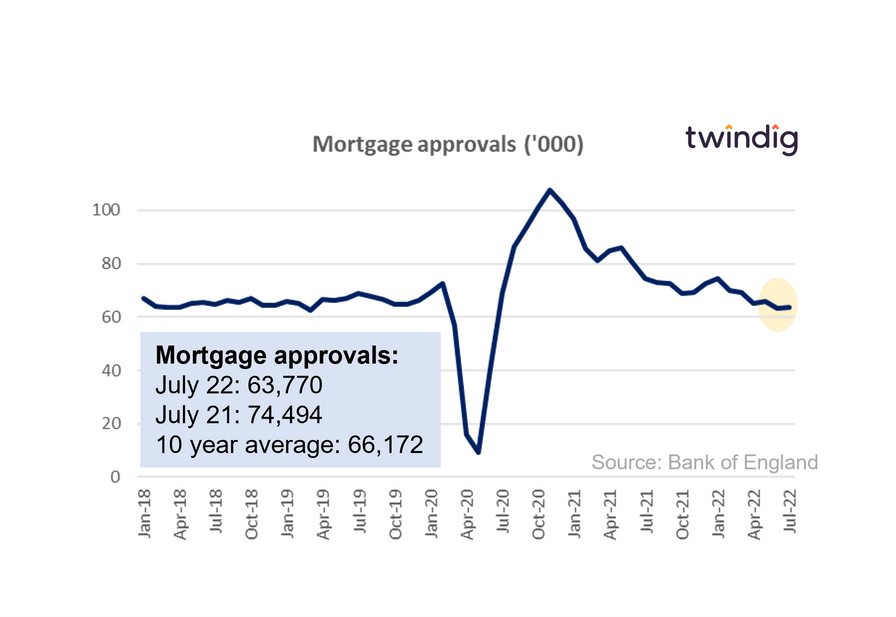

Mortgage approvals nudge up

The Bank of England released mortgage approval data for July this week

What the Bank of England said

Mortgage approvals for July 2022 were 63,770

This was 0.9% higher than the 63,184 mortgages approved in June 2022

This was 14.4% lower than the 74,494 mortgages approved during July 2021

Twindig take

Mortgage approvals stabilised in July nudging up 0.9% (about 600 mortgages) as Boris Johnson resigned, perhaps he was one of those getting a new mortgage approved in July. History appears to be repeating itself with the housing market choosing to tread water as the political backdrop gets a little choppy. Once again uncertainty surrounding the occupant at 10 Downing Street does not appear to unsettle the UK housing market, with households choosing to 'get moving done'.

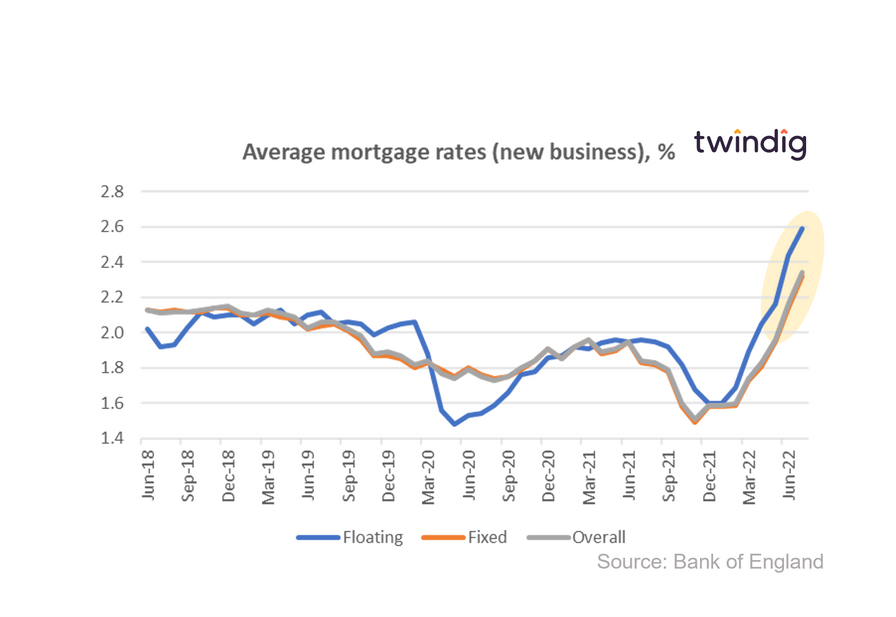

Mortgage rates shoot up

The latest data from the Bank of England revealed that overall average mortgage rates for new business increased again in July 2022, rising by more than 8%

What the Bank of England said

The average floating mortgage rate for new business 2.59%

The average fixed mortgage rate for new business 2.32%

The average overall mortgage rate for new business 2.34%

Twindig take

It was unfortunately no surprise that mortgage rates rose in July, and we expect them to continue to rise inline with the Bank of England's Bank Rate for the foreseeable future.

Bank Rate is currently at 1.75% but may change following the Monetary Policy Committee (MPC) meeting in September. The decision on Bank Rate will be announced on 15 September and we could see Bank Rate increase to 2.00% or 2.25% as the Bank of England continues to wage war on inflation.

How Purplebricks lost its way

This week I spoke to Iain McKenzie and Holly Hibbett from the Guild of Property Professionals about the latest developments in the housing market and how the disruptor estate agent Purplebricks is being disrupted by, rather than disrupting the housing market

Twindig Housing Market Index

In the week that saw mortgage approvals tick up and house prices rise for the 13th month in a row, unluckily for the residential housing market the Twindig Housing Market Index fell by 2.8% to 72.3 this week as tory leadership race fatigue hit new highs, or perhaps it was just a tough first week back at school after the summer holidays.

Investors appeared most concerned about housebuilders this week, which we believe is more to do with their perception of macroeconomic clouds gathering, rather than the performance of the individual housebuilders themselves: our sources are still reporting brisk business in the market for new build homes.