Mortgage approvals stable in July as the stable door at Number 10 opens

The Bank of England released mortgage approval data for July this morning

What the Bank of England said

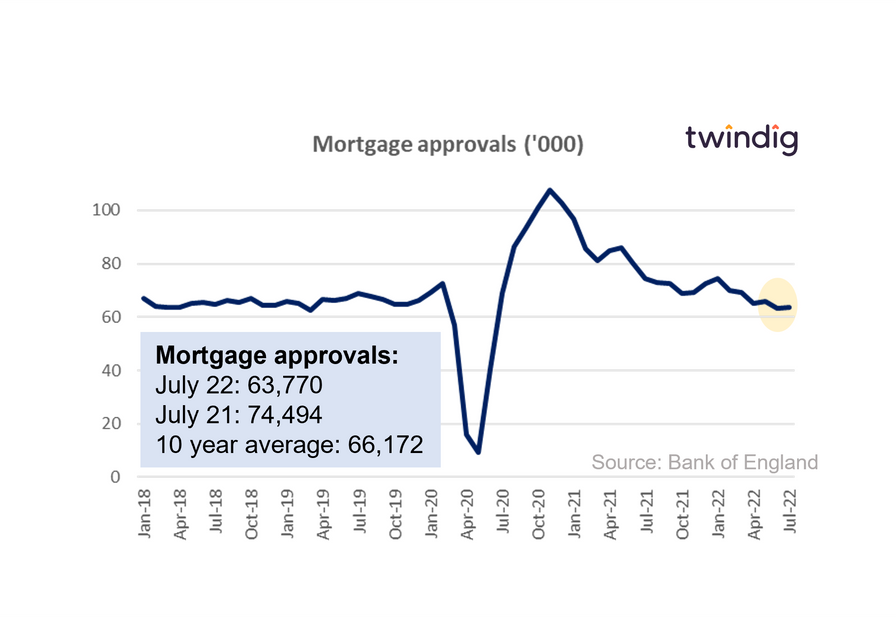

Mortgage approvals for July 2022 were 63,770

This was 0.9% higher than the 63,184 mortgages approved in June 2022

This was 14.4% lower than the 74,494 mortgages approved during July 2021

Twindig take

Mortgage approvals stabilised in July nudging up 0.9% (about 600 mortgages) as Boris Johnson resigned, perhaps he was one of those getting a new mortgage approved in July. History appears to be repeating itself with the housing market choosing to tread water as the political backdrop gets a little choppy. Once again uncertainty surrounding the occupant at 10 Downing Street does not appear to unsettle the UK housing market, with households choosing to 'get moving done'.

With mortgage rates on the rise and the cost of living increasing the housing market is looking solid, and so far those that need to move are moving, without the need for Government intervention. We continue to believe that the biggest drivers of housing transactions (and therefore mortgage approvals) are the need to move and security of employment. If a household believes its employment secure, mortgage rates determine the size and/or location of the house rather the decision to move.