When house prices and stamp duty holidays collide

The Land Registry is the most accurate and most detailed of all the house price indices and its latest update this week included some great data points. The data confirmed that UK house price inflation has accelerated since we entered lockdown 1 in March, but not all houses are equal. In this week's market view we look at house prices across 380 different parts of the country to find out what happens when house prices and stamp duty holidays collide. In short, there are both winners and losers. Is your neighbourhood a house price hit, miss or maybe? Read on to find out.

Picture Credit: Sumo 2 by tunnelarmr

Land Registry House Price Index

This week the Land Registry published its detailed house price index for September 2020

What they said

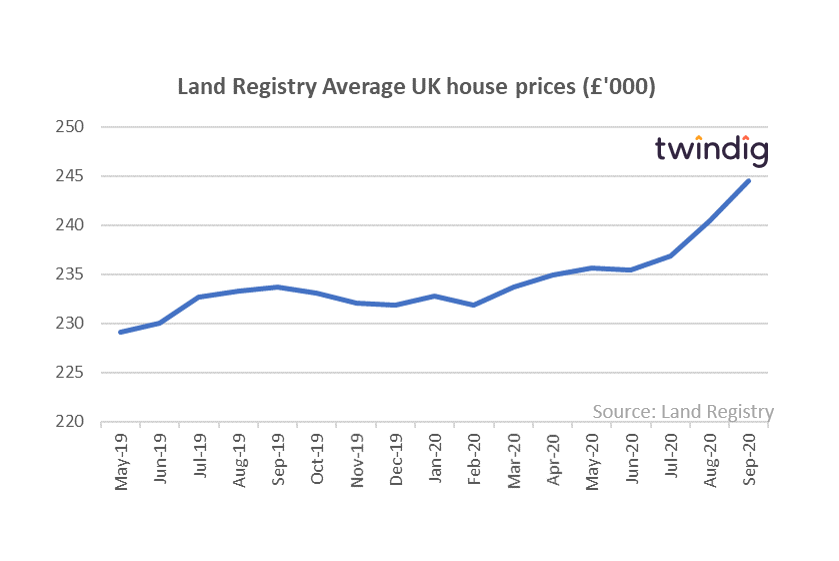

The average price of a property in the UK was £244,513

Annual price change +4.7%

The average change in September +1.7%

Twindig Take

The chart below shows the average UK house price since May 2019, and it seems to us that house prices were broadly stable until the start of lockdown, at which point house price inflation started to accelerate (due to a shortage of supply). House prices moved up another gear as the housing market reopened and following the announcement of the stamp duty holiday.

The positive news surrounding the potential COVID-19 vaccines lead us to believe that the upward trajectory of house prices will continue as home buyers (and mortgage lenders) can now see the light at the end of the tunnel.

Earlier in the week, we produced a detailed report looking at house prices in every Local Authority across England & Wales you can read that report clicking here

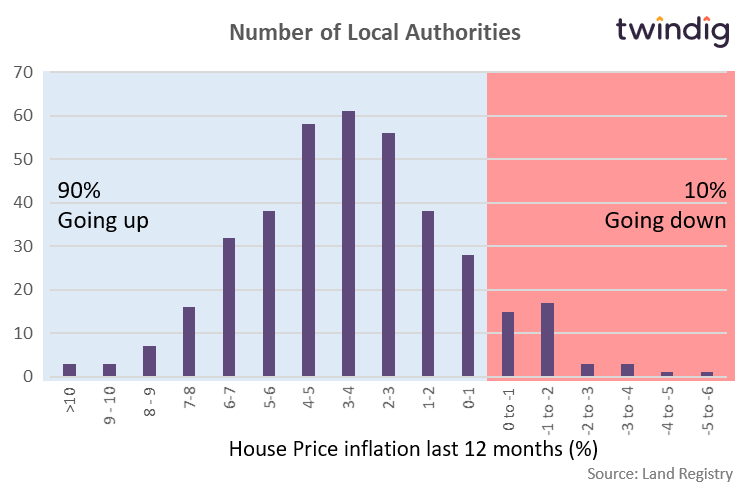

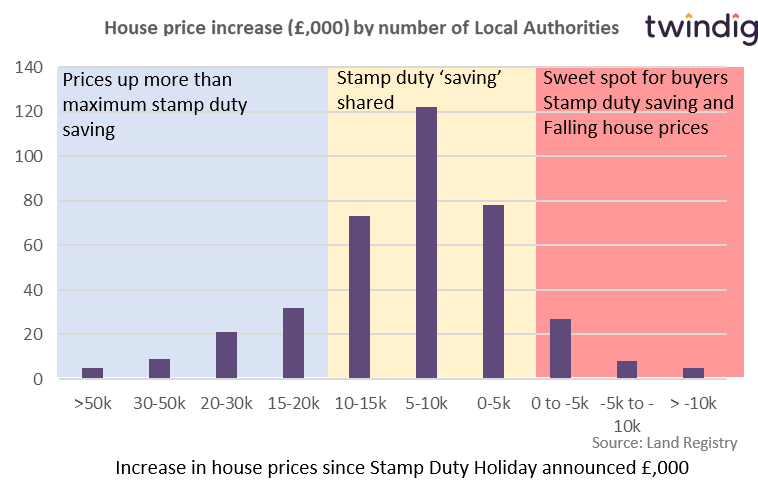

Earlier in the week, we produced a detailed report looking at house prices in every Local Authority across England & Wales. The Land Registry reports on 380 areas or regions, we found that house prices were rising in 340 areas and falling in 40. We summarise the distribution of those house price increases and decreases in the chart below and you can read the full report by clicking here

Land Registry Housing Transactions

This week the Land Registry published provisional details of housing transactions in England and Wales for July 2020

What they said

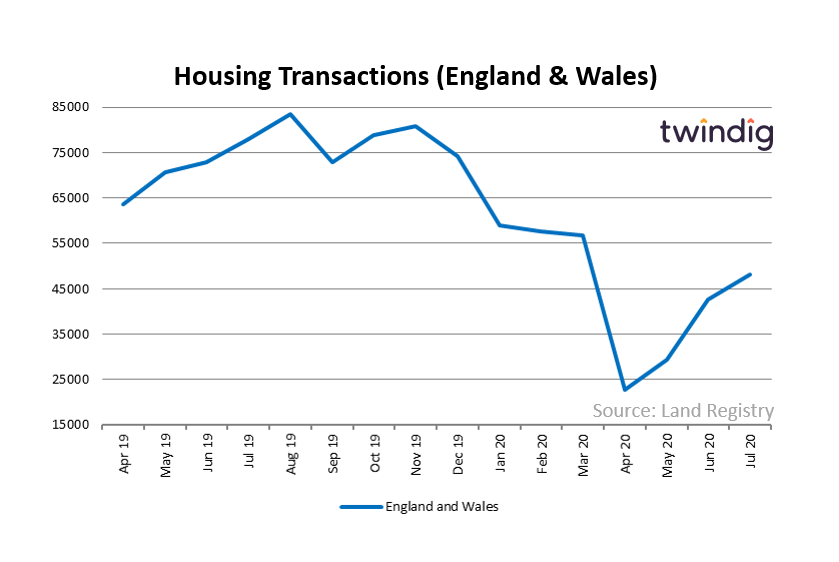

Provisionally there were 48,120 housing transactions in July 2020

An increase of 13% in the month

Transactions in July 2020 were 37% below their level in July 2019

Twindig Take

The rate of growth in housing transactions is slowing, although we must remember that this week’s data is provisional and subject to change. However, the slowing growth is consistent with what we are hearing from the mortgage lenders and conveyancing firms – both are struggling amid very high levels of demand and housing transactions and mortgage applications are taking longer to complete.

Unfortunately, this will mean many are likely to miss the end of the Stamp Duty Holiday and if they do they may pull out of the transaction altogether or seek a compensating reduction in the asking price.

Stamp Duty Winners and losers

Chancellor Rishi Sunak announced the Stamp Duty Holiday on 8th July 2020. Since then house prices in 340 of the 380 areas (90%) reported on by the Land Registry have seen house price increases.

In 67 of those areas house prices have increased by more than £15,000 the maximum saving under the stamp duty holiday. In those areas, the holiday has been expensive and may not have offered good value for money.

In this case for homebuyers, the house price winners become the stamp duty losers.

We show the distribution of stamp duty winners and losers in the graph below, but to read our full report which lights all the areas winning and losing click here

Stamp Duty Receipts

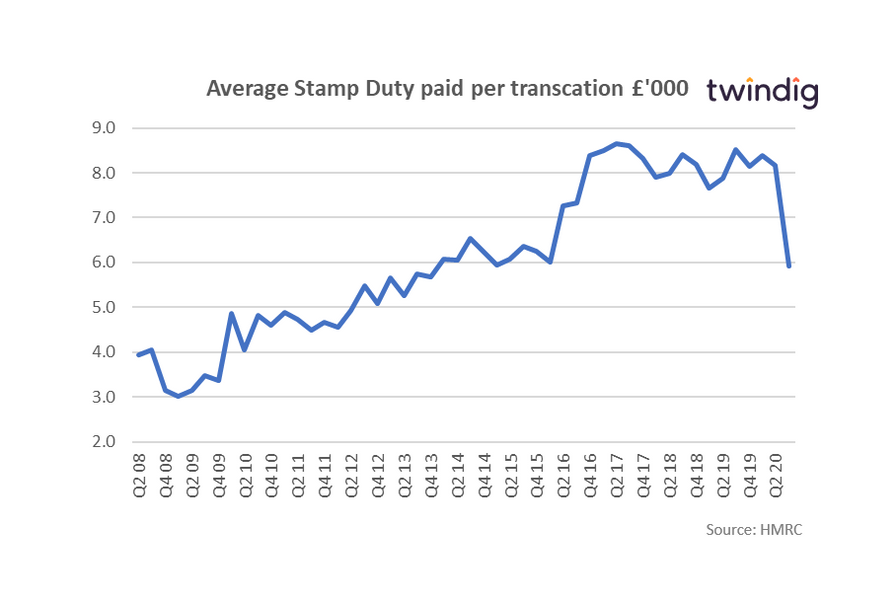

We started to see the impact of the Stamp Duty Holiday on the amount of stamp duty paid during the third quarter. Average stamp duty bills relating to residential properties fell by 27% to £5,915 (from £8,162). Housing transactions increased by 71% but Stamp Duty revenues only increased by 24% during Q3 2020.

Public finances are very tight and it is likely that taxes are going to have to rise. It will be interesting to see if the tax give-away for homebuyers will be balanced by increased capital gains tax on home sellers. Or will the tax breaks for home buyers be paid for by increased income taxes? Will the many pay for the tax break of the few?

With house prices and transaction levels rising it would seem that the housing market does not need to see an extension of the stamp duty holiday. If a stamp duty did kick start the housing market the Government might consider lowering income taxes to grow the numbers in employment rather than adding more stimulus to an already recovering housing market.