Should rising house prices trigger a rise in property taxes?

The COVID pandemic has played havoc with the UK's public finances. Tax receipts are down significantly, whilst public expenditure has increased significantly. Debts are rising, the books need balancing. Meanwhile, house prices are also rising, putting homeownership out of reach for many. Could taxing gains on house sales be the answer to both problems? This article looks at how the Chancellor could raise £29bn from Capital Gains Tax on property and asks: Is Capital Gains Tax one solution for two problems?

The Debt problem

Public sector debt is very high and still rising

The COVID pandemic has been financially costly for the UK Government. At the end of the Financial Year 2020, general Government gross debt was £1,876.8 billion, equivalent to 84.6% of gross domestic product and 24.6 percentage points above the reference value of 60.0% set out in the protocol on the excessive deficit procedure.

The ONS reported that Government debt at the end of November 2020 had reached £2,099.8 billion or 99.5% of GDP.

Tax receipts falling

Whilst debt is rising, tax receipts are falling. Central government tax and national insurance receipts (combined) in the eight months-to-November 2020 fell by £38.3 billion (or 8.6%) compared with the same period in 2019. Over the same period, Government support for individuals and businesses during the pandemic has increased central Government day to day spending by £147.3 billion (or 30.0%) in central government day-to-day (or current) spending, according to the ONS.

Of this additional spending:

£60.4 billion relates to the furlough scheme

£46.9 billion relates to the Coronavirus Job Retention Scheme (CJRS)

£13.5 billion on the Self Employment Income Support Scheme (SEISS)

This negative swing alone (falling revenue plus increased expenditure) is a £185.6bn swing in the wrong direction which will need to be re-paid.

The homeownership problem

The rates of homeownership among the younger age groups have fallen dramatically over the last few years as the statistics below highlight

In 2003-04:

16-24-year-olds: 24.0% were homeowners and 46.3% were in the private rented sector.

25-34-year-olds: 58.6% were homeowners and 21.4% were in the private rented sector.

35-44-year-olds: 74.3% were homeowners and 8.6% were in the private rented sector.

In 2019-20:

16-24-year-olds: 14.3% were homeowners and 66.8% were in the private rented sector.

25-34-year-olds: 40.9% were homeowners and 41.8% were in the private rented sector.

35-44-year-olds: 55.8% were homeowners and 27.0% were in the private rented sector.

House prices and, in particular, having access to a big enough deposit are the main obstacles preventing many aspiring homeowners the chance to get a foot on the property ladder.

Homeownerhip a casualty of its own success

In our view, the homeownership issue is a casualty of its success and can trace its roots back to 1971, when homeownership rates passed 50% for the first time leading to the emergence of the mass affluent. The first mass affluent generation is now passing on their housing wealth to the next generation (either to their children or grandchildren).

This wealth transfer makes perfect sense at a family and household level (who wouldn’t want to help out their children?). However, at a national level, this has led to a divorce between house prices and earnings. A salary in isolation is now not enough to get on the housing ladder.

We are moving to a place where if your parents don’t own their home, you are unlikely to be able to afford a home of your own.

Over time if this pattern goes unchecked, we will see an increasing polarity in the UK housing market between the haves and the have nots and rising levels of housing wealth inequality.

Could a tax on property capital gains be one solution for two problems?

During the pandemic, the UK housing market confounded the market commentators, in the face of the biggest shock to our economy on record where output has fallen, jobs have been lost and many parts of the economy and country locked down, house prices have continued to rise.

The volume of housing transactions has also accelerated following a brief closure of the UK housing market and the introduction of a Stamp Duty Holiday.

The UK housing market is very equity rich (the value of homes far outweighs the value of the mortgages secured on them). Many people make large capital gains when they sell their homes.

Twindig’s high-level analysis suggests that the average capital gain on a house sale is around £100,000. Assuming 1 million housing transactions per year (the 2014 – 2019 average being 1.1 million), this would generate capital gains of £100bn.

To put our £100bn into context in 2018-19 the chargeable gains on property subject to Capital Gains Tax was just £1.7bn.

If our hypothetical property capital gains of £100bn were taxed at a rate of 28% the tax revenue would be £28bn.

Does the Chancellor have his eye on taxing those gains and if not, should he? Should those that have benefitted help those that have not?

For more details on Capital Gains Tax and property read our capital gains tax on property summary

The UK Housing market in context

The UK housing market is very equity rich. There is a lot more cash than debt tied up in the housing market, and because historically house prices have gone up more often than they have gone down there are also a lot of capital gains tied up in the housing market.

We summarise in statistics below why the Chancellor may have his eye on increasing taxes on the housing market:

Value of the UK housing market c.£7 trillion

UK mortgage debt c £1.5 trillion.

Implied housing market Loan-to-Value (LTV) of 21.4%

Number of mortgages 13.4 million.

Number of households c.28 million more than 50% of home do not have a mortgage attached to them

Since 2013-14 there have been more outright owners than mortgagors (i.e. households with a mortgage).

In 2019-20, 35% of households (8.3 million) owned their home outright (without a mortgage)

In 2019-20 30% of households (7.1 million) were buying with a mortgage

The increase in the number and proportion of outright owners is partly explained by population ageing, with large numbers of ‘baby boomers’ reaching retirement age, paying off their mortgages and moving into outright ownership.

In 2019-20, 63% of outright owner households had a Household Reference Person (HRP) aged 65 or over, while 59% of households with a mortgage had an HRP aged 35-54

Average length in your current home: If you have no mortgage 23.8 years, if buying with a mortgage 10.0 years, the average across all homeowners 17.4 years

Sources: ONS, FCA

Will the chancellor raise capital gains tax on property?

The chancellor has initiated a review of Capital Gains Tax and asked the Office of Tax Simplification to review the structure of Capital Gains Tax

One way to simplify Capital Gains Tax would be to normalise the rates paid on property and other assets or indeed harmonise income tax and capital gains tax rates

Capital Gains Tax Calculations

We illustrate below the potential capital gains based on the change in average house prices in England, and the potential capital gains tax revenue across a range of periods including the average periods between buying and selling a home.

House price inflation

House Price Inflation (HPI) last 10 years 47%

HPI last 15 years 58%

HPI last 17 years 93%

HPI last 23.8 years 367%

The average capital gains in housing

The average gain in house prices in England 10 years £84,073

The average gain in house prices in England last 15 years £96,537

The average gain in house prices in England last 17 years £126,290

The average gain in house prices in England last 23.8 years £205,976

Chargeable Capital Gain (Capital Gain less £12,300)

10 years: £71,773

15 years: £84,237

17 years: £113,990

23.8 years £193,676

Capital Gains Tax at 28% per home on average

10 years: £20,096

15 years: £23,586

17 years: £31,917

23.8 years £54,229

Potential Property Capital Gains Tax Revenue

The illustrative estimates assume 1 million housing transactions per year

10 years: £20.1bn

15 years: £23.6bn

17 years: £31.9bn

23.8 years £54.2bn

Weighted average £28.9bn

We estimate that taxing capital gains on property could raise tax revenue in the range of £20bn to £54bn with a weighted average based on holding times of almost £30bn.

Raising taxes on property capital gains would both help balance the public finances and go some way to restoring the link between house prices and household earnings, both of which would, in our view, be good outcomes for our society.

Taxing property wealth is one way of rebalancing the housing market and levelling the playing field for first-time buyers. However, we appreciate such a policy would be very unpopular whilst the majority are themselves, homeowners.

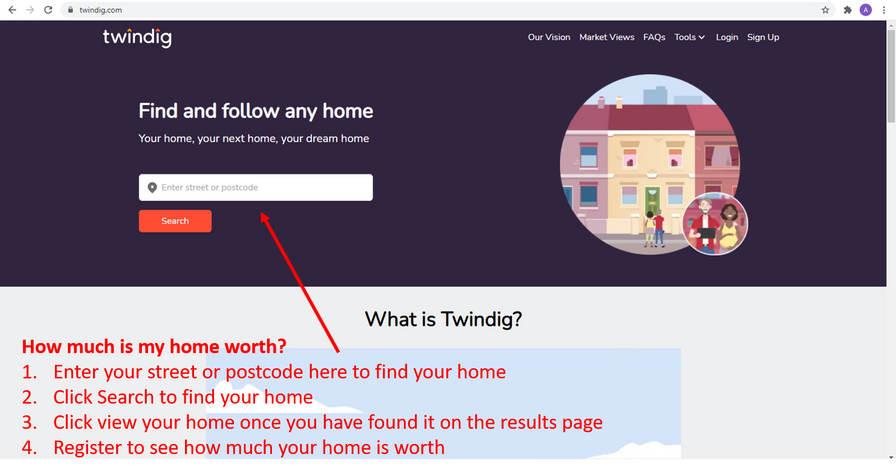

How much is my house worth?

Twindig has details for every home across the country, including yours. If you want to see an estimate of the current value of your home you can do so by visiting twindig.com

Simply:

Enter your street or postcode into the search box

Click search

Find your home in the results page

Click view

Register to see how much your home is worth