Capital Gains Tax UK

In this article, we explain what Capital Gains Tax is, which properties are liable to capital gains tax and how you can calculate your property capital gains tax if it is.

How is capital gains tax calculated on a property?

At the current time (January 2021) the overwhelming majority of people will not have capital gains tax on their main home (primary residence). However, there are a few exceptions. Your home will be liable to Capital Gains tax if you have let your it out, used part of it exclusively for business purposes or it is very large with grounds and buildings covering more than 5,000 square metres.

Capital Gains Tax will be payable on any home that you dispose of that isn’t your primary residence such as holiday homes, second homes and buy to let properties.

Will primary residences be liable for capital gains tax?

In July 2020 the Chancellor Rishi Sunak asked the Office of Tax Simplification to review the structure of Capital Gains Tax. The Office of Tax Simplification published a call for evidence to assist in a Capital Gains Tax review.

Several changes are being considered:

Harmonising income and capital gains tax rates.

At the moment there is an incentive to try to classify income as a capital gain as the tax rate on capital gains is lower than that on income. Currently, capital gains tax on property is either 18% or 28%, whereas the income tax rates in England are 20% (basic rate), 40% (higher rate) and 45% (additional rate).

Capital Gains on property may in the future be treated as the top slice of income and the rate of capital gains tax paid on property be taxed at the same rate as if it were income rather than a capital gain

Capital Gains on Primary residence

Given the high levels of house price inflation in recent years the chancellor may look to charge capital gains tax on the sale of a person’s primary residence. If this were to happen it is likely, in our view, that there would be a tax free allowance of say £50,000 that would be exempt after which all gains would be taxable.

The chancellor may announce changes to Capital Gains Tax in his March 2021 Budget.

What is a capital gain?

You have a capital gain if you sell something for more than you paid for it, the increase in value is called a capital gain.

If you purchased a property for £100,000 and sold it for £120,000 you will have made a capital gain of £20,000 (£120,000 sale proceeds less the £100,000 purchase price)

In the UK it is the capital gain that is taxed rather than the amount of money you receive from selling the asset. If you give your house to your children and value of the house has increased by £100,000, HMRC view you as having made a capital gain of £100,000 even though you haven’t physically received any money.

When do you pay capital gains tax?

You only pay capital gains tax on capital gains which exceed your annual capital gains tax-free allowance, which is also called your Annual Exempt Amount. This is currently £12,300 for individuals. Of you have capital gains of £15,000 you will pay capital gains tax on £2,700 (£15,000 less your £12,300 tax-free allowance).

Capital gains tax calculator

If your property is liable for Capital Gains Tax:

- Start with how much you sold your property for (A)

- Subtract how much you paid for your property when you purchased it (B)

- Your capital gain (C) is the sale price (A) less the purchase price (B)

- Your chargeable gain is (C) less £12,300. You will pay capital gains on any capital gain over £12,300

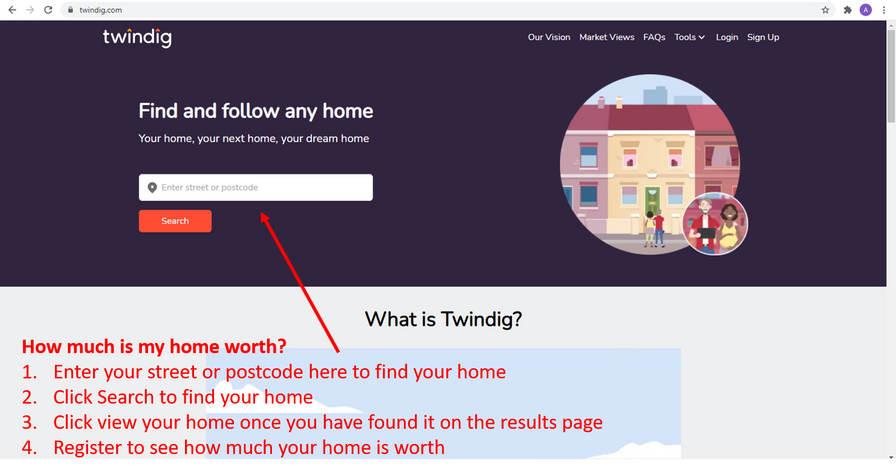

To find out how much your home is worth you can look up its current value on Twindig

The amount of Capital Gains Tax you will pay will depend on if you are a basic or higher rate income taxpayer.

Basic rate taxpayers will pay 18%, but this increases to 28% on any part of the taxable gain which takes them into the higher rate of income tax. (add your taxable capital gain onto your earnings for the year.

If you are a higher rate income taxpayer you will pay 28% tax on your capital gains

What assets do you pay capital gains on?

You will pay Capital Gains Tax on the taxable gain when you sell or dispose of:

- Most personal possessions worth £6,000 or more (but not your car)

- Shares that are not in a tax-exempt saving scheme such as an ISA or PEP

- Business assets (such as land, buildings, fixtures and fittings, machinery, trademarks)

- Property that is not your main home

However, you will pay on your main home if:

- You have let it out

- Used it for business or

- Its grounds and buildings cover less than 5,000 square meters

What assets are exempt from Capital Gains Tax?

Shares held in a tax-exempt savings scheme such as an ISA or a PEP

UK Government gilts and Premium Bonds

Winnings from betting, lotteries or the pools

Gifts of assets made to a charity

Capital Gains Tax allowances

In the UK you only pay capital gains tax on capital gains which are greater than your tax-free allowance

The Capital Gains Tax allowance for individuals is currently £12,300 per year. If you have capital gains of £13,000 you will pay capital gains tax on £700 (£13,000 less your £12,300 capital gain tax-free allowance).

Capital Gains Tax Rates on Property

In the majority of cases as described above you will not pay Capital Gains Tax on your primary residence. You will however generate taxable Capital Gains on any property or home that isn’t your primary residence.

If you are a higher rate income taxpayer, you will pay 28% on your capital gain. If you have a gain of £10,000 the tax payable will be £2,800

If you are a lower rate income taxpayer, you will pay 18% on gains which fall within your unused lower rate tax allowance and 28% on any amount above this

Capital Gains Tax rates on other assets

If you are a higher rate income taxpayer, you will pay 20% on your capital gain. If you have a taxable capital gain of £10,000 the tax payable will be £2,800

If you are a lower rate income taxpayer, you will pay 10% on taxable gains which fall within your unused lower rate tax allowance and 20% on any amount above this

How much is paid in capital gains tax?

In the tax year 2018/19 Capital Gains Tax raised £9.5 billion, This tax was generated on taxable capital against of £62.8 billion.

In 2018/19 276,000 taxpayers were liable for Capital Gains Tax. To put this into context in tax year 2018/19 there 31.6 million people paid income tax. Less than 1% of income taxpayers had to pay Capital Gains Tax.

In 2018/19 £3.8 billion (40% of the £9.5 billion raise) came from taxpayers with capital gains of more than £5 million.

Property and Capital Gains Tax

In 2018/19 residential property (land and buildings) accounted for 10% of the number of assets disposed of, 20% of the value of those disposals and 14% of all the chargeable gains. The median average holding period (the time between purchase and sale) for residential land and buildings was between 10 and 15 years.

What is a capital loss?

If you sell something for less than you paid for it, the decrease in value is called a capital loss.

If you purchased an asset at £100 and sold it at £75 you will have made a £25 capital loss

Capital losses can usually be subtracted from your capital gains. If you sell one asset with a gain of £25,000 and another with a loss of £10,000 your net capital gain in that year would be £15,000.

Capital Gains Tax in perspective

In 2018/19 Capital Gains tax receipts of £9.5bn accounted for 1.3% of all tax receipts.

The biggest source of tax revenue is income tax which raised £192.6bn in 2018/19 accounting for 26.2% of tax receipts.

The next two largest sources of UK taxation were National Insurance £137.3bn (18.7%) and VAT at £133.1bn (18.1%).

UK Corporation tax receipts were £56.3bn (7.7% of the total).

Property taxes in the form of Stamp Duty Land Tax raised £12.9bn in 2018/19 (1.8%) which was closely followed by taxes on alcohol at £12.1bn (1.6%).

The UK Housing market in context

The following statistics highlight why the UK housing market is an attractive market to raise capital gains taxes from, in short, there is more cash than debt tied up in the UK housing market and a substantial amount of capital gains:

Value of the UK housing market c.£7 trillion

- UK mortgage debt c £1.5 trillion.

- Implied housing market Loan-to-Value (LTV) of 21.4%

- Number of mortgages 13.4 million.

- Number of households c.28 million more than 50% of home do not have a mortgage attached to them

- Since 2013-14 there have been more outright owners than mortgagors (i.e. households with a mortgage).

- In 2019-20, 35% of households (8.3 million) owned their home outright (without a mortgage)

- In 2019-20 30% of households (7.1 million) were buying with a mortgage

The increase in the number and proportion of outright owners is at least partly explained by population ageing, with large numbers of ‘baby boomers’ reaching retirement age, paying off their mortgages and moving into outright ownership.

In 2019-20, 63% of outright owner households had a Household Reference Person HRP aged 65 or over, while 59% of households with a mortgage had a HRP aged 35-54

Average length in your current home: If you have no mortgage 23.8 years, if buying with a mortgage 10.0 years, the average across all homeowners 17.4 years

The Potential Capital Gains Tax Revenue from Property

In this section, we look at house price inflation across a number of typical ownership periods (the frequency with which you buy and sell a home) to assess a high-level estimate or illustration of the potential revenues which could be raised from Capital Gains Taxes on residential property

- HPI last 10 years 47%

- HPI last 15 years 58%

- HPI last 17 years 93%

- HPI last 23.8 years 367%

- Average gain in house prices in England 10 years £84,073

- Average gain in house prices in England last 15 years £96,537

- Average gain in house prices in England last 17 years £126,290

- Average gain in house prices in England last 23.8 years £205,976

Chargeable Capital Gain (Capital Gain less £12,300)

- 10 years: £71,773

- 15 years: £84,237

- 17 years: £113,990

- 23.8 years £193,676

Capital Gains Tax at 28%

- 10 years: £20,096

- 15 years: £23,586

- 17 years: £31,917

- 23.8 years £54,229

Potential Capital Gains Tax Revenue (assuming 1 million housing transactions)

- 10 years: £20.1bn

- 15 years: £23.6bn

- 17 years: £31.9bn

- 23.8 years £54.2bn

Capital Gains Tax a brief history

Capital Gains Tax was introduced into the UK in 1965 by the labour Chancellor James Callaghan in his first budget, in part because of high levels of property and house price inflation in the post-war period had led to significant gains falling outside of the taxation system and then like now, the UK Government was facing the challenges of high levels of public debt. The initial rate of Capital Gains Tax was set at 30%.

At the time of its introduction in April 1965 James Callaghan said:

"Capital gains confer much the same kind of benefit on the recipient as taxed earnings, yet earnings pay tax in full while capital gains go free. This is unfair to the wage and salary earner."

He also noted that "the present immunity from the taxation of capital gains had given a powerful incentive to the skilful manipulator to turn what is really taxable income into tax‐free capital gains."

Since the introduction of Capital Gains Tax, there have been many long and detailed debates discussing why, if at all, capital gains should be taxed differently from income, especially where from an accounting point of view tax affairs can be structured in a way to pay less tax.

When structuring a capital gains tax system, there are a number of challenges to be overcome:

The tax to be charged on real rather than inflationary gains, this becomes an important issue following a sustained period of high inflation

The tax should not as an incentive for individuals to convert income into capital gains in order to pay less tax

The tax should promote and encourage long term investment and entrepreneurship

In July 2020 the Office of Tax Simplification published a call for evidence to assist in a Capital Gains Tax review which had been requested by Chancellor Rishi Sunak

Inflationary vs real Capital Gains

Many believe that it is unfair to tax inflationary or paper gains. The argument is that if the underlying rate of inflation is 10% then a gain of 10% is not a real gain. The owner of the asset is no better off, no ‘gain’ has been made and therefore it is unfair to tax the inflationary increase.

To address the issue of inflationary gains indexation relief was introduced in 1982, which sought to exclude pure inflationary increases in the value of an asset.

Indexation relief was replaced by taper relief in March 1998 a relief designed to encourage assets to be held for the longer term and/or to tax shorter-term speculative capital gains.

Taper relief was withdrawn in April 2008 and introduced a single rate of capital gains tax set at 18%.

In June 2010 the 18% rate was replaced with a 28% rate for higher rate taxpayers and 18% for lower rate taxpayers. The new rate was effective the ‘from midnight on Budget day’ leaving little time for gains to be crystalised before the new higher rate applied.

In March 2016 Capital Gains Tax rates were cut from 28% to 20% for higher rate taxpayers and from 18% to 10% for basic rate taxpayers, although gains from property would continue to be taxed at 28% and 20% respectively.