Stamp Duty for Second Homes

This article explains how much Stamp Duty is payable on second homes or additional properties. We also include a link to our Stamp Duty Calculator so that you can calculate the Stamp Duty on your second home.

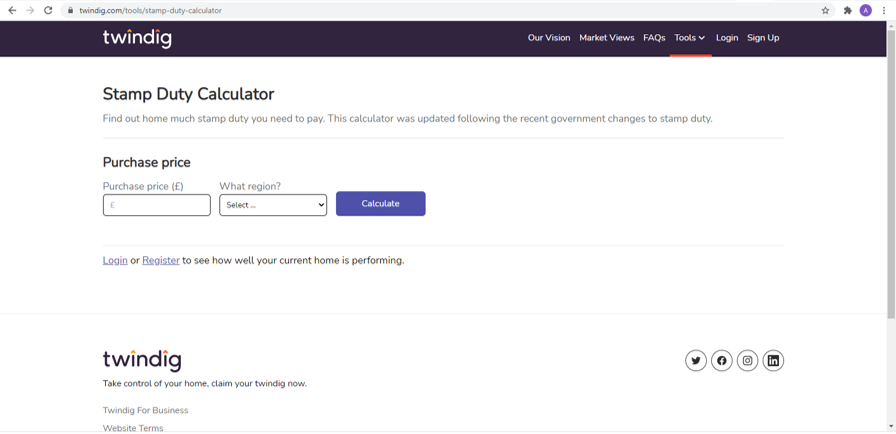

Second Home Stamp Duty Calculator

Second home buyers can use our Second Home Stamp Duty Calculator to work out how much stamp duty they will need to pay when buying their second or additional home. The amount of Stamp Duty will vary depending on where the second home is. Our Stamp Duty Calculator takes location into account and can be used for second home purchases in England, Scotland, Wales and Northern Ireland.

What is Second Home Stamp Duty?

Stamp Duty is a tax paid when you buy a property above a certain price. Above a certain threshold it is payable when you buy a freehold property, a new or existing leasehold property, buy a property through a shared ownership scheme or if you are transferred property in exchange for payment. Second Home Stamp Duty is the Stamp Duty payable on any home that isn't your primary residence.

What is a Second Home?

Concerning Stamp Duty a second home is any home you purchase that is not your primary residence that is the home you live in most of the time, the place you would call your ‘home’ – typically the address where you have most, if not all, of your letters sent to.

Any other home, be it a holiday home a holiday let, a buy to let property or even a property you have bought for your children or a friend or family member is classed as a second or additional home when it comes to Stamp Duty Tax.

How much is Stamp Duty on a second home?

The bad news is that Stamp Duty on a second home is higher than on your primary residence. The Stamp Duty rate is three percentage points higher on each Stamp Duty Band for second homes than it is for primary residences.

The UK Government’s thinking behind these higher rates is threefold:

People buying a second home are likely to be at the higher end of the UK’s income and wealth scale and are therefore able to pay more tax.

With many first-time buyers struggling to get a foothold on the property ladder this is an attempt to tilt the scales slightly in their favour. First time buyers are often competing with Buy to let investors when seeking to buy their first home and buy to let investors typically have more financial fire power than first time buyers.

There is one school of thought that believes that those buying second homes as holiday homes are much wealthier than the majority of the population in living in the holiday home location itself and may be pricing the locals out of the market.

We suspect that that the main reasons come down to second home buyers ability to pay more and assuaging the concerns of those seeking to buy their first home.

Stamp Duty History

Stamp Duty has been around for a very long time, it was introduced into England on 28 June 1694 during the reign of King William III (also known as William of Orange). It was established in parliament to last for four years and the tax was raised to help pay for the war against France and Louis XIV and was initially raised on Vellum, Parchment and Paper.

It was not a popular tax, the Stamp Act of 1765 attempted to raise Stamp Duty in the British colonies in America contributed to the outbreak of the American War of Independence. The arrival of ships bearing ‘stamped papers’ led to major rioting, the most well known being the riots of the Boston Tea Party

It was not until 1808 that Stamp Duty was first applied to housing in respect of conveyances on a home’s sale.

How is Stamp Duty Calculated?

The current method of calculating Stamp Duty was introduced on 3 December 2014. The amount of Stamp Duty that you have to pay is based on the purchase price of the property. Currently in England the Stamp Duty you will pay on your primary residence is:

no stamp duty on homes costing up to £500,000

- 5% on the amount of the purchase price between £500,001 and £925,000

- 10% on the amount of the purchase price between £925,001 and £1,500,000 and

- 12% on any amount above £1,500,000

How was Stamp Duty Calculated before 3 December 2014?

Before the 3rd December 2014 Stamp Duty was calculated on a slab rather than a slice system. If the home you were buying fell into the £250,001 to £500,000 Stamp Duty Band you would pay the Stamp Duty rate for that band on the full price of your home.

For instance, if your house cost £265,000 and the £250,001 to £500,000 band was 3.0% you would £7,950 = £265,000 x 3%

Second Home Stamp Duty rates from 1 April 2021

- Up to £40,000 Nil

- £40,000 to £125,000 3%

- £125,000 to £250,000 5%

- £250,001 to £925,000 8%

- £925,000 to £1,500,000 13%

- More than £1,500,000 15%

Second Home Stamp Duty from 8 July 2020 to 31 March 2021

- Up to £500,000 3%

- £500,001 to £925,000 8%

- £925,000 to £1,500,000 13%

- More than £1,500,000 15%

Second Home Stamp Duty from 22 November 2017 to 7 July 2020

- Up to £40,000 Nil

- £40,000 to £125,000 3%

- £125,000 to £250,000 5%

- £250,001 to £925,000 8%

- £925,000 to £1,500,000 13%

- More than £1,500,000 15%

Here is a link to historic Stamp Duty Rates