Stamp Duty for First Time Buyers

This article explains how much stamp duty first time buyers will have to pay when they purchase a property.

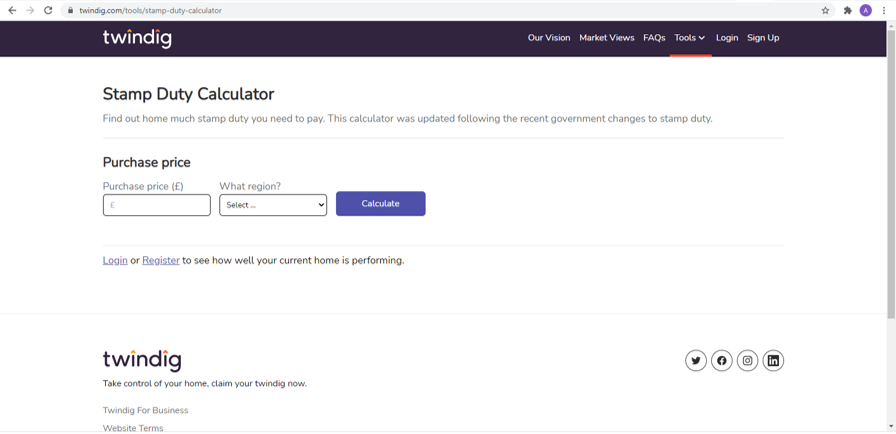

First Time Buyer Stamp Duty Calculator

You can use our stamp duty calculator to work out how much Stamp Duty you will need to pay. Amounts vary depending on where the property is: England, Scotland, Wales or Northern Ireland, whether or not you are a first time buyer and if you are purchasing you main home or an additional property such as a holiday home, a holiday let or a buy to let property. Our Stamp Duty Calculator takes all of these factors into account

What is Stamp Duty?

Stamp Duty is a tax paid when you buy a property above a certain price. Above a certain threshold it is payable when you buy a freehold property, a new or existing leasehold property, buy a property through a shared ownership scheme or if you are transferred property in exchange for payment.

What is a first-time buyer?

Concerning Stamp Duty Tax, a first-time buyer is an individual or group of individuals who have never owned an interest in a residential property in the United Kingdom or anywhere else in the world and who intend to occupy the property they are buying as their main residence.

When does a First-time buyer have to pay stamp duty?

If you are a First-time buyer in England or Northern Ireland you have to pay your stamp duty within 14 days from the date you complete your house purchase.

How does a First-time buyer pay Stamp Duty?

The easiest way is to ask your solicitor to arrange the payment. You still have to transfer the amount of the Stamp Duty to your solicitor, but they will make sure it is paid on time, you will have plenty of other things to be doing.

Can First-time buyers add stamp duty costs to their mortgage?

Some mortgage lenders allow you to and some won’t, but we advise that you don’t. If you add Stamp Duty to your mortgage you will pay interest on the amount over the whole length of your mortgage which could be 25 or 30 years that is a lot of interest to pay on top of the tax itself.

Adding stamp duty to your mortgage will also increase your all-important Loan to Value (LTV) ratio. The higher your LTV the higher your mortgage rate is likely to be, so not only will you end up paying interest on your stamp duty you could end up paying a higher mortgage rate on your entire mortgage.

Why is First Time Buyer Stamp Duty different to home-movers?

The UK Government is keen to encourage homeownership and appreciates that buying your home is a very expensive thing to do, so it is a way of helping you on to the housing ladder. However, the COVID related Stamp Duty Holiday has temporarily equalised Stamp Duty rates for first time buyers and home movers although the First Time Buyer Stamp Duty advantage is scheduled to return on 1 April 2021

Stamp Duty History

Stamp Duty has been around for a very long time, it was introduced into England on 28 June 1694 during the reign of King William III (also known as William of Orange). It was established in parliament to last for four years and the tax was raised to help pay for the war against France and Louis XIV and was initially raised on Vellum, Parchment and Paper.

It was not a popular tax, the Stamp Act of 1765 attempted to raise Stamp Duty in the British colonies in America contributed to the outbreak of the American War of Independence. The arrival of ships bearing ‘stamped papers’ led to major rioting, the most well known being the riots of the Boston Tea Party

It was not until 1808 that Stamp Duty was first applied to housing in respect of conveyances on a home’s sale.

How is Stamp Duty Calculated?

The amount of Stamp Duty that you have to pay is based on the purchase price of the property. Currently in England the Stamp Duty you will pay on your primary residence is:

- no stamp duty on homes costing up to £500,000

- 5% on the amount of the purchase price between £500,001 and £925,000

- 10% on the amount of the purchase price between £925,001 and £1,500,000 and

- 12% on any amount above £1,500,000

First Time Buyer Stamp Duty rates from 1 April 2021

Houses costing up to £300,000

- Up to £300,000 Nil

Houses costing between £300,000 and £500,000

- Up to £300,000 Nil

- £300,00 to £500,000 5%

Houses costing more than £500,000

- Up to £125,000 Nil

- £125,000 to £250,000 2.0%

- £250,001 to £925,000 5.0%

- £925,000 to £1,500,000 10.0%

- More than £1,500,000 12.0%

First Time Buyer Stamp Duty from 8 July 2020 to 31 March 2021

- Up to £500,000 Nil

- £500,001 to £925,000 5.0%

- £925,000 to £1,500,000 10.0%

- More than £1,500,000 12.0%

First Time Buyer Stamp Duty from 22 November 2017 to 7 July 2020

Houses costing up to £300,000

- Up to £300,000 Nil

Houses costing between £300,000 and £500,000

- Up to £300,000 Nil

- £300,00 to £500,000 5%

Houses costing more than £500,000

- Up to £125,000 Nil

- £125,000 to £250,000 2.0%

- £250,001 to £925,000 5.0%

- £925,000 to £1,500,000 10.0%

- More than £1,500,000 12.0%

Here is a link to historic Stamp Duty Rates