Twindig Housing Market Index (HMI) - 25 June 22

In the week that saw housing transactions nudge upward and inflation reach a 40-year high, the twindig housing market index was unchanged this week at 72.2.

Investors' confidence in housebuilders took a hit again this week, perhaps Berkeley Homes CEO Rob Perrins worried investors when he told the Financial Times that "The number of new homes being built in London could halve in the coming years as a result of rising construction costs and development taxes, worsening an already severe supply crunch". However, the reduction in investor confidence in housebuilders was neutralised by increasing confidence in the estate agency, mortgage lending and property portal markets leaving the twindig housing market index unchanged for only the second time in its history.

Housebuilders woes?

The theme from housebuilders is that they will be less aggressive or active in the land market for the next 6-12 months to give the macroeconomic headwinds a chance to subside. Land is the lifeblood of housebuilders and buying the right amount of land, in the right place, at the right price, at the right time is the key to success. Although the actions of the housebuilders make perfect sense, investors took this to mean that the next six to twelve months could be a rocky period for the housing market and investor confidence in housebuilders fell by 4.4% this week. We think this reaction is too severe because the mainstream housebuilders have good landbanks, strong or record orderbooks and house price inflation is covering build cost inflation.

Housing transactions nudge up

The latest data from HMRC shows that housing transactions nudged up in May 2022. It seems that so far the cost of living crisis and rising mortgage rates have not been hampering homebuyers and home movers' plans. Whilst we appreciate the barrier to homeownership is being raised as household budgets are squeezed it seems that plenty are still able to clear the hurdle, suggesting that when times are tough, there really is no place like home.

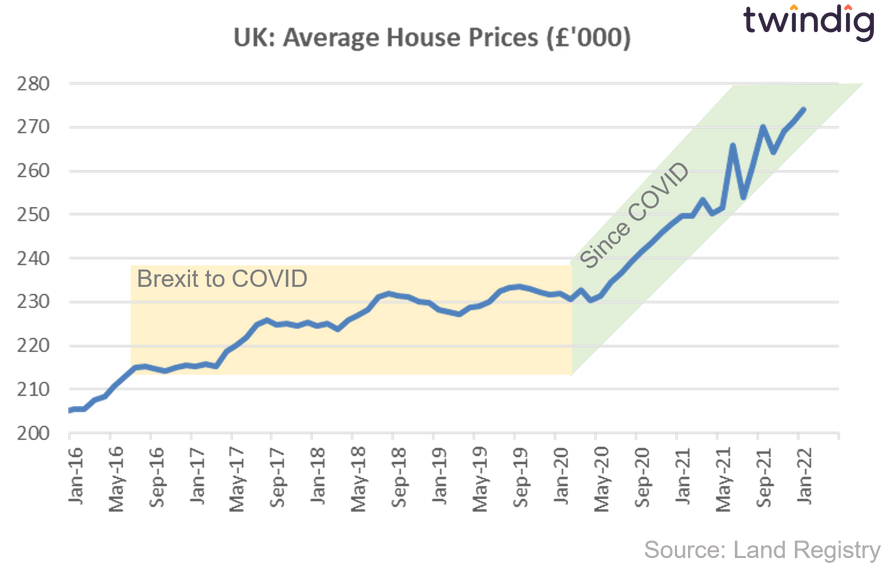

Brexit vs COVID

This week we past the sixth anniversary of the EU Brexit Referendum, and it allows us a chance to reflect on what has been better or worse for house prices - Brexit or COVID? Both had a big impact on our economy and most thought house prices would fall in the aftermath of both. So far, Brexit has been more challenging for house prices than COVID, the chart below paints a simple picture..

... but is the devil in the detail? you can read our full analysis below