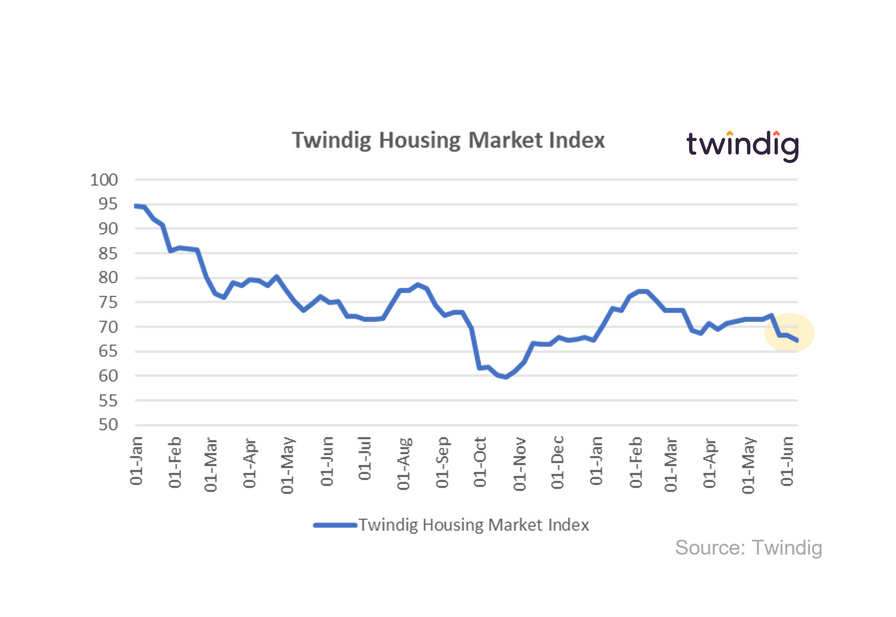

Twindig Housing Market Index 10 June 23

In the week that saw annual house price inflation turn negative for the first time since December 2012 and confusion in the mortgage market, the Twindig Housing Market Index fell by 1.7%.

House prices turning negative

Is the house price party finally over? The Halifax House Price Index for May 2023 revealed the first annual decline in house prices since December 2012. Average house prices are now £3,009 lower (1.0%) than they were in May 2022.

According to the Halifax house prices, on average are now £7,460 lower than their August 2022 peak of £293,992.

As inflation remains stubbornly high the Bank of England will likely raise Bank Rate again as it continues to try to tame inflation through interest rate rises. As a result of these heightened interest rate expectations, lenders have been both reducing the number of mortgage products they sell and increasing the mortgage rates on those that remain.

RICS Housing Survey: Reasons to be less miserable

Given the recent upheaval in the mortgage market and the higher-than-anticipated inflation figures, the RICS survey was more positive than we had expected. It may be that both issues were not caught by the survey and/or their impact has yet to play out at the coal face, but we will take positive news where we find it.

Across all regions, virtually all parts of the UK saw slightly less negativity concerning the level of new buyer enquiries when compared to the start of the year.

Mortgage market mayhem?

HSBC shocked the UK mortgage market this week by turning off the taps of its mortgage supply on Thursday due to extremely high demand. With all the major lenders either raising or about to raise mortgage rates this week, there was a rush as homeowners sought to remortgage before the rate rises, leading mortgage computer systems across the country saying 'No'.