Rents follow house prices as tick follows tock…

Property portal Zoopla reported this week that rents are growing at their highest level for 13 years, unlucky for tenants, but lucky for landlords. UK rents are rising at around 5% per annum as demand in major cities doubles.

Why are rents rising so fast?

Zooming back to real life

Zoopla’s research suggests that rents are rising as we return to more normal patterns of life following the end of lockdown restrictions. The resumption of ‘normal’ urban life as we return to our offices, gyms and favourite restaurants and bars as we leave zoom calls behind to meet in person rather than online.

Supply shortages

Zoopla also points out that the supply of properties for rent is also low, some 43% below the five-year average. Structural changes to the rental market such as the additional stamp duty on buy to let properties, changes in taxation relating to property income and expenditure, and an increasing regulatory burden on landlords has taken out capacity from the market. These structural trends are likely to continue, in our view.

Race for space

Much has been made of the race for space in the owner-occupied sector, where lockdown experiences coupled with the opportunities provided by the stamp duty holiday led homebuyers to seek bigger homes with more internal (that home office) and external (a garden) space.

The same race for space has also happened in the rental market coupled with households seeking to rent in a less rural environment to try out the ‘good-life’ before committing to a home purchase.

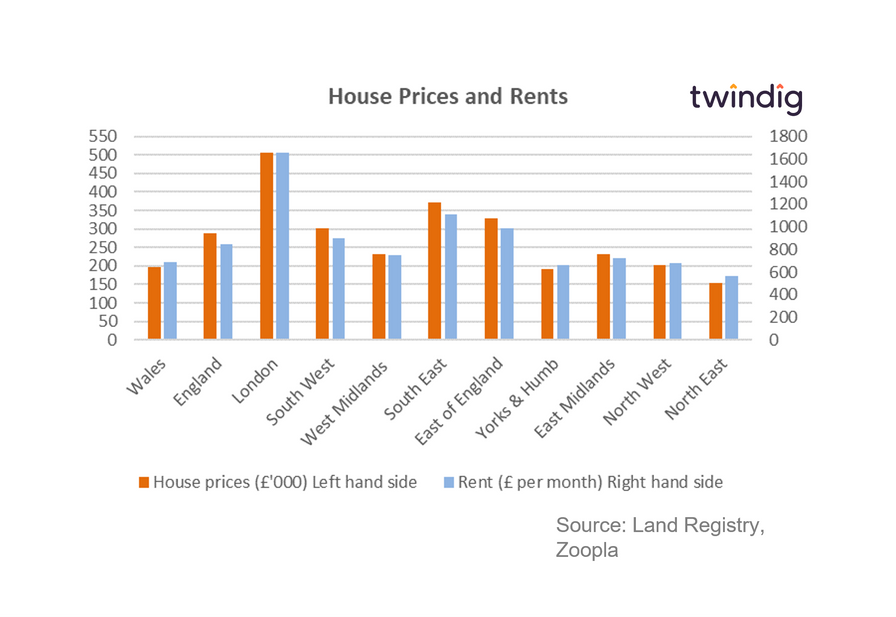

Rents are linked to house prices

We must also not forget that house prices and rents are inextricably linked. Whilst homeownership is the norm rents will follow house prices, as the decision to buy a rental property will be linked to expected financial returns (how much will the rent be compared to the purchase price of the home)

Landlords will either be thinking of what financial return their rental properties are generating. The basic rental yield calculation is:

Rent / House price = rental yield

Or they will be linking rental payments with their mortgage costs. As house prices increase a bigger mortgage is needed to buy a home and therefore a higher rent will be needed to cover the mortgage costs.

The social cost of rising rents

Rising rents have a social cost, especially for aspiring homebuyers. The more rent they pay, the less they can save for a deposit, rising rents are likely to lead to a longer amount of time living in rented accommodation. Meanwhile, landlord’s wealth grows at the expense of those seeking to get onto the housing ladder to start accumulating housing wealth.

How to address the rental supply shortage

There is a small but growing build to rent sector, where homes are built specifically for the private rental sector. These are typically purpose-built blocks owned and managed by big corporate landlords such as Citra Living

The good news is that these properties help address the rental supply shortage

The bad news, in our view, is that they reduce the supply of homes available to buy and we are already not building enough homes and they accelerate the growth in inequality of housing wealth. The big corporate landlords build up housing wealth at the expense of the would-be first-time buyer.

Is fractional homeownership a better alternative

We believe it is, rather than having landlords big and small competing against homebuyers, fractional homeownership allows landlords and homebuyers to work together. Fractional homeownership allows both landlord and homebuyer to get access to and accumulate housing wealth rather than competing against each other. With fractional homeownerhip, homeownership needn’t be a zero-sum game with landlords pitched against homeowners.

You can read our full case for fractional ownership here