Mortgage rates bottoming out

The Bank of England released average mortgage rates by Loan to Value (LTV) today

What they said

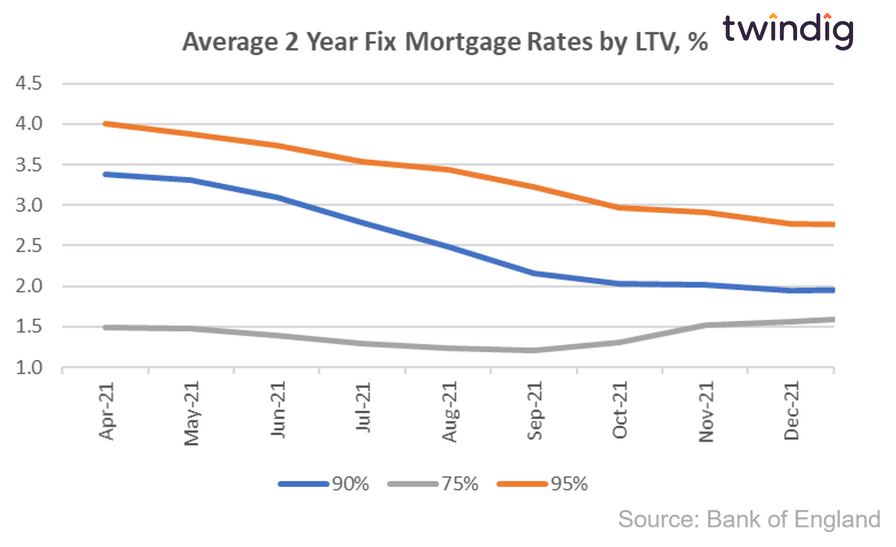

Average mortgage rate for 75% LTV mortgages 1.62%

Average mortgage rate for 90% LTV mortgages 1.96%

Average mortgage rate for 95% LTV mortgages 2.75%

Twindig Take

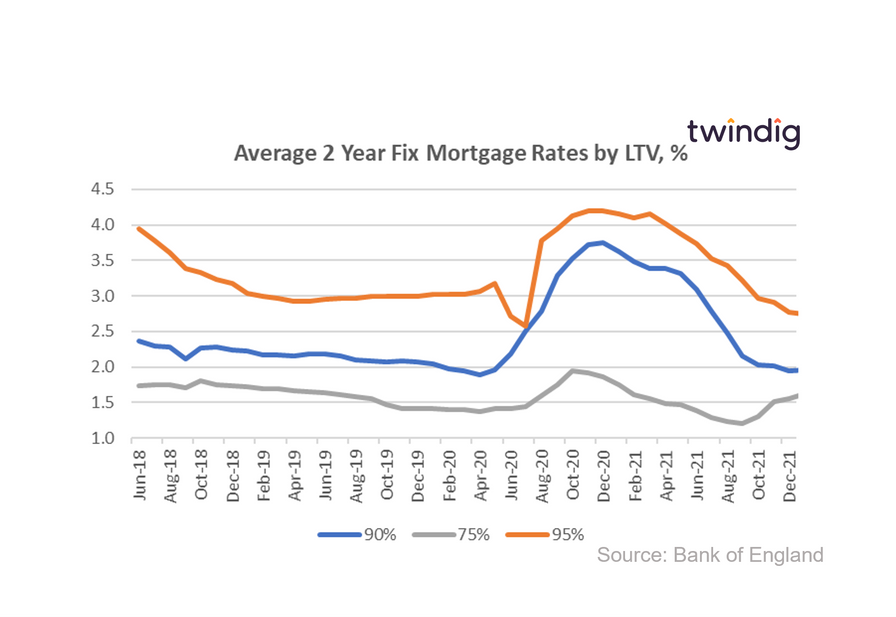

It certainly seems to us that mortgage rates are bottoming out in the early stages of 2022. The average mortgage rate for a 75% LTV mortgage has now increased for the fourth month in a row, up from 1.20% in September to 1.62% in January 2022.

The average mortgage rate for a 90% LTV mortgage increased in January 2022 for the first time in over a year, the last increase was in December 2020. The rise itself was barely noticeable, a very small step from 1.95% to 1.96%, but this is likely, in our view, to mark the point of the turn.

Surprisingly the average rate of 95% loan to value mortgages continues to fall, down 2 basis points from 2.77% in December 2021 to 2.75% in January 2022, but as illustrated in the graph below the rate of decrease is in decline and we suspect the next move will be up not down.

Last week the Bank of England raised Bank Rate (the central Bank interest rate which governs all other interest rates) from 0.25% to 0.5% and it will only be a matter of time, in our view, before the rise in Bank Rate feeds through to mortgage rates. If you are in the re-mortgaging window, we advise you to speak to your mortgage broker to see if you can secure a low mortgage rate deal before they disappear.