UK Housing Market: Is Stamp Duty Holiday history repeating itself?

The latest RICS survey suggests that the market is not expecting an extension to the stamp duty holiday as estate agents reported that enquiries, sales and new instructions all fell for the first time since May 2020. Homebuyers and sellers have decided it is futile to try and beat the looming stamp duty holiday deadline due to capacity constraints in mortgage lending, conveyancing, local searches and land registry services. It looks as if history will repeat itself and we will see the usual lull in housing market activity once the Stamp Duty holiday ends.

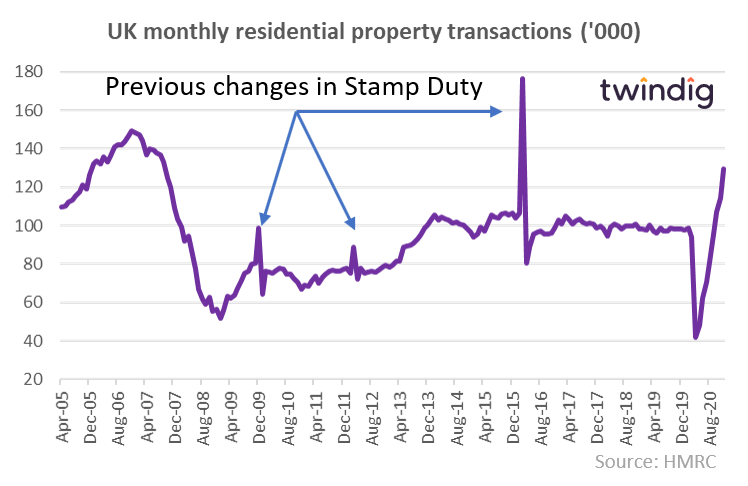

Can you spot the previous ends to stamp duty holidays?

It is clear from the chart above that the end of Stamp Duty holidays or the dates when previously announced changes to stamp duty come into effect lead to a rush of transactions as the deadline approaches followed by a lull in transactions afterwards. It is very difficult to conclude that the catalyst of a stamp duty holiday has any long term impact on activity levels in the housing market.

Could property logbooks help prevent another Grenfell Tower disaster?

According to an investigation for the inews by Vicky Spratt the UK Government does not know the true scale of the cladding building safety crisis.

The inews reports that more than three years after the Grenfell Tower fire, the Government has no complete data on how many mid-rise buildings under 18 metres high have been built with dangerous materials and fire safety defects.

If every home had a twindig then the UK Government would know the true scale of the cladding building safety crisis, and the Governments remediation fund could be properly costed and quickly actioned allowing everyone to once again sleep soundly in their beds.

You can read our full report here Could property logbooks help prevent another Grenfell Tower disaster?

Twindig CTO featured in the Times

This week Times Property journalist Carol Lewis wrote about the house sales at risk from the looming Stamp Duty Holiday deadline. Here reported included our own CTO John Blackmore, who is putting his twindig to the ultimate test by attempting to buy and sell a home (an actual physical home, not its digital twin) in the middle of a global pandemic and at a time when the housing market is overwhelmed by buyers pushing to complete before the end of the Stamp Duty Holiday on 31 March 2021.

Stamp duty holiday: house sales at risk as deadline looms

Bellway

Bellway one of the UK’s biggest housebuilders issued a trading update this week

What they said

Record first-half volumes of 5,656 homes

Record half-year investment in land at 8,848 plots

Forward sales up by 28% to 5,889 homes

Twindig take

A record-breaking first half for Bellway, record volumes pointing to the strength of the current housing market and record land buying pointing to the Group’s confidence in the UK housing market of the future. This confidence is underpinned by a forward order book up 28% in terms of volume and 39% in value. Changes to Help to Buy and the looming end of the Stamp Duty holiday do not appear to be derailing either Bellway of the wider UK housing market.

Redrow is calling for reform of Stamp Duty Tax rather than an extension of the stamp duty holiday, to improve the longer-term performance of the housing market rather than looking for a quick fix. However, Redrow’s performance today and order book for tomorrow suggests that Stamp Duty plays a minor rather than a leading role in the housing market a role which can frustrate rather than de-rail.

Redrow

FTSE 250 Housebuilder Redrow reported its first-half results this week

What they said

Record first-half revenue

Record number of homes sold

Dividend reinstated

Twindig take

Redrow followed Bellway’s lead and also reported a record-breaking first half with revenue and legal completions up 20% a record order book and a return to the dividend list. Redrow’s sales also suggest that the short-term lockdowns are leading to long term societal changes in how and where we choose to live with a growing demand for homes suitable for working from home and with easy access to green spaces.

Redrow is calling for reform of Stamp Duty Tax rather than an extension of the stamp duty holiday, to improve the longer-term performance of the housing market rather than looking for a quick fix. However, Redrow’s performance today and order book for tomorrow suggests that Stamp Duty plays a minor rather than a leading role in the housing market a role which can frustrate rather than de-rail.

Finally, Redrow’s new customer portal is very timely given the recent launch of the New Homes Quality Board and the soon to be launched New Homes Ombudsman service. Redrow is fully prepared for the changes both will bring to the new homes industry.

RICS

RICS published their January 2021 Residential housing market survey this week

What they said

Enquiries, sales and new instructions fell for the first time since May

House prices continue to rise for the time being

Expectations point to a more subdued trend in sales persisting over the near term

Twindig take

Enquiries, sales and new instructions fell for the first time since May 2020 according to the RICS January Residential Housing Market survey as Lockdown3 deters buyers and sellers.

It seems that Stamp Duty Holiday history is repeating itself, with the RICS lead indicators implying that following a storm of activity leading up to the Stamp Duty Holiday deadline, there will be a lull in transactions and a relative period of calm whilst backlogs are worked through and the market finds its way back to equilibrium.