Inheritocracy to oppocracy

In a recent article in The Times, Tom Calver eloquently argued that the UK Housing market has become an inheritocracy, where your chances of winning or losing in the housing market are determined by whether or not your parents own their home.

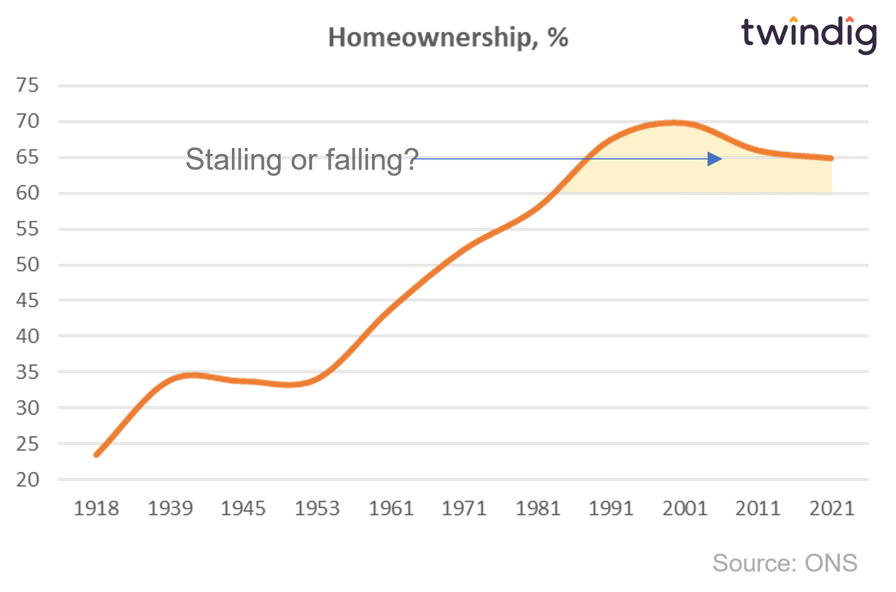

We believe that housing wealth inequality will worsen with homeownership levels, at best stalling and at worst falling. In our view, an inheritocracy is bad for both the economy and society. However, we believe there is a way to increase opportunity for all and turn the inheritocracy into an oppocracy, where the haves can help themselves and help the have-nots.

The problem: house prices divorced from wages

Homes were never meant to be financial assets, but now they are it is almost impossible to turn them back into mere homes.

The reality is that homes are now both a source of physical and financial shelter, and given that reality, we believe in the social good of homeownership. The social good is the accumulation of wealth in our earlier years that can be used to fund our later years and reduce our reliance on the state.

However, the intergenerational transfer of assets, in particular our homes, creates an unlevel playing field, giving the advantage to those whose parents have wealth to transfer. As these transfers play out over successive generations, we believe that wealth inequalities widen to the detriment of society and the economy.

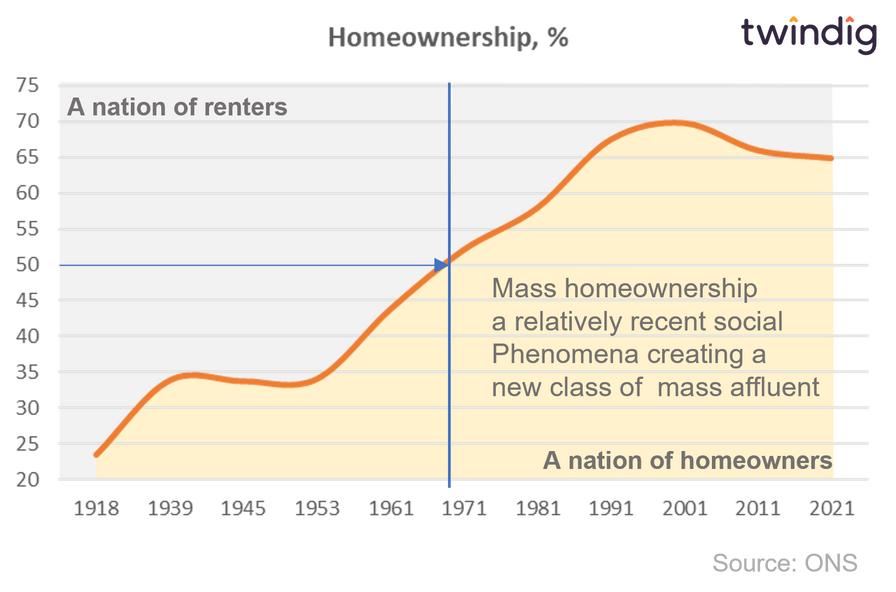

From renters to homeowners

Whilst we view the UK as a nation of homeowners, we were a nation of renters until 1971. It was not until 1971 that homeownership rates in the UK hit 50%. In our view we are now at the stage where the first wave of homeowners (the mass affluent) are passing their housing wealth onto the next generation. It is our assessment that housing wealth inherited is reinvested into the housing market, for instance, the recipient of housing wealth may decide to buy themselves a bigger home.

From homeownership to inheritocracy

At a microeconomic level there is nothing wrong with wealth transfers, passing on wealth from one generation to another at the family level makes perfect sense. However, at a macroeconomic or societal level, it creates a two-tier system where those without are trying to accumulate wealth with one arm tied behind their backs.

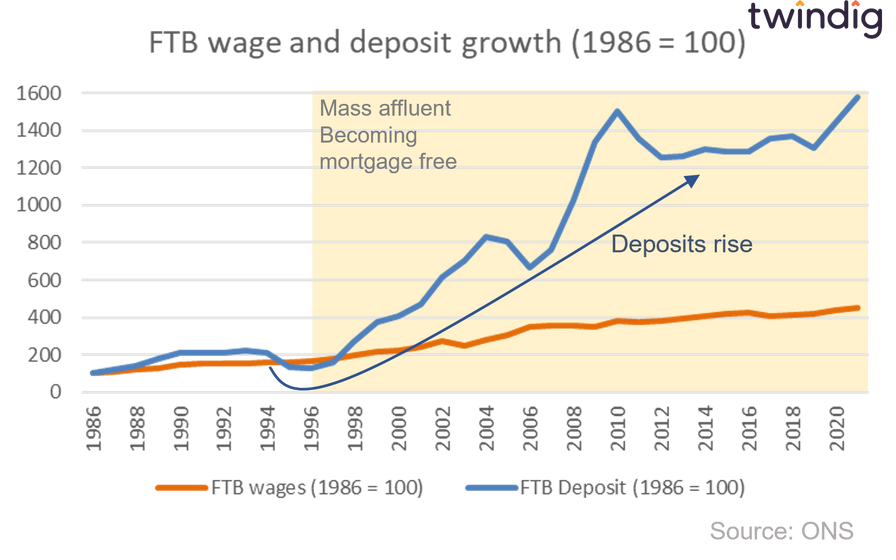

By way of illustration, in the graph below we show how the level of first-time buyer deposits over time. Until around 1996, the size of the average first-time buyer deposit moved broadly in line with average first-time buyer wages.

However, following 1996 the size of first-time buyer deposits starts to increase significantly and breaks its link with wages. Interestingly, 1996 is precisely 25 years after homeownership reaches 50% and the first wave of the mass affluent is becoming mortgage free. Now the genie is out of the bottle, it is very difficult to get it back in again, but we do believe that there is a way....

How to create a homeowning Oppocracy

We believe it is possible to turn the tide on the UK's housing inheritocracy back to an oppocracy where all have the opportunity to accrue housing wealth, via fractional homeownership.

Fractional homeownership allows individuals to buy shares in a property in a similar way to the way one buys shares in a company listed on the London Stock Exchange.

Homeownership for all

Being able to invest in residential one share at a time dismantles the deposit barrier, no longer do you need a huge deposit in order to take your first steps onto the housing ladder, and by buying a share at a time you also don't need to saddle yourself with significant amounts of mortgage debt and be at the mercy of rising mortgage rates.

Investors working with rather than against first-time buyers

Fractional homeownership also allows property investors to be on the same side of the french as the first-time buyer, working towards common goals rather than competing against each other. A property investor would no doubt prefer to spread their investments across multiple properties rather than concentrating the risk on one or two. Fractional homeownership allows them to do this. They can buy parts of many homes and their investment acts as a deposit to the ultimate homebuyer reducing the size of the mortgage the homebuyer needs to secure. If the investor puts down 10% of the purchase price, when the home is eventually sold, they get 10% of the proceeds.

Oppocracy also solves the old-age pension crisis

The average UK adult retires with a pension pot of around £65,000, this is not enough to provide a comfortable retirement, and yet, they probably live in a home worth £250,000 with no mortgage.

Currently, the only way to take money out of their home is to either downsize (an unpopular choice) or take on debt, or as it's more commonly known equity release.

Fractional homeownership allows them to sell part of their home without the need to downsize or take on debt. If they sell 10% of their home, when they eventually sell, they keep 90% of the sale proceeds. This helps improve their standard of living whilst offering others the opportunity to start building their housing wealth for the future.

Oppocracy also helps us get to net zero

We need to reduce the emissions and energy usage of our homes, but many cannot afford to pay for these improvements. Fractional ownership allows a homeowner to get the benefit of lower bills without the need to pay for the improvements in cash. They sell a part of their home to pay for the improvements (say 3%) and when they sell they keep 97% of the sale proceeds. With energy costs rising and net zero deadlines getting closer, we believe that making energy efficiency improvements to your home will also increase its value, a win for the environment, homeowner and homebuyer.

You can read more about the case for fractional homeownership here