Houselungo 26 September 21

A lungo length look at this week's housing market news

Death Taxes and now mortgages

It used to be said that the only certainties in life were death and taxes, but perhaps we should now add mortgages (or debt) to life’s certainties. UK Finance reported this week that more than half of new mortgage borrowers will still have a mortgage when they turn 65. However, is Later Life Lending a triumph for the financial services sector or a failure of it?

Is rising debt the new rising damp?

In 2014, around one-third of new mortgage lending went beyond the borrowers 65th birthday, but for the first time this year, that figure has risen above 50%.

Why are we borrowing more in later life?

In our view this rising debt is caused by several factors: rising house prices, availability of credit and lenders also suggest the impact of an ageing population.

Jam today has to be paid for tomorrow

Later life lending is not a free ride. It is likely to force many to work for longer and remain in the workplace longer than they had originally intended in order to repay the later life loan.

Pension crisis

In our view, the growth in later life lending points to the growing pension crisis and perhaps the acceleration in the former reflects an acceleration in the latter. As we said earlier, no one wakes up in the morning wishing they had more debt and it is our view that many are turning to later life lending to top up inadequate pensions.

Why equity release is a wolf in sheep's clothing

In our mind, equity release is a wolf in sheep's clothing. It is not as innocent as it at first appears. Traditional equity release is a debt secured on your home. In our view, it offers financial handcuffs rather than financial freedom. Equity release capitalises on the opportunity provided by poor pension provision coupled with rising house prices. We believe that there is a better, more equitable way. For many, the path of fractional ownership leads to a better destination than the debt-fuelled journey of traditional equity release.

Paltry Pensions

According to Legal & General Home Finance, in 2019/2020, 86% of pension pots accessed for the first time had a value of less than £10,000. This one statistic very neatly defines the pension crisis facing the UK.

The UK Government’s Wealth and Assets Survey found that, on average, UK adults thought they would spend 23 years in retirement. It does not take a rocket scientist to work out that £10,000 will not be enough.

Prosperous Property

In the UK, Legal & General Home Finance estimate that the total property wealth among the over 50s is estimated to be £3.8 trillion, with three quarters (74%) of those aged 55 and over owning their own home. While their average pension pot size may be low, for homeowners in or nearing retirement their homes are very likely to be their biggest assets.

The question for pensioners will increasingly be, can I tap into my prosperous property to top up my paltry pension? Is there a way to release the equity tied up in the home?

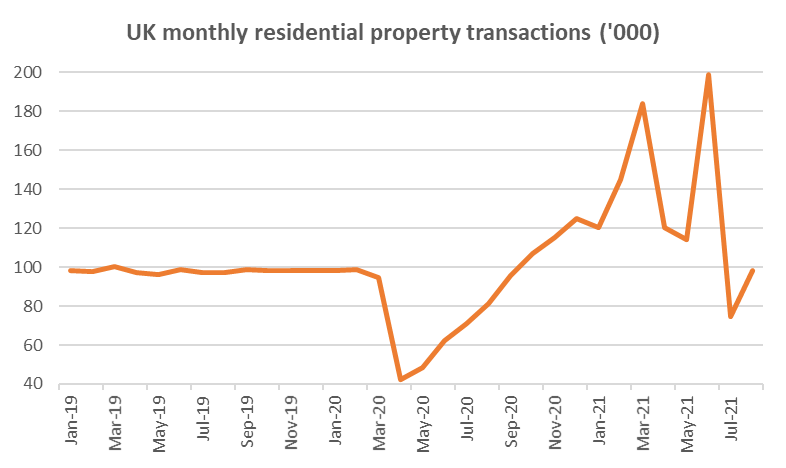

Housing transactions bounce back in August

HMRC released provisional housing market transaction data for August 2021 this week

What they said

Housing transactions in August 2021 were 98,300

This was 32% ahead of July 2021

However, housing transaction levels in August were around 50% lower than in June 2021

Twindig take

The bounce back

Housing transactions bounced back quickly from their first dose of stamp duty holiday blues. The level of housing transactions in August was not far off their five year average of 101,000. This is positive news for the UK housing market, although August still benefits from a stamp duty holiday benefit.

There is still a Stamp Duty holiday on house prices up to £250,000 until the end of September 2021, when the Stamp Duty Tax threshold returns to its pre-pandemic levels of £250,000.

We expect to see housing transactions increase in September, the final spike of the pandemic stamp duty holiday, followed by another dip.

It is difficult to tell how long the post stamp duty holiday dip will last. We estimate that around 250,000 housing transactions have been pulled forward by the stamp duty holiday, which equates to about two and a half months of housing market activity. We expect that housing transactions will remain below trend levels between October and December and return to a more normal pattern from January 2022.

Why Property Logbooks are a right riveting read

A property logbook is a very useful tool for every home buyer, homeowner, home seller and landlord. It is a physical record of all the vital information about your home, think of it as the ultimate Wikipedia page – the source of all knowledge and insight about your home.

Property logbooks help homeowners stay on top of managing their home, from reminders to get the boiler serviced or to check the best utility deals, to a secure a safe place to store warranty and guarantee information. You will never forget that important date of loose that important document once it has been recorded or stored in your property logbook.

We call a property logbook a ‘twindig’ – a digital twin of your home, which you can access via your smartphone, making your twindig a really useful place to store things like floor plans and the sizes of your windows. If you are in John Lewis wondering if that sofa will fit through your door or what size curtains you need, all your measurements will be to hand on your twindig.

Can’t remember the exact colour you painted your living room, record it in your twindig and we will do the remembering for you.

To start your twindig simply register your property on twindig.com today it will only take a couple of minutes but could save you hours. Once registered find your property and start your digital property log