Houselungo 20 March 22

Is this Wordle for houses?

Well, we know it is fun, competitive, mildly addictive, and you can challenge your friends to see who knows the most about house prices. At a recent housing conference we attended, we estimate that the majority of attendees were playing the game, which some, referred to as wordle for houses. We will let you decide if it really is Wordle for houses, we think it's about numbers and pictures rather than words and letters, but, as they say, beauty is in the eye of the beholder...

Play the game to see if you are a house price expert

Housing Market waking up

RICS released its latest UK Residential Market Survey last week

What they said:

New buyer enquiries and agreed sales pick up in February

New instructions are broadly stable

Stock levels remain low

Twindig take

This month's RICS Residential Market Survey builds nicely on the previous month's, in our view. If in January the UK Housing market started to stir, in February it started to wake up and we hope that in March it will get out of bed.

At a headline level, RICS reported that a net balance of +17% of survey participants reported an increase in new buyer enquiries during February marking the sixth consecutive positive monthly reading. At the same time, RICS agreed sales indicator also improved over the month, posting a net balance of +9% in February which, although only modestly positive, is the strongest reading since May 2021.

The challenge for estate agents remains securing enough homes on the market to meet buyer demand. Stock levels remain close to historic lows and these shortages continue to both underpin and drive house prices upwards.

Agents are mindful of the likelihood of further rises in Bank Rate and the fact that mortgage rates may continue to rise, however, they remain bullish on house prices on both a three and 12-month view and they expect house prices to continue to rise over both periods.

What does rising Bank Rate mean for me?

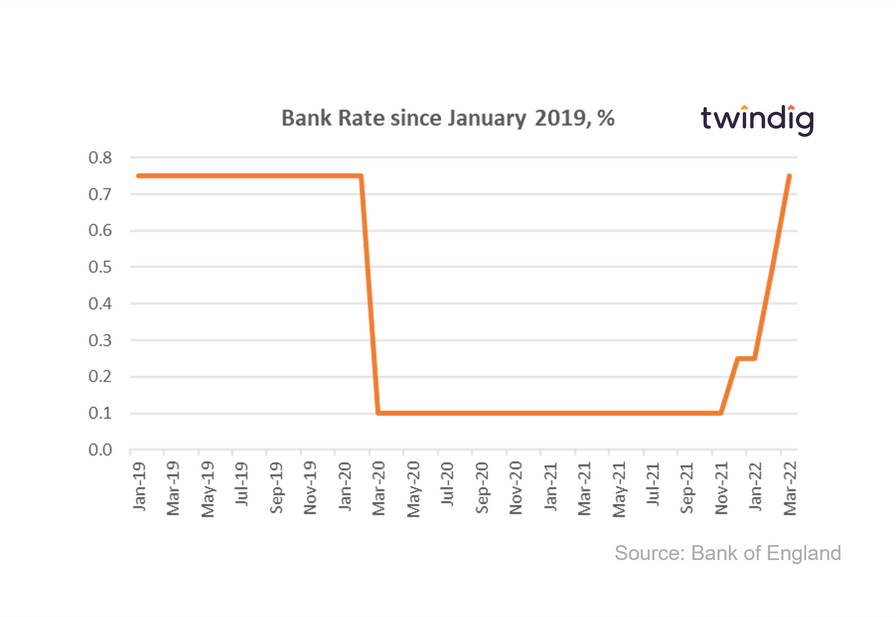

This week the Monetary Policy Committee voted to raise Bank Rate by 0.25% to 0.75%

At its meeting on 16 March 2022, the MPC voted by a majority of 8-1 to increase Bank Rate by 0.25 percentage points, to 0.75%. One member preferred to maintain Bank Rate at 0.5%

The MPC believes that the invasion of Ukraine by Russia has led to further large increases in energy and other commodity prices including food prices. It is also likely to exacerbate global supply chain disruptions and has increased the uncertainty around the economic outlook significantly. Global inflationary pressures are therefore likely to strengthen considerably further over the coming months.

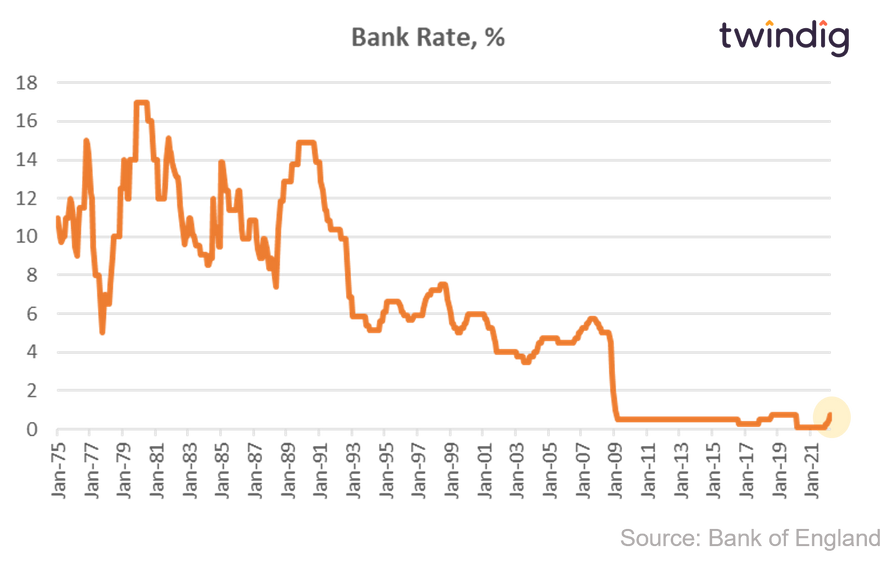

The increase in Bank Rate was large in relative terms, but in absolute terms it is worth putting the current rate into historical context...

Bank Rate in historical context

It is also worth noting that even after the change in Bank Rate this week, Bank Rate remains very low in a historical context. Bank Rate fell significantly in the early stages of the Global Financial Crisis and has never returned to what at the time we viewed as a normalised Bank Rate of around 6.0%.

But what does the increase in Bank Rate mean for you?

Can you afford not to have a property logbook?

Whether we like it or not, digital logbooks are coming, the Department of Levelling Up Housing and Communities wants to see material upfront information provided at the start of the home buying and selling process and upfront information will soon be required in order to list properties on the property portals.

Twindig offers every homeowner a free logbook and a growing number of estate agents are looking to provide their clients with digital property logbooks to make the buying, selling and managing process easier. Getting organised is boring, but as the stamp duty holiday deadlines demonstrated those who don't get their current house in order often risk missing out on securing the purchase of their next one...

Twindig Housing Market Index

In the week that saw Bank Rate rise by 50% (albeit from a very low base) from 0.50% to 0.75%, after five weeks of decline the Twindig Housing Market Index rose by 4.1% to 79.1. Perhaps buoyed by the news from RICS that the housing market is waking up in time for a spring selling season, or the strong sets of results published this week from the UK's two largest estate agents (Connells and LSL Group), investors seem to have lost some of their housing market concerns which dominated the last few weeks.