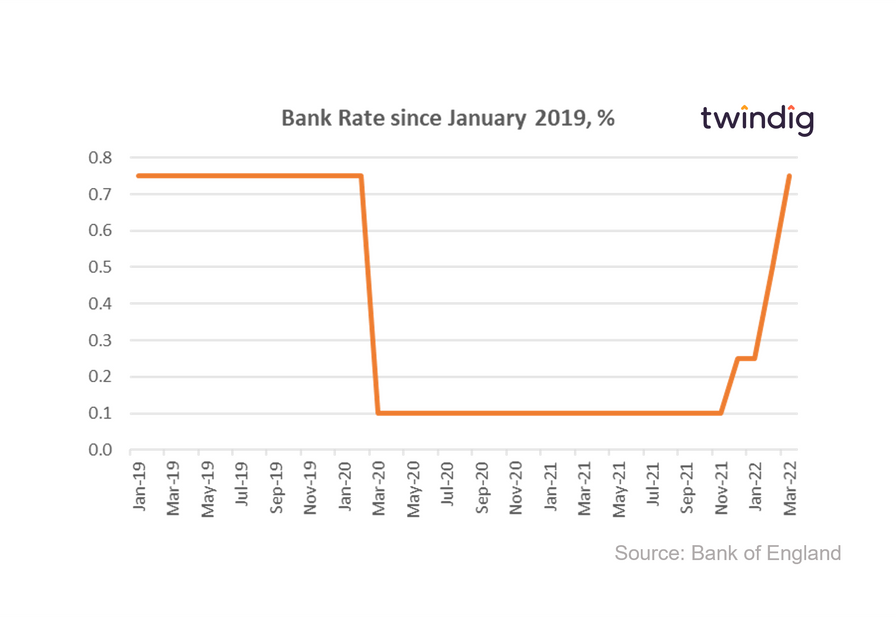

Bank Rate increased by 50% in March 22

This week the Monetary Policy Committee voted to raise Bank Rate by 0.25% to 0.75%

At its meeting on 16 March 2022, the MPC voted by a majority of 8-1 to increase Bank Rate by 0.25 percentage points, to 0.75%. One member preferred to maintain Bank Rate at 0.5%

The MPC commented that:

Developments since the February Report are likely to accentuate both the peak in inflation and the adverse impact on activity by intensifying the squeeze on household incomes.

Twindig Take

The MPC sets monetary policy to meet the 2% inflation target, and in a way that helps to sustain growth and employment.

The MPC believes that the invasion of Ukraine by Russia has led to further large increases in energy and other commodity prices including food prices. It is also likely to exacerbate global supply chain disruptions and has increased the uncertainty around the economic outlook significantly. Global inflationary pressures are therefore likely to strengthen considerably further over the coming months.

What does this mean for house prices?

In our view, house prices are being driven by a shortage of supply of homes or sale, or rather the demand for homes is outstripping supply as we readjust to life after COVID. Mortgage rates will increase as a result of the increase in Bank Rate, but most people are on fixed rates so they will not see the impact immediately.

The MPC is seeking to control inflation and over the long run the Retail Price Index (RPI) has a positive correlation with house prices, this means that rising inflation s usually accompanied by rising house prices. Wages typically increase during periods of inflation and as mortgage lending multiples are linked to wages high wages means bigger mortgages which paves the way for higher house prices.

A grey if not a silver lining?

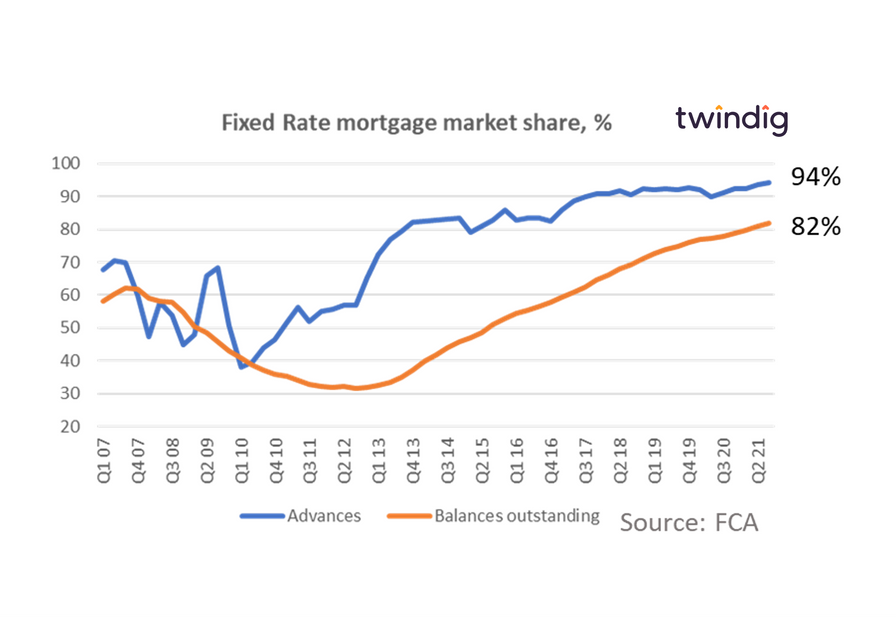

Unlike the rise in energy costs which will be immediate, for many the Bank Rate increase will take time to hit their household budgets. The latest data from the FCA suggests that in Q4 2021 94% of gross mortgage advances were fixed-rate mortgages and 82% (just over 4 out of 5) of all mortgages are on fixed-rate deals which means that the mortgage rate will not change until the current mortgage deal expires.

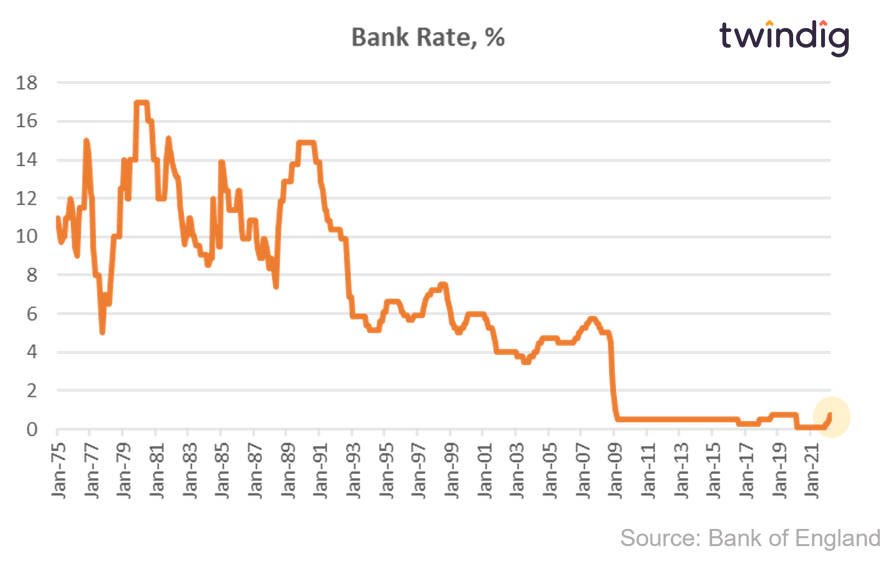

Bank Rate in historical context

It is also worth noting that even after the change in Bank Rate this week, Bank Rate remains very low in a historical context. Bank Rate fell significantly in the early stages of the Global Financial Crisis and has never returned to what at the time we viewed as a normalised Bank Rate of around 6.0%.

What does the Bank Rate rise mean for me?

The average floating mortgage rate is currently 2.42%. The 0.25% rise in Bank Rate is likely to be passed on moving the mortgage rate to 2.67%.

For a £100,000 repayment mortgage the increase in mortgage rate from 2.42% to 2.67% will lead to an increased mortgage payment of £13 per month taking the monthly payment from £443 to £456 per month

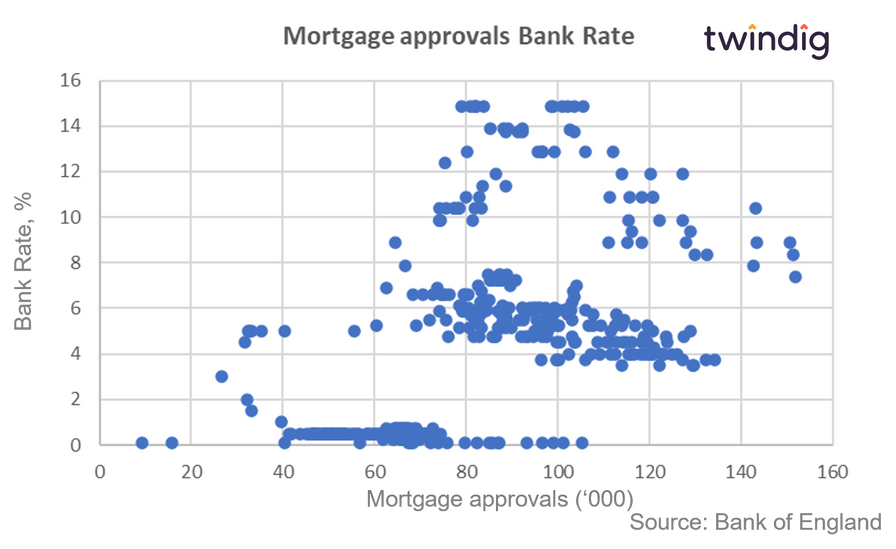

What does rising Bank Rate mean for housing transactions?

The good news is that it is very difficult to spot a correlation between Bank Rate and mortgage approvals (where mortgage approvals are the key lead indicator for future housing transactions). The highest ever number of mortgage approvals occurred when Bank Rate was 7.38% almost ten times higher (9.8x) than it is today. Even at its peak, when Bank Rate was 15% there were several occasions where mortgage approvals were greater than 100,000 this is incredible when we compare that to the current 10-year average of 65,900 mortgage approvals per month