Houselungo 17 October 21

A lungo length look at this week's housing market news

Shortage of Supply likely to push house prices higher

The latest RICS UK Residential Market Survey published this week

What they said

Sales and sales instructions soften in September

Homebuyer demand stabilising

House prices inflation slows, but house prices still growing

Twindig take

The RICS Survey reported that homebuyer demand has steadied following a frenzy as the stamp duty holiday drew to a close. This is to be expected, in our view, taking away the additional incentive to buy a home will take away the demand caused by that incentive.

The lack of supply of homes for sale continues to be an issue for the housing market. The September new instructions net balance came in at -35% and has now been in negative territory for the last six months. A negative balance means that more agents are reporting a fall in new sales instructions than a rise.

The supply of homes coming to the market is not likely to improve anytime soon as the number of market appraisals (estate agent valuations) undertaken during September 2021 was also reported by RICS members to have fallen with a negative net balance of -26%.

The continued imbalance of supply and demand of homes implies to us that house prices remain firmly underpinned. We do not envisage any significant house price falls in the near future.

Good news from the Bank of England

The Bank of England released its latest quarterly credit conditions survey on Thursday

What they said

The availability of secured credit to households increased in Q3 2021 and lenders also expected the availability of secured credit to increase further over the next three months

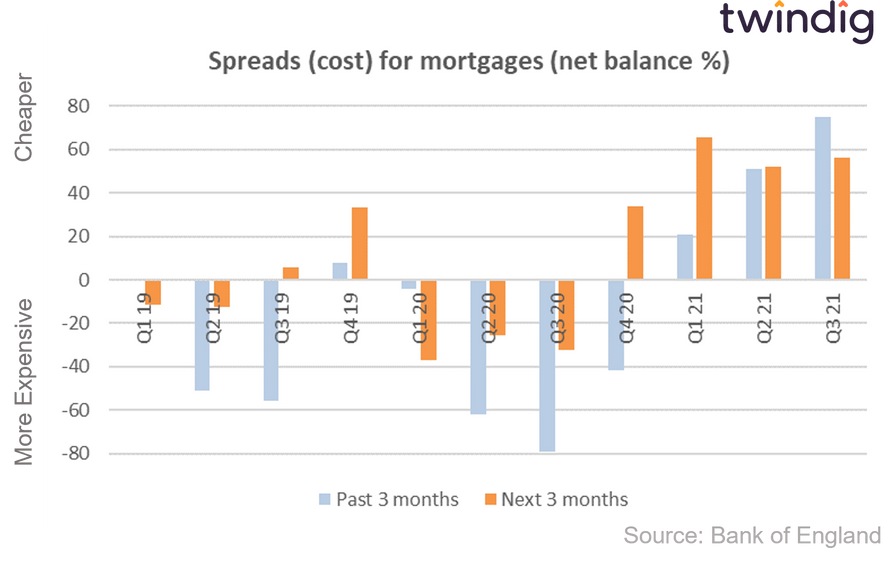

Lenders reported that overall spreads on secured lending to households – relative to Bank Rate or the appropriate swap rate – narrowed in Q3, and were expected to narrow further in Q4

Lenders reported that demand for secured lending for house purchases decreased in Q3, and was expected to decrease further in Q4

Demand for secured lending for remortgaging increased in Q3, and was expected to increase further over the next quarter

Twindig take

Supply of mortgages

The increase in the availability of secured credit to households (mortgages) is good news for homeowners and homebuyers, it means that the supply (or number) of mortgages on offer will increase providing more choice for homebuyers and homeowners.

Price of mortgages (mortgage rates)

It is also good news for homebuyers and homeowners that the spreads on secured lending narrowed and is expected to narrow further. This means that relative to the Bank of England Bank Rate the cost of mortgages (mortgage rates) is likely to fall in the coming months. If Bank Rate does not increase then mortgages rates (and mortgage payments) will fall. If Bank Rate rises, a narrowing spread implies that lenders will not pass on the full increase onto homeowners.

Deposit Unlock - all you need to know about the Deposit Unlock scheme

What is Deposit unlock?

Deposit unlock is a new 95% Loan To Value (LTV) mortgage product being offered to homebuyers of new build homes.

Why is deposit unlock needed? Aren’t there already lots of 95% LTV mortgages on the market?

Whilst there is an increasing number of 95% LTV mortgage products on the market, these are focused on existing or second-hand homes. Many lenders are wary of lending at 95% LTVs on new build properties because of the so-called ‘new build premium’. Just as a brand new car loses value once driven off the forecourt, many believe that the value of new homes has a high risk of falling compared to second-hand homes, because of the risk of many similar homes being on the market at the same time. During the Global Financial Crisis of 2008-09, many homebuilders heavily discounted the price of their homes to sell them, and this behaviour has made mortgage lenders nervous.

How does deposit unlock work?

From the perspective of a homebuyer, deposit unlock works like a normal 95% LTV mortgage. The homebuyer supplies a 5% deposit and takes out a mortgage for the remaining 95%.

However, because of the perceived additional risks relating to new build properties, behind the scenes the homebuilders are providing (and paying for) a mortgage indemnity scheme to insure the mortgage lender against the risk of falling house prices. The homebuilders hope that by providing the mortgage indemnity guarantee they will encourage more lenders to offer 95% loan to value mortgages on new build properties.

How much can I borrow with deposit unlock?

The deposit unlock scheme lets you borrow up to 95% of the value of the home you are buying. If the home cost £150,000, you could borrow up to £142,500, leaving you to provide a deposit of £7,500.

However, most lenders have strict lending multiple guidelines. This means that very few lending will lend above 4.5x your income and only 15% of mortgages issued by a lender can be at lending multiples at or above 4.5x your income.

Barratt firmly on track despite help to buy headwinds

FTSE 100 Housebuilder Barratt Developments issued a trading update on Wednesday

What they said

The positive start to the new financial year has continued in recent weeks with private reservations remaining strong

We remain on track to deliver both our FY22 and medium term targets set out in the FY21 results

There has been a significant year on year reduction in Help to Buy reservations

We have not experienced any significant disruption to our build programme as a result of the challenging supply chain environment.

Twindig take

Barratt issued a positive trading update this morning, but flagged that changes to Help to Buy have had more impact on its business than changes in Stamp Duty. Following the introduction of regional price caps and limiting Help to Buy to first-time buyers Help to Buy accounts for 21% of sales so far this year compared to 51% in the previous financial year and the scheme is scheduled to close in March 2023.

However, the overall forward order book is larger in both volume and value than it was last year and remains on track to deliver results this year in line with the market's expectations. So far Barratt is taking the transition away from Help to Buy in its stride.

The challenges to the supply chain are on the radar but not yet impacting results and build programs and we hope this remains the case, but it does add an element of uncertainty going forward

One thing, however, is certain, the demand for new homes is strong and we are not building enough homes to meet demand. Housebuilders such as Barratt are in the right place at the right time.

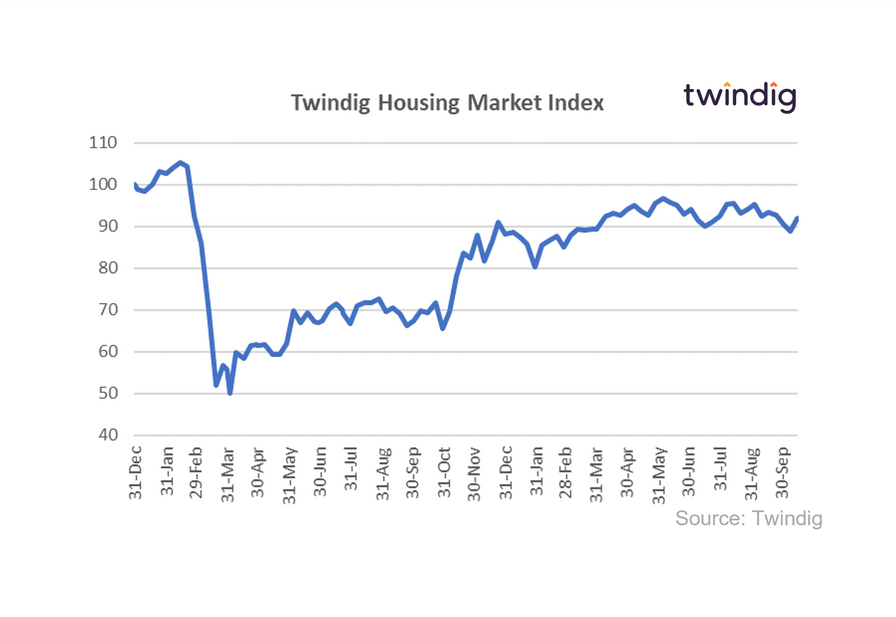

Twindig Housing Market Index

The Twindig Housing Market increased by 3.4% this week to 91.9 as RICS reported that a continued shortage of housing supply was likely to push UK house prices further still. House prices in the UK increased by almost £25,000 during the COVID-19 Stamp Duty Holiday. Many think that prices may soften following the end of the Stamp Duty Holiday, but RICS make a robust argument as to why that not be the case and this helped buoy investor confidence in a week where most of the economic news focused on negative rather than positive elements.

Investors were comforted by this week's Credit Conditions survey which suggested that mortgages supply will rise and mortgage costs (mortgage rates) will fall in the coming three months implying lenders want to get more active in the housing market and are feeling more bullish in their outlook. Lenders will spend an awful lot of time managing the risks of their lending books and therefore we view this expansionary stance as a positive for the UK housing market.