Bank of England Q3 2021 Credit Conditions Survey

The Bank of England released its latest quarterly credit conditions survey this morning

What they said

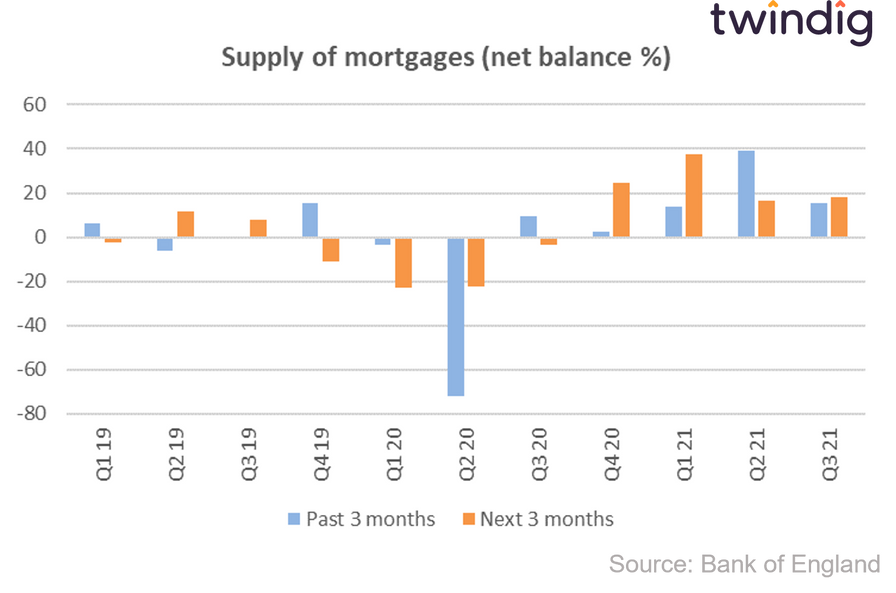

The availability of secured credit to households increased in Q3 2021 and lenders also expected the availability of secured credit to increase further over the next three months

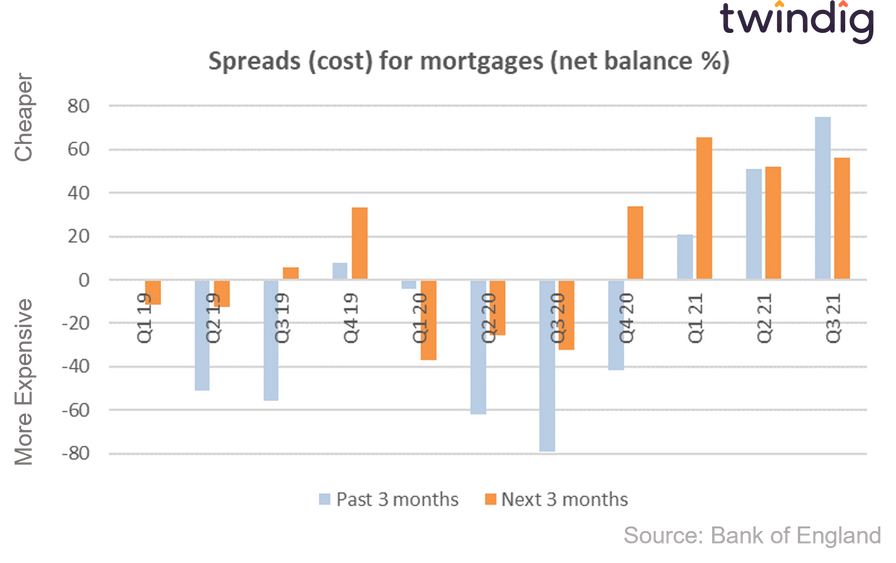

Lenders reported that overall spreads on secured lending to households – relative to Bank Rate or the appropriate swap rate – narrowed in Q3, and were expected to narrow further in Q4

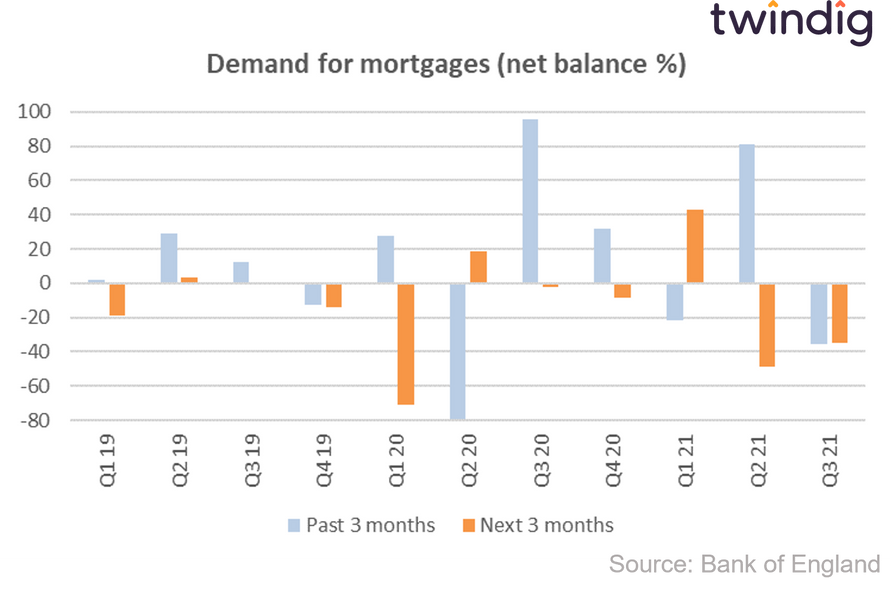

Lenders reported that demand for secured lending for house purchases decreased in Q3, and was expected to decrease further in Q4

Demand for secured lending for remortgaging increased in Q3, and was expected to increase further over the next quarter

Twindig take

Supply of mortgages

The increase in the availability of secured credit to households (mortgages) is good news for homeowners and homebuyers, it means that the supply (or number) of mortgages on offer will increase providing more choice for homebuyers and homeowners.

Price of mortgages (mortgage rates)

It is also good news for homebuyers and homeowners that the spreads on secured lending narrowed and is expected to narrow further. This means that relative to the Bank of England Bank Rate the cost of mortgages (mortgage rates) is likely to fall in the coming months. If Bank Rate does not increase then mortgages rates (and mortgage payments) will fall. If Bank Rate rises, a narrowing spread implies that lenders will not pass on the full increase onto homeowners.

If we take the increasing supply and reducing spreads together, Twindig’s take is that lenders are feeling more sanguine about the UK housing market than they were. This means the outlook for house prices is up rather than down.

If you are thinking of re-mortgaging you can use our mortgage calculator to see how your mortgage payments may change

Demand for mortgages (housing transactions)

However, despite the increased supply and lower prices, lenders expect demand to fall. This means fewer people buying a home with a mortgage. This is not a surprise as the next quarter is the first following the COVID-19 Stamp Duty holiday. In our view, the number of mortgage approvals during the stamp duty holiday was more than 350,000 higher than expected in a normal market as households brought forward their home moving plans. We have seen a fall in demand following all the previous stamp duty holidays and this one will be no different in our view.

Conclusion

In summary, mortgage supply up, mortgage rates down, so a good time to re-mortgage, demand (number of people moving) are expected to fall as we recover from the stamp duty holiday.