Houselungo 12 June 22

Right to Buy: Right or Wrong?

This week the Prime Minister announced that 2.5 million tenants renting their homes from housing associations will be given the right to buy them outright

This ‘new’ policy is an extension of the original Right to Buy scheme launched 42 years ago by the then Prime Minister Margaret Thatcher

In this article, we look at whether the Right to Buy is right or wrong

Did Right to Buy work? (Take 1)

Yes. By the end of 1982, more than 240,000 council tenants have purchased their homes through the Right to Buy scheme

In the 42 years since the Right to Buy scheme was launched, almost 2 million social housing tenants have purchased their homes through Right to Buy.

Did Right to Buy work? (Take 2)

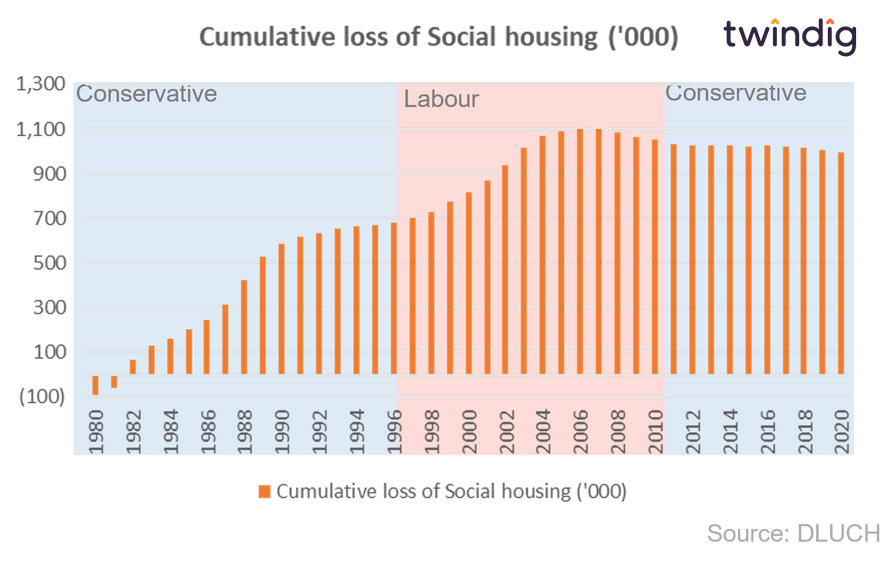

No. According to the housing charity Shelter, fewer than 5% of the homes sold through Right to Buy have been replaced, the stock of council housing has therefore dropped dramatically.

The chart below shows the cumulative loss of social housing calculated as social housing sales less social housing supply - if the balance is greater than zero more homes were sold than replaced.

Housing market about to turn?

RICS released its latest UK Residential Market Survey for May 2022 this week

What RICS said

New buyer enquiries indicator turns slightly negative

New instructions and sales remain more or less flat

House prices continue to rise across although twelve-month

expectations point to an easing in momentum

Twindig take

The May 2022 RICS Residential Survey reports a drop in the balance for new buyer enquiries, coming in at -7%, which is down from +8% in April 2022.

Whilst one swallow doesn't make a summer, this could be significant as it brings to an end a run of eight consecutive positive readings for buyer demand. The imbalance of supply and demand, where demand has outstripped supply, has, in our view, underpinned much of the house price growth since the start of the pandemic, and if we are seeing a turning point in buyer demand, we may also see a softening of house price inflation in the coming months.

House prices rise for 11th month in a row

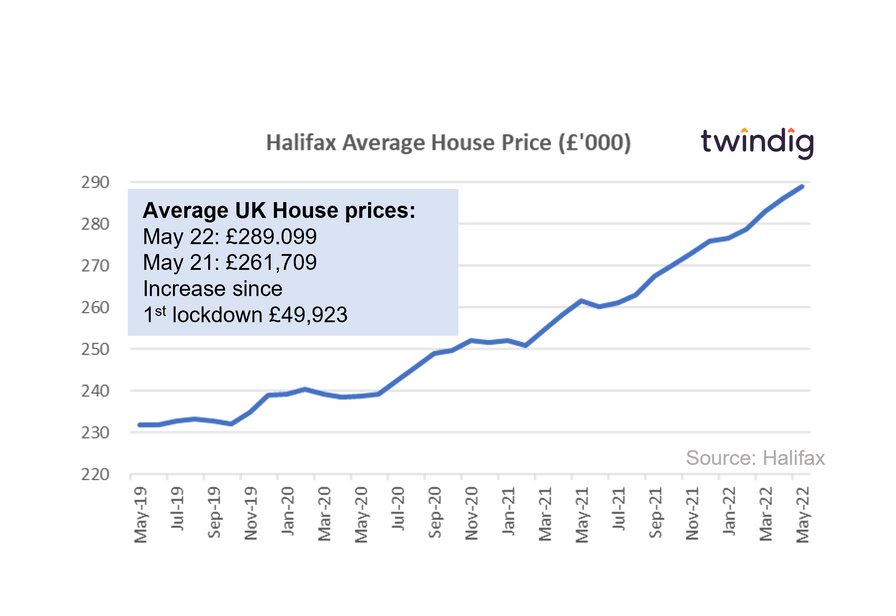

The Halifax released their House Price Index for May 2022 this week

What the Halifax said

Average house price £289,099

House prices increased by 1.0% in May

Annual house price inflation 10.5%

Twindig take

House prices rise for the eleventh month in a row, but has the race for space made climbing up the property ladder more difficult than getting on it? Detached house prices have risen by £50,000 in the last year which is five times greater than the increase in the price of flats, will those lucky enough to get on the housing ladder become stuck on the bottom rung?

May marks the eleventh consecutive monthly rise for the Halifax House Price Index, average house prices have risen by £27,390 over the last year or by £2,283 per month as house prices hit a new high in May 2022.

The race for space appears to still be in full swing as the average prices of flats have risen by around £10,000 in the last year compared to £50,000 for detached homes. These changes will frustrate second steppers as it means that not only is it hard to get on to the housing ladder, it is increasingly more difficult to move up the ladder once you are on it.

Is the private rented sector shrinking?

The plight of Generation Rent fills many column inches in both newspapers and political policy documents. Growing numbers of households cannot buy and find themselves in rented accommodation for much longer than they had hoped.

However, a research report jointly produced by the BBC and the estate agency trade body Propertymark found that the private rented sector appeared to be shrinking rather than growing.

But how can the private rented sector be shrinking at the same time as generation rent is growing?

So is generation rent growing or slowing?

The BBC / Propertymark survey found that the number of landlords leaving the private rented sector had increased over the last three years, and the number of new landlords entering the private rented sector over the same period had decreased.

The survey also found that the average number of properties available for rent per branch (across more than 4,000 branches) had halved between March 2019 and March 2022 from 30.4 to 15.6

Between 2019 and 2021 estate agents reported that the number of buy-to-let properties bought and sold was similar. However, in March 2022, the average number sold per branch was 9.6 while the number purchased by investors was only 4.5, suggesting that the owner-occupier sector had started to grow whilst the private rented sector started to shrink.

What does this all mean?

The survey results were derived from 443 responses covering more than 4,000 branches across the UK, about 20% of the sector, so a decent sample size.

But, the private rented sector cannot be shrinking if 'generation-rent' is growing, so what is going on here?

Twindig Housing Market Index

In the week that saw house prices rise for the 11th month in a row, and Right to Buy re-launched and extended to housing associations as well as local authorities the Twindig Housing Market Index rise by 0.1% the slightest of margins to 75.1 this week.

It seems that the extension of Right to Buy to Housing Associations and the battle cry of Benefits to Bricks did little to cheer residential investors this week.

However, much like the Confidence vote this week, investors maintained a level of confidence in the housing market even if today's vote is not a ringing endorsement.

That said the continued rise in house prices heartened investors although some believe that the scale of the increases is creating problems for the future. Interestingly RICS reported this week that buyer demand for homes fell for the first time in eight months during May, leading some investors to ask if house prices had travelled too far in the face of significant increases in the costs of living. When the RAC tell us that a litre of petrol or diesel will soon cost more than £2 and that filling our tank will cost more than £100 it is easy to see why buyers are questioning whether now is the time to take on more debt in the form of a larger mortgage.