Monthly homeownership costs lower than rents

The Halifax published an updated version of its owning vs renting review this week

What the Halifax said

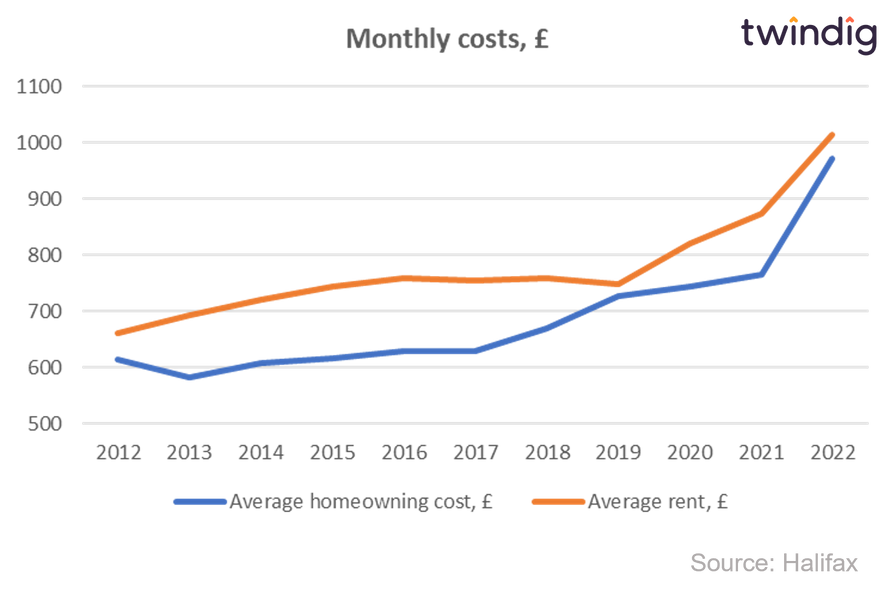

The monthly cost of owning a home for first-time buyers is now £971 - £42 (4%) lower than the cost of renting the equivalent property.

The difference is greatest in London, where homeowners are paying nearly £3,000 less each year than those renting similar homes.

The East of England only region where it is cheaper to rent than own.

Twindig take

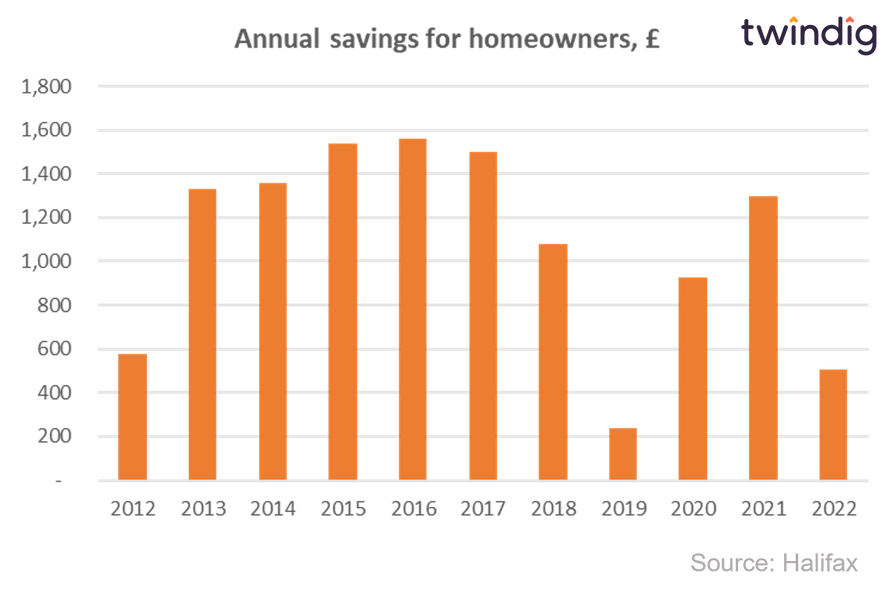

The Halifax found that homeowners are almost £500 better off annually than renters. Their analysis, is based on housing costs for first-time buyers with a mortgage on a three-bed home compared to the average monthly rent of the same property type. They found that the £971 owners are now paying, compares to £1,013 for renters, each month.

The 'owning costs' include household maintenance, repair, minor alterations, insurance costs and income lost by funding a deposit rather than saving as well as the mortgage costs themselves.

It is clear from the chart below that both homeownership costs and rents increased significantly during the COVID-19 pandemic adding to the challenges caused by rising costs of living

However, the gap between monthly ownership and rental costs has been reduced. Falling from £1,300 in 2021 to £498 in 2022

We suspect the reduction in the gap is of little comfort to those currently aspiring to own a home and working hard to save for a deposit.

As we noted yesterday in our note about The Bank of Mum and Dad it is not so much the monthly costs that are the issue, but the size of the deposit, which means that most are unable to buy a home without the help of the Bank of Mum and Dad.