Fixing the housing market ladder: Part 2 - Help more to sell

In our first article we looked at how to help those trying to a foothold on the broken lower rungs of the housing ladder. In this article, we look at how to fix the often ignored broken rungs at the top of the housing ladder.

Equity rich, pension poor

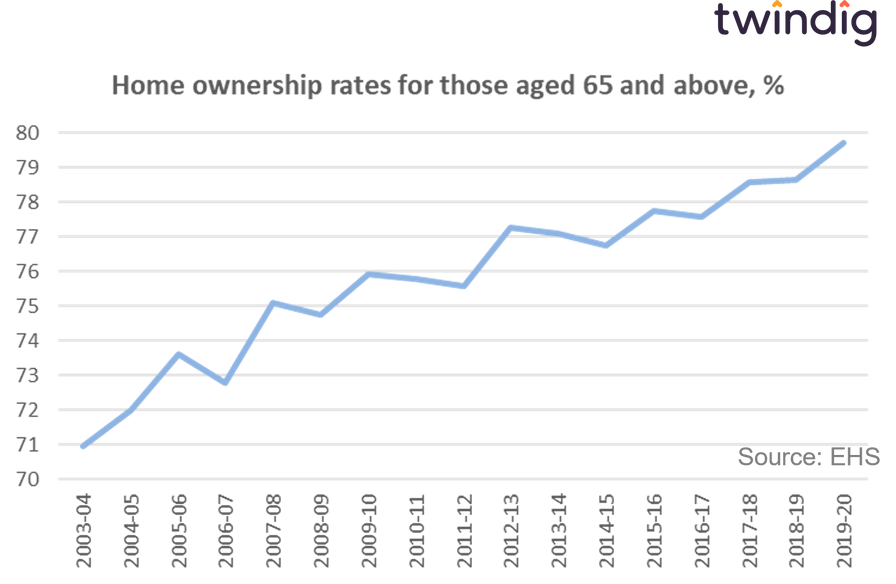

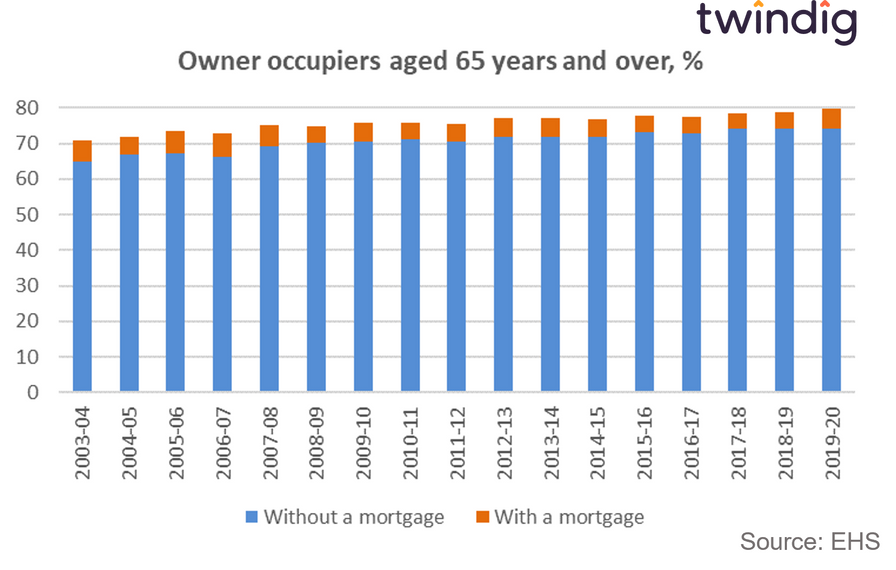

Homeownership rates are only rising in the UK for one age group, those aged 65 and over, the so-called baby boomers.

However, whilst this generation may be housing rich, they are also often pension poor. Not all baby boomers and certainly not those coming up behind them are blessed with index-linked final salary pension schemes.

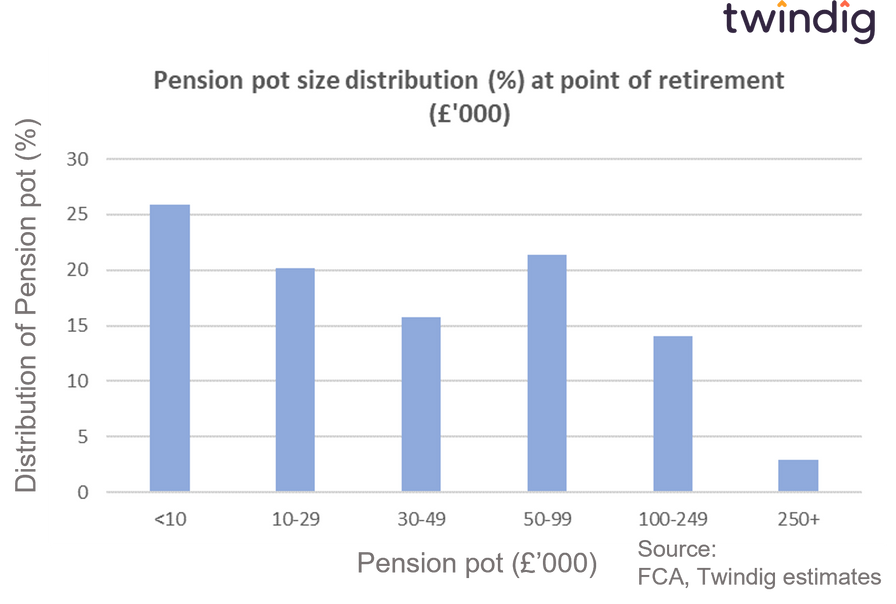

Our analysis of FCA pension data suggests that the average pension pot of those at retirement age is currently around £62,000

We are not ready for retirement

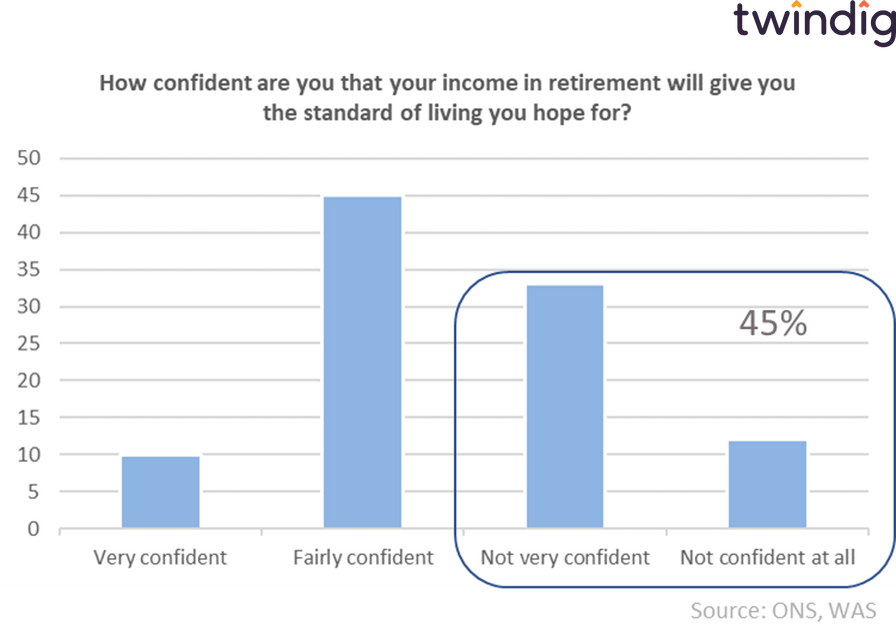

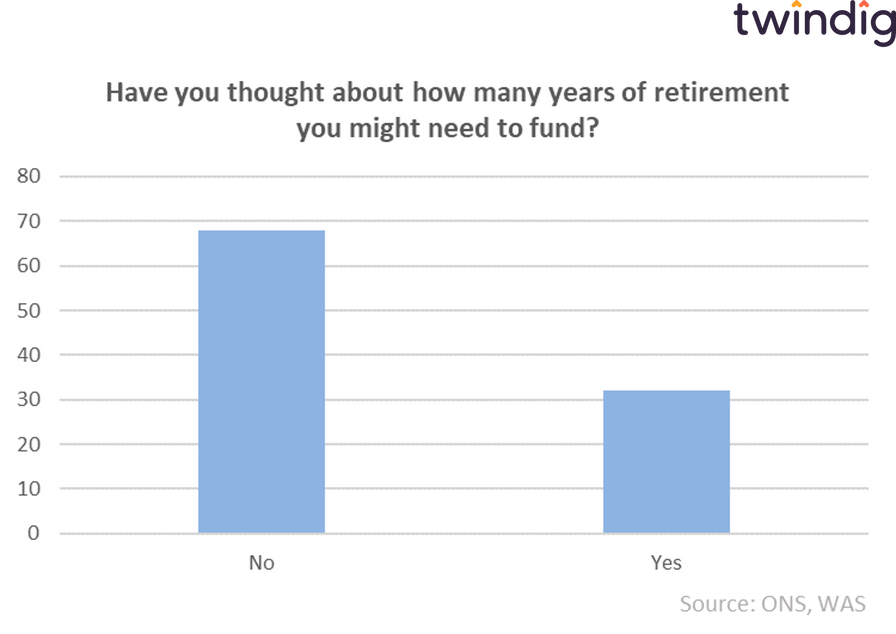

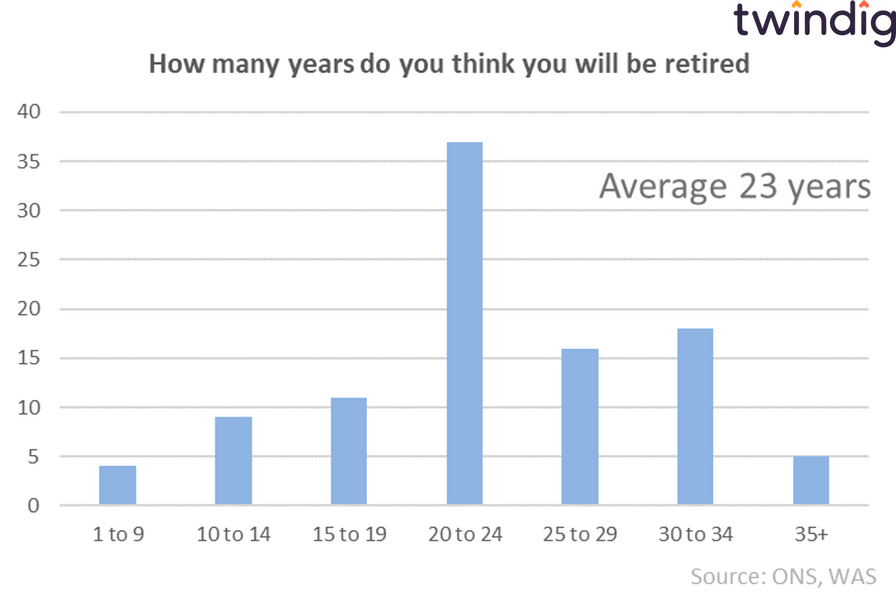

According to the UK Government’s Wealth and Assets Survey:

45% of adults are either not very confident or not confident at all that they will be able to fund a comfortable retirement.

Less than 1 in 3 adults have thought about how many years of retirement they will need to fund

Of those that did, on average they expect 23 years of retirement.

How much pension do I need?

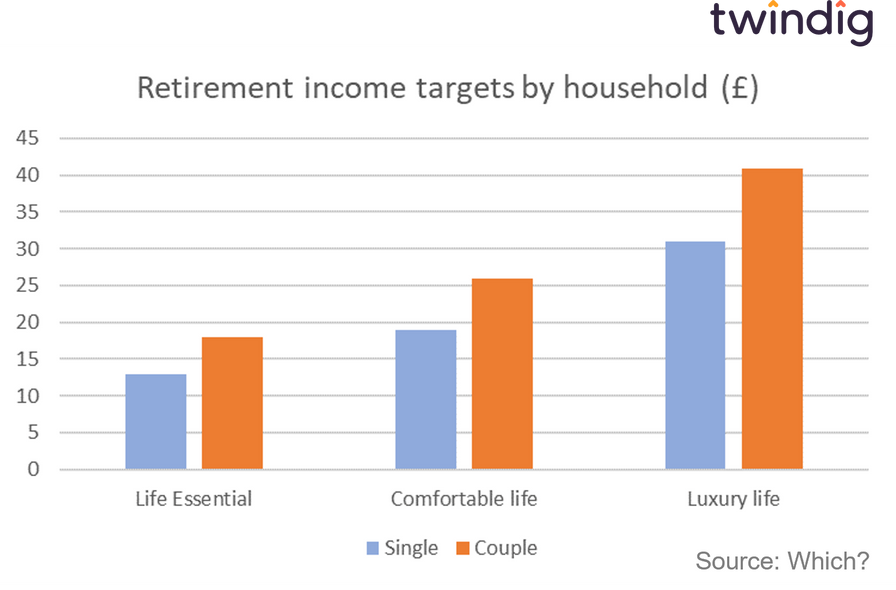

Research by Which in May this year reported that for a comfortable retirement lifestyle a single person required an income of £19,000 a year, rising to £26,000 per year for a couple, these figures were based on survey data from thousands of retired households.

The average state pension is around

£8,330 per year for men

£7,300 per year for women, and

£16,300 for the average couple

This implies that the average person or couple needs their state pension topped up by £10,000 per year to maintain a comfortable lifestyle.

Which go on to report that an income of £10,000 per year would require a pension pot of around £265,000 to purchase an annuity or a pot of £154,700 for an income drawdown strategy (assuming 3% interest per year and 21 years of retirement.

How much pension have I got?

Twindig’s analysis of FCA pension data suggests that the average pension pot at retirement is around £62,000.

This is £200,000 lower than the amount required for an annuity for a comfortable retirement lifestyle and would only fund a £10,000 pa draw down retirement income for seven years somewhat short of the 23 years of retirement retirees expect to enjoy.

Whichever way we view the pension pot it is around £100,000 short of what is required.

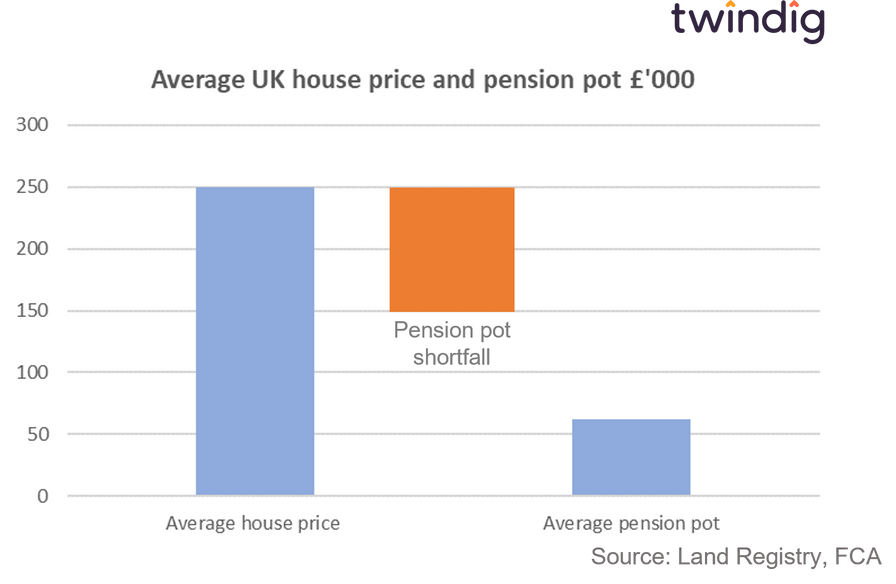

Meanwhile, those aged 65 or more have the highest rates of homeownership in the UK. The average house price in the UK is around £250,000 and 94% of those older owner-occupied households are mortgage-free.

Could housing be the answer?

We believe that not only could it be the answer, but it is also the answer. The housing market, especially for older households is equity rich. Around 94% of those owner-occupied households are mortgage-free.

The overwhelming majority of retired households are therefore in a strong position to fund their retirement through the release of housing equity.

We estimate that the average pension pot at retirement is around £62,000 suggesting that retirees are £100,000 short of a comfortable retirement, whereas the average house price is around £250,000, suggesting that housing wealth could, for many, more than offset the pension shortfall and defuse the ticking pension time bomb.

But how can you sell your home and live in it?

The answer is to turn Help-to-buy on its head. Rather than help households buy their first home, help households sell part of their last home so that they can remain in it. We might call it Help-to-sell.

A homeowner sells part of their home, but remains in the home. The homeowner remains responsible for the upkeep and maintenance of the home but does not pay rent on the part they do not own. When the property is sold, the sale proceeds are shared in accordance with the ownership shares of each party.

The social good of Help to Sell

As we noted in Helping to Fix the Housing market ladder Part 1, the Bank of Mum and Dad is both a help and a hindrance to the housing market. What starts as a good intention and a logical pattern of behaviour at the family level has drastic and far-reaching consequences at a society level as it shuts out of the housing market for those without access to the Bank of Mum and Dad.

Help to Sell would allow the intergenerational housing wealth transfers to occur across non-familial lines. Mr & Mrs Smith could sell a part of their home to Miss Jones allowing Miss Jones to start accumulating housing wealth by actually investing in the housing market rather than by saving for a deposit in a savings vehicle that is unconnected to the returns generated by the housing market.

Wouldn't such an investment be illiquid?

No, not in the way we are thinking of structuring it... but more on that in another article...