Equity release leaps 19% in Q3 2021

In this article, we look at the Q3 2021 trends in the equity release market including equity release mortgage rates and how homeowners use their equity release loans.

What is equity release?

We think it is important to fully understand what equity release is. Whilst its name suggests that it provides freedom and unlocks the cash which is tied up in your home, the reality is that equity release is debt. Pure and simple, equity release is a form of mortgage where money is loaned to you, the loan is secured on your home and interest charged on the amount you borrow and you will have to pay back what you borrow plus the interest accrued on the loan.

The amount of home equity released in the UK was up 19% in Q3 2021 to £1.05bn putting the equity release market on track to reach a total of £4.5bn in 2021.

During Q3 2021 equity release customers took on equity release ‘home loans’ of, on average, £101,593.

Equity release drawdown

In Q3 2021 three out of four (75%) equity release customers choose a drawdown plan rather than a lump sum plan. The initial drawdown was, on average, £57,183 and this represented around 60% of the total loan facility.

Equity release re-mortgaging

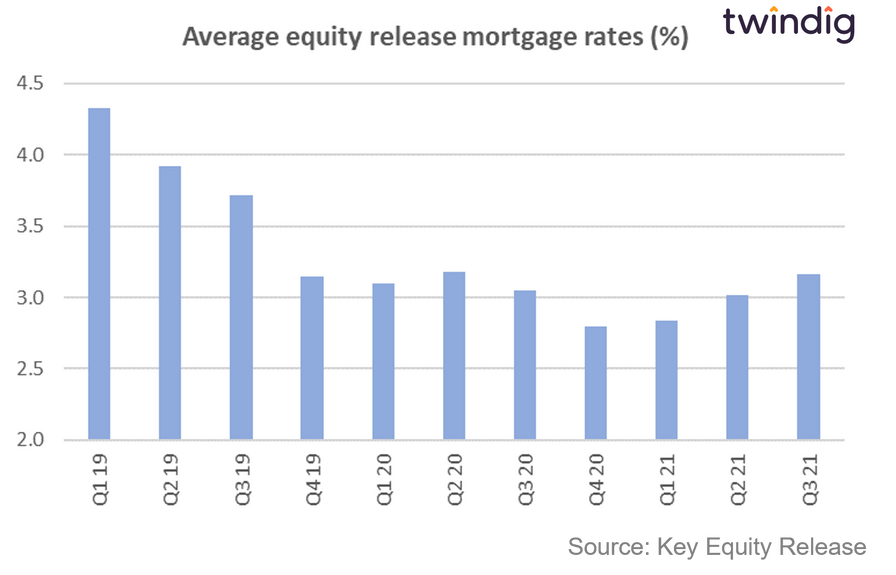

A growing volume of equity release loans made during the last three months were used for ‘re-mortgaging’, which hopefully confirms that equity release is taking on debt rather than releasing equity. The average amount of equity released remortgaged was £134,597. The re-mortgaging activity of equity release loans was driven, in our view, by the reduction in equity release mortgage rates. Those re-mortgaging saw the interest rate charged on their equity release loan fall from an average of 5.1% to 3.6%

Mortgage rates

We show in the chart below the average equity release mortgage rates for equity release products, which after a period of decline are once again on the rise

Uses of equity release mortgages

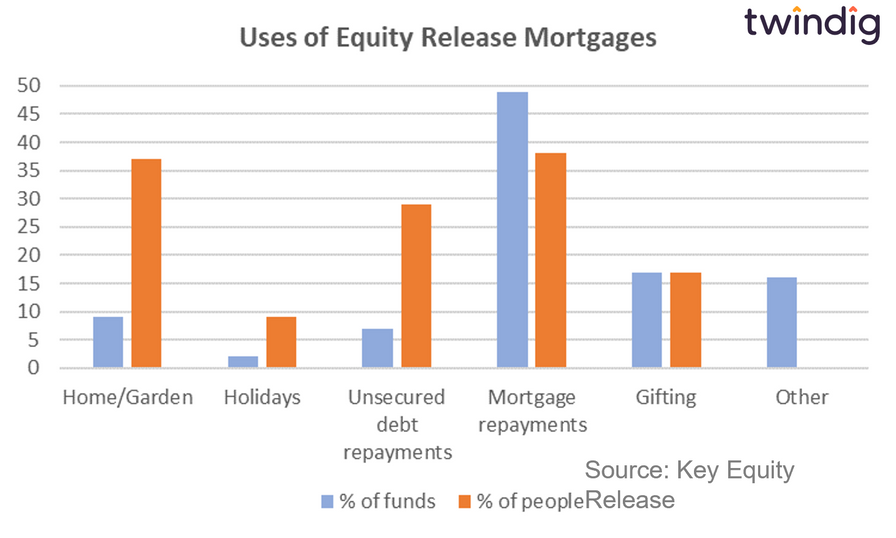

Interestingly the biggest ‘use’ of equity release mortgages (both in value and volume terms) is the repayment of mortgages. More than half (56%) of all equity release mortgages were used to repay debt, either mortgage debt or unsecured debt. However much of this re-mortgaging was undertaken to take advantage of lower mortgage rates.

Equity Release Gifting

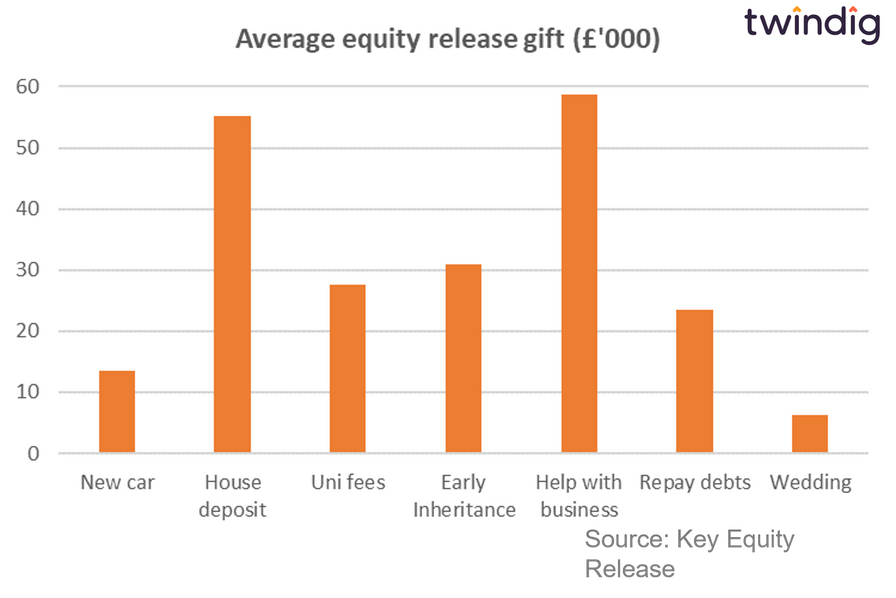

Turning to how equity release gifts are given the biggest uses are for early inheritances 61% of people and help with a house deposit 40% of people. In terms of the value of gifts, help with a house deposit accounts for 43% of equity released and early inheritances 36%

The size of the average ‘house deposit’ gift was £55,200 and for those receiving help with a business, the average gift received was on average £58,800.

Can you release equity without taking on debt?

Not yet, but we believe that fractional homeownership is the way forward. We think it is a strange situation when you have to take on debt to release equity from your home. We believe that you should be able to release equity, by selling part of your home as and when you need to. The benefit of fractional ownership is that it is not a loan, you don't have to pay it back and it can be used as part of a households retirement and estate and inheritance planning. You can read more about fractional homeownership in our Case for Fractional Homeownership article.