Biggest rise in interest rates since 1995

The Bank of England increased Bank Rate by 50 basis points to 1.75% today

What the Bank of England said

Bank Rate increased from 1.25% to 1.75%

The MPC voted by a majority of 8-1 for a 50 basis point increase

The MPC members in the minority voted for a 25 basis point increase

Twindig Take

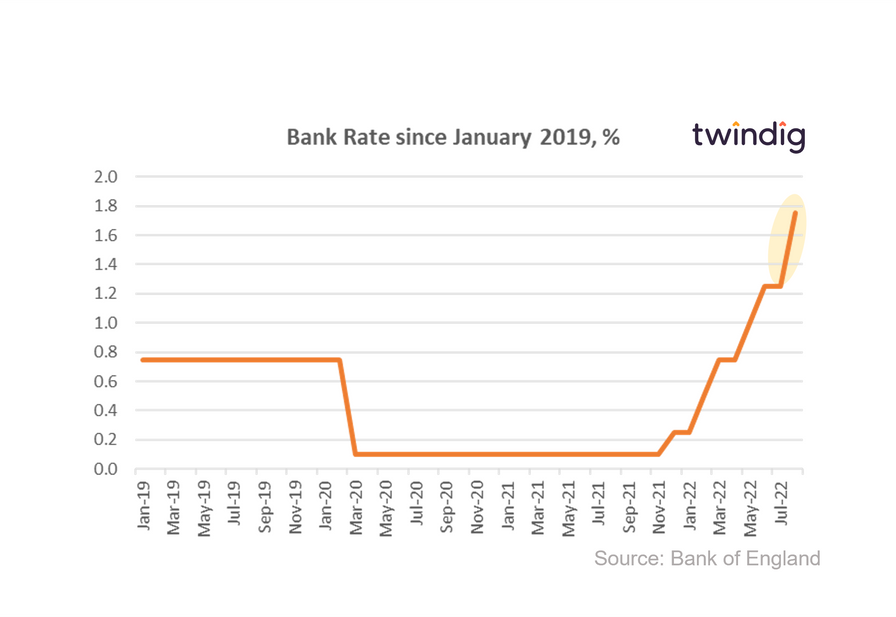

As widely anticipated, the MPC decided to raise Bank Rate by 50 basis points from 1.25% to 1.75% today as the Bank of England gets tough on inflation and the causes of inflation, seeking to control inflation through the use of monetary policy.

The Bank of England commented that inflationary pressures have intensified since the MPC's last meeting. Consumer Price Inflation (CPI) is expected to rise from 9.4% in June to just over 13% in Q4 2022 and to remain at elevated levels throughout much of 2023, before falling to the Government's 2% target in 2024.

A 50 basis point rise is the largest rise since 1995 and indicates that the Bank of England prefers short-term pain today rather than longer-term pain tomorrow. The Bank currently expects Bank Rate to peak at around 3% in March 2023.

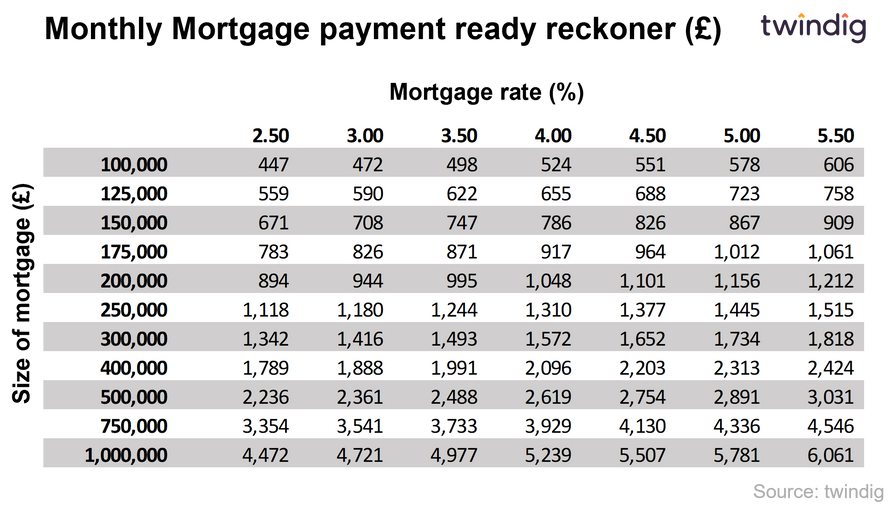

We expect that this latest 50 basis point rise in Bank Rate will feed through to mortgage rates in September. These rises are likely to increase floating mortgage rates and standard variable rates by half of one per cent (50 basis points). If your floating rate is 2.50% today it is likely to be 3.0%in September leading to an additional monthly mortgage payment of £25 per month for every £100,000 borrowed. However, those on fixed rates will not see changes to their mortgage payments until their fixed rate period ends.

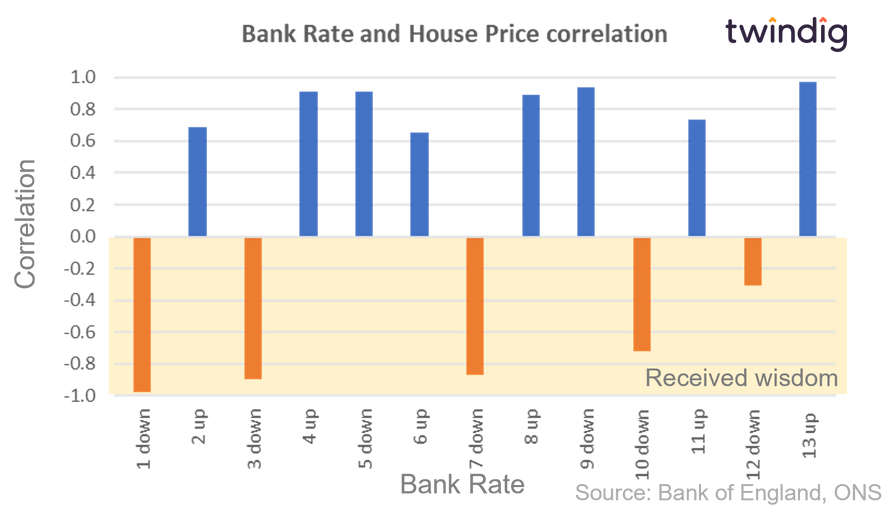

Will house prices fall as Bank Rate rises?

Whilst the received wisdom is that it will, the evidence supporting that view is patchy. We looked at the last 13 periods of rising nad falling Bank Rate and as illustrated below house prices have not fallen as Bank Rates rise see periods 2, 4, 6, 8, 11 and 13 in the chart below. If house prices fell as bank rate rose we would expect to see a negative correlation here, but we did not.

For a fuller analysis of mortgage rates and house prices cluck read more below

How much will my mortgage cost now?

For those on fixed-rate mortgages the monthly payments will remain fixed for the duration of the fixed term, after that it is likely that the remortgaged rate will be higher than it currently is.

To calculate mortgage payments you can use the Twindig mortgage calculator below