UK Housing market: Are we addicted to housing drugs?

Housing transactions and house prices are rising, so do we need the continued stimulus of stamp duty breaks? Is it like a drug where the short term fix blinds us to the longer-term damage and distress it will cause?

We already live in a country where house prices are divorced from wages as the first wave of housing wealth from the mass-affluent cascades down to the next generation. If your parents do not own their home it is increasingly unlikely that you will not be able to get on the housing ladder.

On average, house prices have already increased by more than six times the stamp duty saved. At a time when for many wages are at best stagnant and at worst, at risk.

Are we being fooled or have we fooled ourselves? Like it or loath it, the presence or absence of Stamp Duty will not fix our broken housing market.

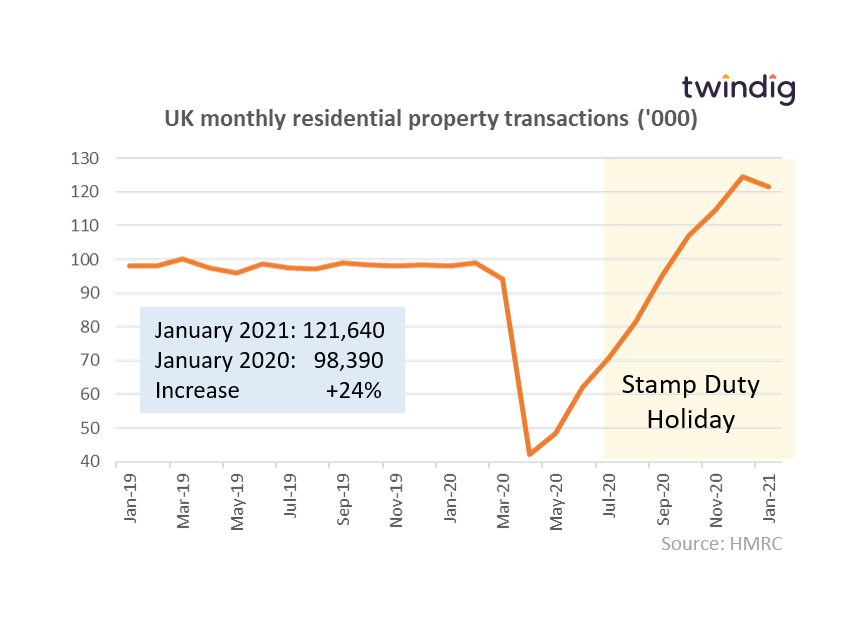

HMRC Housing Transactions

The HMRC released its provisional data for the number of UK housing transactions in January this week

What they said

Housing transactions Jan 2021: 121,640

This is 24% higher than January 2020

This is 2.4% lower than December 2020

Twindig Take

Provision HMRC Housing transaction data reports there were 121,640 residential housing transactions in January 2021 an increase of 24% over January 2020.

The impact of the Stamp Duty Holiday is in full swing and the post-Christmas lockdown did little to subdue the housing market.

Now that we have a roadmap to take us out of lockdown, does that lessen the need to extend the Stamp Duty Holiday? All eyes will be on the Chancellor as he presents his budget next week.

Stamp Duty Holiday extension – a hammer looking for a nail

There has been press speculation that the Chancellor will extend the Stamp Duty Holiday in next Wednesday’s budget.

Many have said that thousands of housing transactions will fail without a stamp duty holiday extension. However, housing transactions fail all the time. The main reasons why housing transactions fail are buyers changing their minds and not being able to secure a mortgage. The level of Stamp Duty is not a significant factor.

Is the Stamp Duty holiday, therefore, a hammer looking for a nail and should it be knocked on the head itself?

Stamp Duty Calculator

You can use our handy stamp duty calculator to work out how much Stamp Duty you will need to pay on your next home purchase.

What did we do when we stayed at home last year?

It seems that staying at home encouraged us to look at other peoples homes. We spoke about drugs earlier and it appears we are addicted to looking at property as well as buying it.

Rightmove reported this week that 15.1 billion minutes were spent on its site last year across 2.1 billion visits. To put that in context that is 748 minutes (12.5 hours) for every woman, man and child in the UK ...

That is a lot of time looking at property and Rightmove only has the properties currently for sale or rent, about 1 million whereas Twindig has every home across the country 28 million in total. If the property you like isn't currently on the market you can follow it like you follow people on Facebook, Twitter or LinkedIn

Budget Preview

Picture credit: Harriet Pavey

Few people envy being the Chancellor of the Exchequer and fewer still would relish being the pandemic Chancellor. Mr Rishi has some tough calls to make, the two biggest being what to stimulate and how to pay for it.

In terms of the UK economy, the UK housing market has been the stand-out performer, in our view. It has been robust and it has kept on going and we do not believe that it needs further stimulus. However, perhaps the chancellor has ambitions to move house himself, possibly to the house next door and will use the budget to curry favour with homeowners and aspiring home buyers.

It seems a racing certainty that the Stamp Duty holiday will be extended, but if it is we hope that its implementation is tapered and qualified otherwise whilst an extension moves some away from the stamp duty cliff edge, many more will journey towards its precipice. The Times also reported this week that the Government is set to re-launch a Mortgage Indemnity Guarantee Scheme to boost the high loan to value mortgage market. This will be a great help to first time buyers, where securing a deposit is the biggest barrier to homeownership for those without access to Bank of Mum and Dad.

The chancellor has asked for a review of Capital Gains Tax and with house prices at record levels, it would seem fair that those who have benefitted from pandemic house price rises would be called upon to help pay for the spending which has helped those less fortunate than themselves. However, we do not expect taxes to rise until the UK economy has been fully re-opened for business.

We expect that next week’s budget will see the extension to and/or the ramping up of economic stimulus policies rather than them being dampened down and this applies to the housing market as well as all the other markets which together make up the UK economy.

Coming Home – tackling the housing crisis together

Whilst all eyes next week will be on the short-term impact of the Government’s Stamp Duty Holiday on the UK housing market, perhaps we should be thinking more long term.

Some very learned people got together with the Archbishops of Canterbury and York to look at how our current housing crisis could be made good. The focus on long term solutions rather than short term stimuli and a vision where housing is sustainable, safe, stable, sociable and satisfying.

What I found interesting was the report's conclusion that a solution requires collective action and a mind shift from all of us. Wherever we find ourselves, we all have our part to play. Food for thought on a Sunday. You can read the full report here.

Magic Links - no more passwords

The average adult now has more than 100 passwords to remember (or forget). The tech team at Twindig noticed that many people were forgetting their Twindig password. So to solve the problem they have done some magic - taken the password away and made our site more secure...

Good news no more passwords and better news the site is more secure.

How does it work? Now when you log in we ask you to put in your email address (the one linked to your account) and we send you a 'magic-link' - the link will log you in, but it only works with your email and it expires after a short period of time. You can try it here Magic Link Log In

Do let us know what you think of the magic link.

Rightmove

Rightmove the UK's largest property portal issued its financial results for 2020 on Friday

What they said

Revenue down 29% to £205.7m

Profit before tax margin 66%

Average revenue per customer (branch) per month Dec 2020: £1,103

Twindig take

It looks like Rightmove’s agents gave it COVID herd immunity, despite the pandemic it's FY 2020 Profit Before Tax margin 66% (meaning 66p of every £1 spent by agents is pure profit) and net assets increased by £82m of which £65m was an increase in cash in the bank. Nice work if you can get it and Rightmove certainly has it. As we stayed at home we were certainly looking at homes time spent on Rightmove last year increased by 31% to 15.9 billion minutes across 2.1 billion visits to the property portal. Rightmove has previously shown itself recession-proof, and for now it seems to be pandemic proof as well. Although revenue took a hit in 2020 it exited 2020 with revenue per customer of £1,103 higher than its 2019 level of £1,088. Rightmove had a booming time in 2020, but will Boomin provide it with a tougher challenge in 2021?

LSL Property Services

LSL the UK's largest listed estate agent (operating across 226 owned and 130 franchised branches) issued a trading update this week

What they said

Each division, Estate Agency, Financial Services and Surveying reported growth in underlying operating profits in January 2021

No indication of a material increase in fall-through trends

Twindig Take

LSL is making hay whilst the sun shines during the Stamp Duty Holiday. It is also comforting to see that there is no material increase in fall through trends (failing housing transactions) which suggests that fears of a Stamp Duty Holiday cliff-edge may be over-egged