Is the Stamp Duty Holiday a hammer looking for a nail?

Many have said that thousands of housing transactions will fail without a stamp duty holiday extension. However, housing transactions fail all the time. The key reasons being buyers changing their minds and not being able to secure a mortgage rather than the level of stamp duty. Is the Stamp Duty holiday therefore a hammer looking for a nail and should it be knocked on the head itself?

Is a Stamp Duty Holiday the right tool for the job?

There is widespread press speculation today that the Chancellor will extend the Stamp Duty Holiday by three months to 30 June 2021. But is a Stamp Duty Holiday the right tool for the job or just a hammer looking for a nail?

No tax, no brainer right?

At first glance, tax cuts will look like good news to anyone who will end up paying less tax.

BUT

Would you like to spend £16,671 to save £2,575?

Data from the Land Registry reveals that average house prices have increased by £16,671 since the start of the Stamp Duty Holiday with the average stamp duty saving being just £2,575.

Stamp Duty Holiday has cost the average homebuyer more than £14,000

The average homebuyer is, therefore, worse off by £14,096.

But thousands of transactions have collapsed during the Stamp Duty Holiday without it

Housing transactions fail every week

Unfortunately, thousands of housing transactions collapse every week, with or without stamp duty holidays. The problem isn't Stamp Duty and the solution is not a Stamp Duty Holiday.

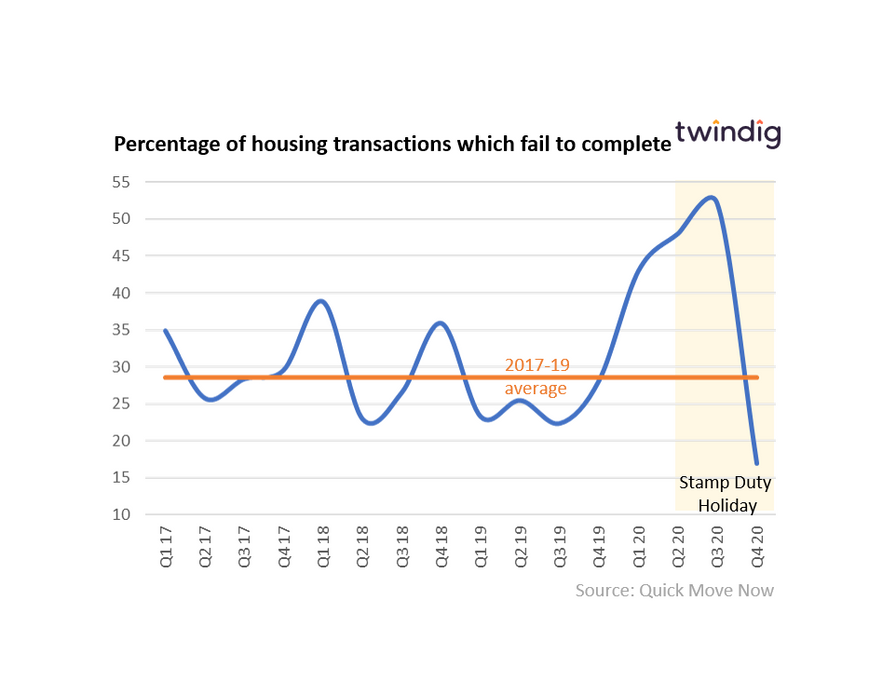

According to Quick Move Now, 52 per cent of sales in England and Wales fell through before completion between July 2020 and September 2020 and the stamp Duty holiday started on the 8th July 2020.

Yeah, but no, but yeah, but...

46 per cent of sales that failed during the first half of the year did so either because the buyer changed their mind or because they had a change in circumstances.

Quick Move Now’s research revealed that the five main reasons for the transactions failing during 2020 were

31% Buyer changed their mind

15% Buyer unable to get a mortgage

13% Buyer pulled out due to slow progress

11% Buyer attempted to renegotiate the price

11% Buyer pulled out after a survey

Failing housing transactions is not a pandemic phenomenon

Quick Move Now found that on average almost one in three (28.5%) of housing transactions fell through between 2017 and 2019 in the pre-pandemic era.

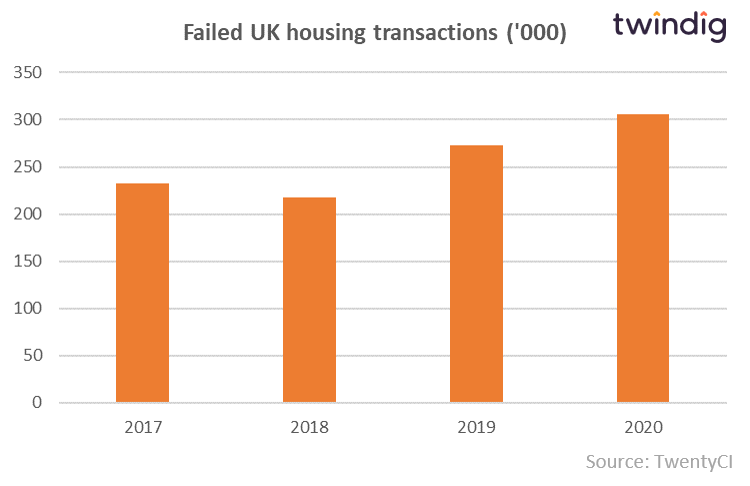

More than 250,000 housing transactions fail each year

Data company TwentyCI has also reported high levels of housing transactions failing to complete, averaging more than 250,000 per year since 2017.

When is a cliff edge not a cliff edge?

Not extending the stamp duty holiday will cause misery for many of those who miss the deadline, but on the other hand, a new deadline potentially sets up many more to fail.

However, perhaps there is a third way. If the Stamp Duty Holiday is to be extended, perhaps it could be extended for those who have exchanged contracts and are therefore legally bound to complete the transaction or face penalties. Or should it be extended for those who have a mortgage offer on a particular property to allow them to purchase that particular named property? Whatever 'taper' is chosen, the extension should be tied to a particular property at a particular point in time, in our view.

This, however, would still leave a group of people who just miss out, those that have through no fault of their own not secured the mortgage offer or have not been able to exchange contracts.

The problem with drawing a line is that there will always be people on one side of it who want to be on the other. Life is not fair and although the housing market contains a lot of equity, it will never be equitable for all.