Halifax House Price Index

House Prices in March 2023

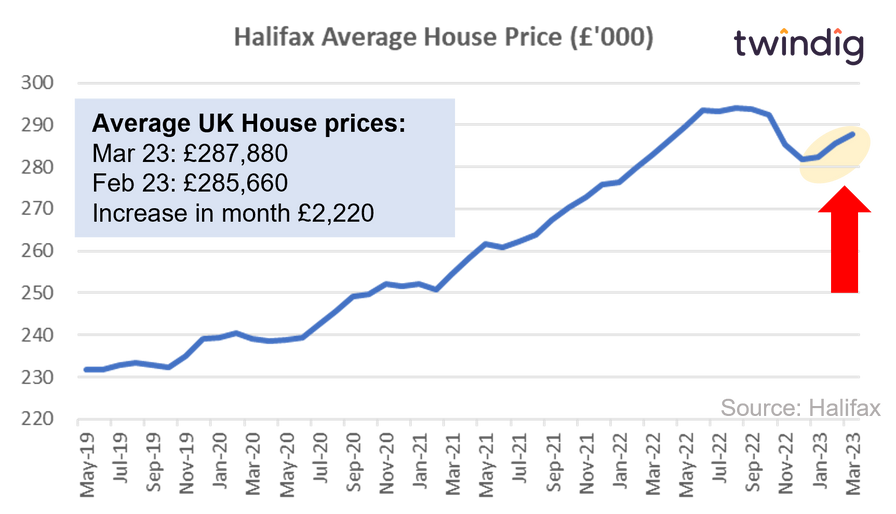

The average UK house price in March 2023 was £287,880

House prices rose by 0.8% or £2,220 during the last month

House price increased by 1.6% over the last year

Halifax House Price Index Chart

Halifax House Price Index Commentary

House prices Rose by 0.8% or £2,220 during March 2023, reducing some of the falls seen in recent months. According to the latest Halifax house price data, house prices are now only 2% or £6,112 below their August 2022 peak. The story of house prices so far in 2023 has been one of house prices falling upwards rather than crashing down. However, it is probably too early to say that stability has returned to the housing market, more a case that few stories are truly one-sided, there will be ups and downs along the way. Perhaps the outlook for house prices is not as bleak as some believe, but for now, we continue to believe that the direction for UK house prices is downwards not upwards.

Average UK house prices are currently £47,000 higher than their pre-pandemic levels

House prices rose by £5,824 during 2022, which is significantly less than the average rise of £24,335 in 2021 and the average increase of £12,556 in 2020.

Whilst falling house prices may seem like good news for aspiring first-time buyers, unfortunately, for them, rising mortgage rates and tightening lending criteria continue to push their dream of homeownership further out of reach. This is troubling as first-time buyers are the lifeblood of the housing market and are often the lynchpin to many transactions in a housing chain. Bad news for first-time buyers often, therefore, means bad news for the housing market as a whole.

An indication of first-time buyers' challenges in securing mortgages as interest rates rise is that house prices for first-time buyers are falling faster than for home movers. Homemover house price inflation fell from 10.3% in September to 8.9% in October for homemovers, but fell from 10.1% to 7.5% over the same period for first-time buyers.

Estate agents continue to report a shortage of homes to sell, which will help underpin prices in the coming months and housebuilders are selling homes as quickly as they can build them.

Whilst rising living costs and rising interest rates are starting to impact house prices, most are on fixed-rate mortgages and therefore changes to Bank Rate will not impact them immediately. However, those securing a mortgage for a house purchase are being hit by both rising mortgage rates and increased living costs and this is weighing on house prices and causing them to fall. .

How much is my house worth?

If you would like to quickly see how much your house is worth you can do so by visiting twindig.com we have details of every house across the country, all 28 million, not just the one million or so that are currently for sale or rent

How much will my mortgage payments be?

If you would like to quickly see how much your house is worth you can do so using our handy mortgage calculator which lets you see how much your mortgage payments will be as mortgage and interest rates change.

Halifax House Price Index Publication dates

- Tuesday 9th May 2023

- Wednesday 7th June 2023

- Friday 7th July 2023

- Monday 7th August 2023

- Thursday 7th September 2023

Halifax House Price Index methodology

Lloyds Banking Group is the sole source of data for the Halifax House Price Index. The index is based on mortgage approval data provided by Lloyds Banking Group.

In order to provide a robust measure for UK house prices the Halifax House Price Index removes or excludes several types of mortgage transactions from the index:

- Re-mortgages

- Business use, capital raising, or building mortgages

- Discounted mortgages relative to market value where the property valuation is deemed to be less than 75% of the purchase price for instance in the case of many Right to Buy house purchases.

However, to better reflect the structure of the UK housing market, since 2019 the Halifax House Price Index has included shared ownership mortgages

The Halifax House Price Index is calculated by estimating the price of a fixed 'basket' of houses sold, not unlike the way the retail and consumer price indices are calculated by the Office of National Statistics (ONS).

The Halifax House Price Index uses a number of different property characteristics to determine the standardised house referred to in its house price index and average house prices. The index takes into account the following property characteristics:

Property type: Lloyds Banking Group attributes a property type to each mortgage approval and mortgage offer: Detached, semi-detached, terraced, flat, bungalow

Property size: The Lloyds Banking Group mortgage data includes the size of each property in square metres. Typically the bigger the property the higher its price

Number of bedrooms: The number of bedrooms a residential property has impacts the price of the home as well as its overall size.

Age of home: The Halifax House Price index finds that in the main, new homes tend to attract a price premium over older homes with similar attributes. This could be due to a number of factors including improving building regulations and standards, warranties and energy efficiency. New homes are also likely to need fewer repairs and have lower maintenance costs than newer homes and this gets reflected in the relative prices of the homes.

Location: It is often said that house prices are all about 'Location, location, location' and this belief turns out to be true. The Halifax House Price index looks not only at the main nine regions within England (North East, North West, Yorkshire & Humberside, East Midlands, West Midlands, East England, South East, South West and Greater London), Scotland, Wales and Northern Ireland, but also at the house price differences between postcode districts to improve the accuracy of its house price index.

History

The Halifax Building Society launched its House Price Index in January 1983, which makes it the longest-running monthly house price index in the UK.