Stamp Duty Reform - be careful what you wish for

The Stamp Duty Holiday has confirmed what we already knew, we don’t like paying tax. It has also re-opened the debate on the structure of property taxes. On the one hand, economists will tell you that transaction taxes should be avoided as they reduce the efficiency and effectiveness of the way assets and resources are employed. On the other hand, most of us agree that public services such as the NHS and state school education are good things that we should pay for. The challenge is how to efficiently and equitably raise the taxes to pay for the things we want. This article compares our current one-off Stamp Duty tax with a monthly property tax based on the value of the home. The proportionate property tax is more affordable, but the catch is it is also more expensive. When it comes to stamp duty reform, we must be careful what we wish for.

Tax Property on purchase, sale or ownership?

Economists dislike transaction taxes such as Stamp Duty. Paul Johnson CBE, economist for the Institute for Fiscal Studies visiting professor in the Department of Economics at University College London has said that “Stamp duty is an economic nonsense”.

He has also said that “we should get rid of stamp duty on residential property transactions.” and that “at least some of that should be made up by increasing council tax”.

Fairer Share takes this idea one step further, they propose abolishing Stamp Duty, Council Tax and Bedroom Tax and replacing them with a proportional property tax paid only by the owners of the property rather than tenants. This tax would be similar to council tax an annual charge paid in monthly instalments by the owner of the property on an ongoing basis.

The benefits of taxing ownership rather than purchase or sale

Taxing ownership monthly, rather than by one large upfront (Stamp Duty) lump sum lowers one of the cost hurdles to getting on the housing ladder by spreading that cost over time. Taking away the need to fund stamp duty upfront would certainly help first time buyers who are already struggling to save for a sufficient deposit.

Taxing property monthly also removes the risk of inertia that a sales or capital gains tax may create. Homeowners would not put off a sale to avoid a tax bill. Asset rich but cash poor downsizers would not have to find a stamp duty lump sum and would benefit from a lower monthly tax bill. Without the burden of Stamp Duty the downsizing market may take off, which would lead to a more efficient use of our existing housing stock. Growing households would be more able to trade up and older households more able to trade down to a smaller property. Less over-crowding for growing families and lower bills for empty nesters and retired households.

The drawbacks of taxing ownership rather than purchase

There is however a social cost to proportional property tax rather than having a stamp duty on the purchase. Our incomes vary enormously over our lifetime. At the peak of our career, we may have the funds to put down roots in a community and purchase our ideal family home, where over many years we build up valuable social networks (of the physical rather than digital kind). However, as our income reduces and as we retire there may be a risk that we are priced out of the community we live in.

A simple solution would be to allow those who are asset rich but cash poor to defer their ownership tax until the property is sold. However, it seems reasonable that interest should accrue on the deferred taxes to incentivise those who can pay to pay. The essential services we need the taxes to pay for need cash today not cash tomorrow.

How much should the Proportional Property Tax be?

A good question. FairerShare suggests a flat rate of 0.48% on primary residencies rising to 0.96% for second and additional homes (why they chose 0.48% and 0.96% rather than 0.5% and 1.0% we don’t know…). They believe that this tax would raise £36.7bn per year which they say is the same amount of tax revenue that would be lost by scrapping Stamp Duty, Council Tax and Bedroom Tax.

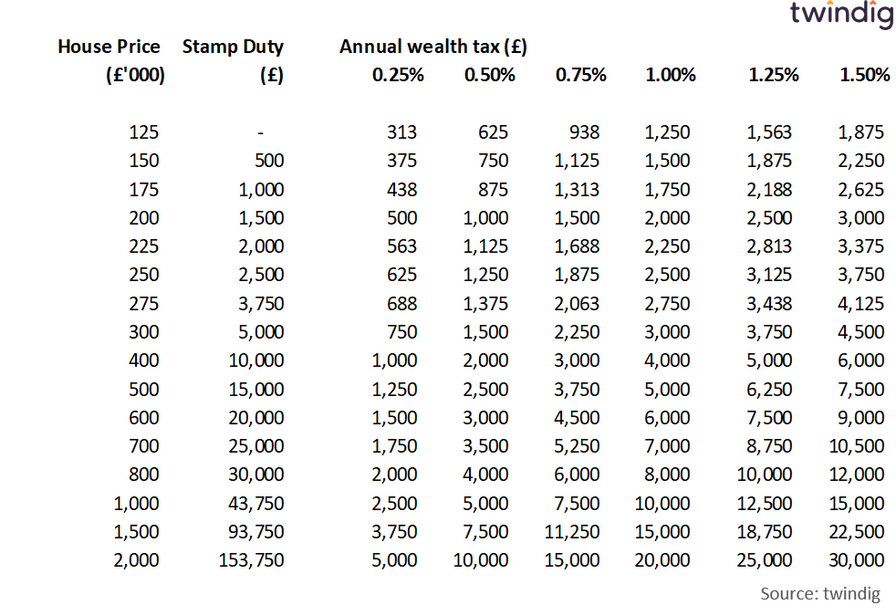

Given that the UK Government has not commented on the appropriateness of the 0.48% and 0.96% charge our analysis shows how much a Proportional Property Tax would be for homeowners across a range of different tax rates, ranging from 0.25% to 1.50%

Stamp Duty Compared to a Proportional Property Tax

What is evident from the table is that the annual proportional property tax is much lower than the upfront lump sum payment required by our current Stamp Duty tax. Our analysis does not take into account a reform of council taxes. We directly compare stamp duty costs (using rates scheduled to be in force from 1 April 2021) to a proportional property tax rate.

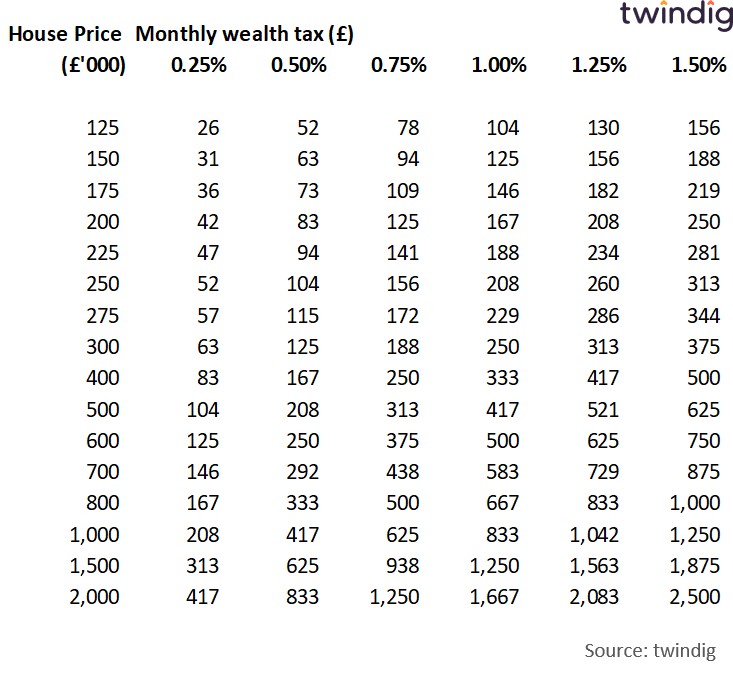

House prices and the monthly cost of a Proportional Property Tax

The table below shows the monthly cost of a Proportional Property Tax for a range of house prices and proportional property tax rates.

For there average UK house which costs around £250,000 the monthly property tax cost at tax rate of 0.5% would be just over one hundred pounds (£104) per month, rising to £208 per month if the tax rate was 1%.

Stamp Duty Tax reform - be careful what you wish for

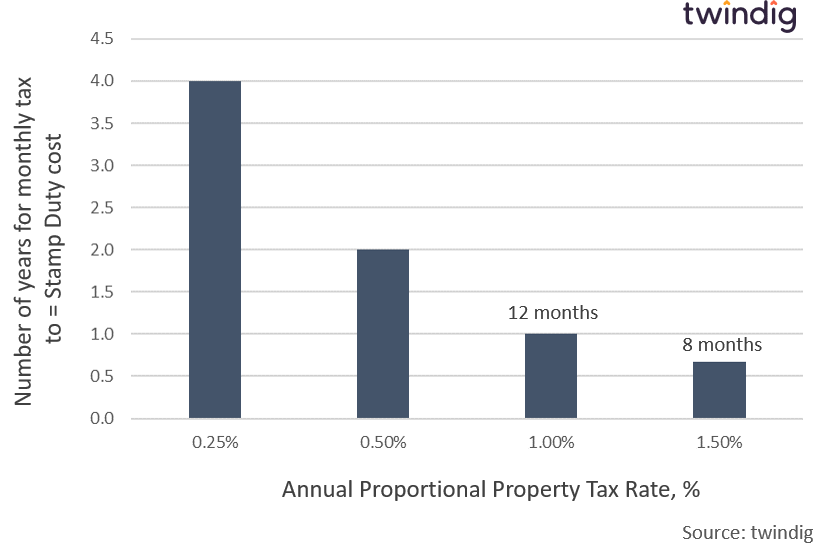

The monthly property tax figures are certainly a lot easier on the eye than those of the much larger stamp duty lump sums, but there is a catch. The lump-sum is a one-off, the monthly payments are ongoing.

At some point, the cumulative total of the monthly payments will outweigh the original stamp duty lump sum. The proportional property tax will be more affordable, but more expensive.

To illustrate the point we show in the following graphs how many years it takes for these affordable property tax payments to be more expensive than the Stamp Duty payments they could replace.

For the average UK house costing £250,000 the cross over point is six years at 0.5%, three years at 1.0% and just two years at 1.5%.

Number of years taken for monthly property tax payments to equal stamp duty tax

The English Housing Survey 2019-20 found that those buying a home with a mortgage had, on average, lived in that home for 10 years. Those who owned their home outright had lived there for an average of almost 24 years. The average length of ownership was 17.4 years.

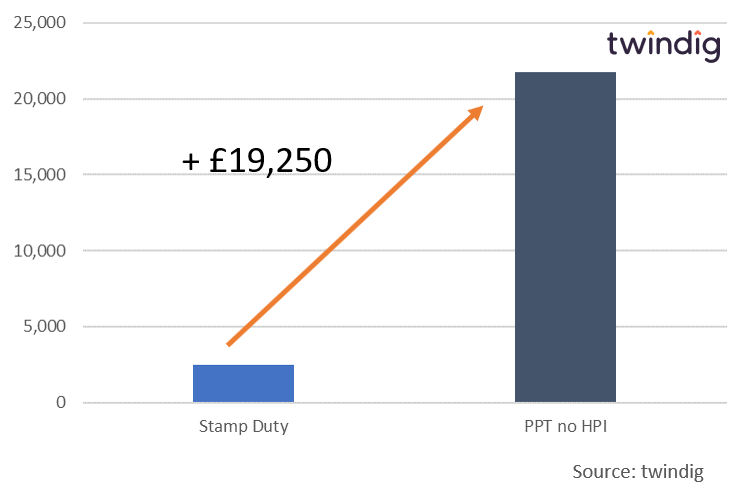

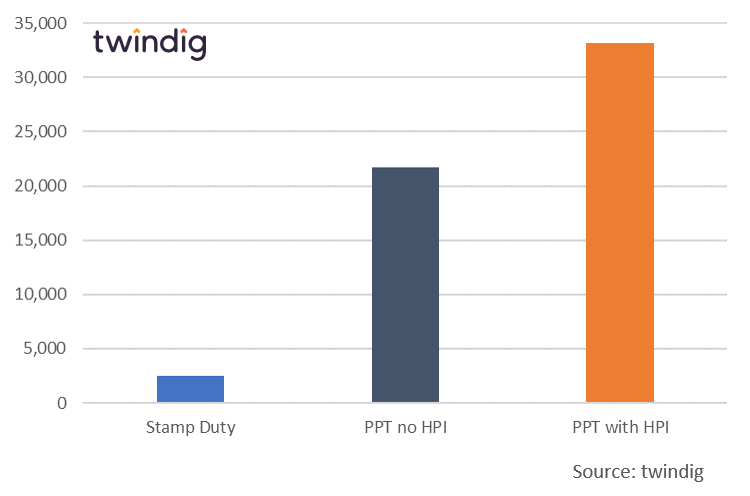

If we take the average of 17.4 years, the average house price of £250,000 and a proportional property tax rate of 0.5% the homeowner would have paid £21,750 in proportional property tax or £19,250 more than the previous stamp duty of £2,500

Stamp Duty cost compared to Proportional Property Tax cost, £

One more catch… house prices tend to go up

Our calculations above are based on the assumption of no house price inflation, but house prices tend to go up more often than they go down and house prices. If we look back over the last 17.4 years, the average length of homeownership, we see that house prices have more than doubled, increasing by 117%.

If the monthly tax was based on monthly house prices this would increase the total payments from £21,750 with no house price inflation to £33,204 an increase of £11,454.

Stamp Duty Tax compared to Proportional Property Tax for the average length of homeownership

Sorry there is another catch.. house prices increase faster than wages

If we look at house price growth and average wage growth over the last 17.4 years, we see that house prices more than doubled, up 117% average, but wages only increased by 61%.

UK House price growth compared to wage growth

The Proportional Property Tax, therefore, not only increases but increases at a faster rate than wages. The property tax will take up an ever-increasing share of your wages. Perhaps the upfront lump-sum stamp duty tax payment isn’t so bad after all.