With Number 10 empty should I buy a home now?

The economy is currently in a bit of a mess, and it seems that the prime minister changes more frequently than the weather and house prices appear to be about to fall. If I am buying a home or thinking of moving, should I ‘get the purchase done’ or ‘put the purchase off’?

The strange outcome is that you might be worse off waiting for house prices to fall because of the impact of rising mortgage rates

Why are you moving?

The key to answering the question is to ask why are you moving? If you are moving home for a job or family reasons, and you have found the home you want to buy, and can afford to buy it, there are strong arguments to suggest that it makes sense to move: You need to move, you have found the home you want to buy and you can afford it.

Won’t it be cheaper if house prices fall?

If house prices fall, you are likely to be able to negotiate a better price. However, whilst you may hold all the aces when negotiating a better price, you have a much weaker hand when securing a mortgage.

Mortgage rates are rising, and mortgage rates cannot be negotiated in the same way that house prices can. Mortgage rates are rising, and the impact of rising mortgage rates is likely to be bigger than the impact of falling house prices.

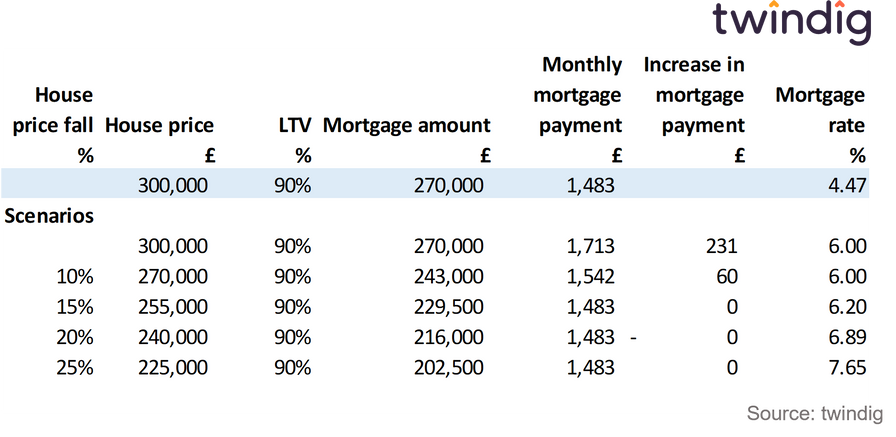

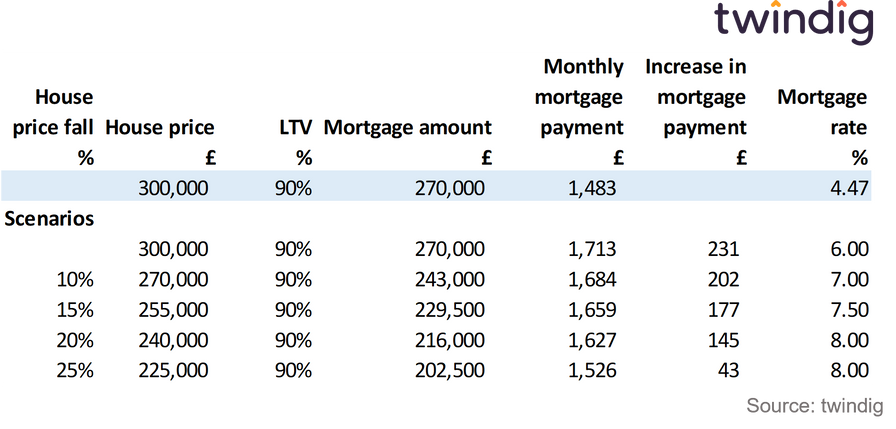

We show in the table below the impact of falling house prices and rising mortgage rates.

Our starting point is a house price of £300,000 with a 90% LTV mortgage. Last month (September 2022) the average mortgage rate for a 90% LTV mortgage was 4.47%. This implies a monthly mortgage payment of £1,483.

The best 90% LTV mortgage rate available on Moneyfacts today (21 Oct 22) was 6.0%, the mortgage payment at 6.0% is £1,713 an increase of £231

If house prices fell by 10% the mortgage payment would be £1,542 which is still £60 more than the original mortgage at 4.47%.

If house prices fell by 15% you would need a mortgage rate of less than 6.2% before your mortgage payments are reduced.

If house prices fell by 20% (and they only fell by 19% during the Global Financial Crisis) you would need a mortgage rate of less than 6.89% to lower your mortgage payments.

The Bank of England will likely raise Bank Rate on 3 November 2022. Bank Rate is the interest rate which impacts all other interest rates and if Bank Rate rises mortgage rates will likely rise by at least as much as the increase in Bank Rate.

If Bank Rate increases from 2.25% to 3.00% or 3.25% or even 3.50% The current 6.0% mortgage rate is likely to rise to 6.75%, 7.0% or 7.25%

Conclusion

If you have a mortgage offer and you are in a position to move, think very carefully before pulling out of the purchase. Your monthly cashflow could be negatively impacted and with rising food and energy costs higher mortgage payments are unlikely to be welcomed.