Why your mortgage payments may change next week

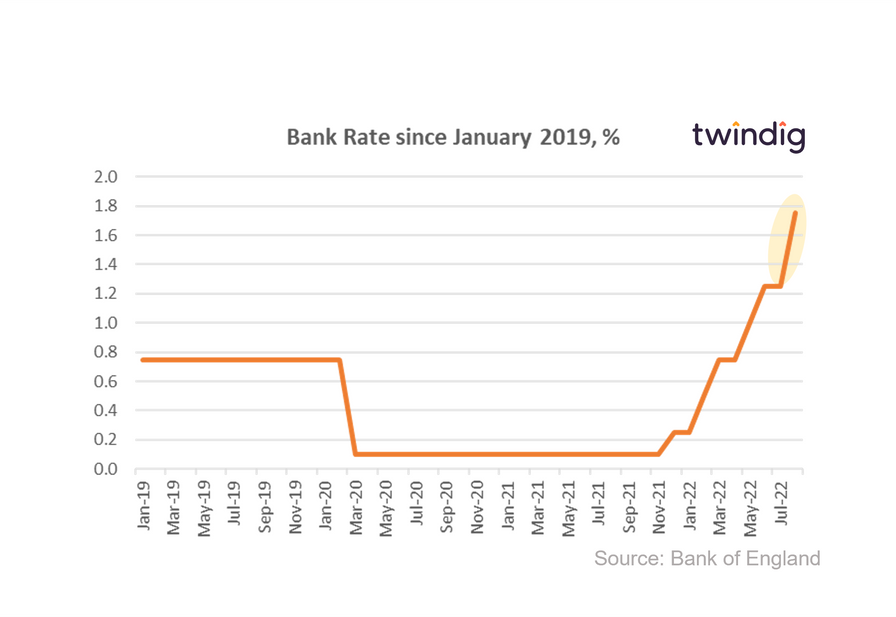

The Bank of England's Monetary Policy Committee (MPC) is due to meet next week to announce its decision on Bank Rate.

In our view, the Bank of England will likely raise Bank Rate by either 50 or 75 basis points (bp) next week, taking Bank Rate to either 2.25% or 2.50%.

A 50bp rise would follow the 50bp increase in August, whereas a 75bp rise would be the biggest increase since October 1989.

Are you a fixer or a floater?

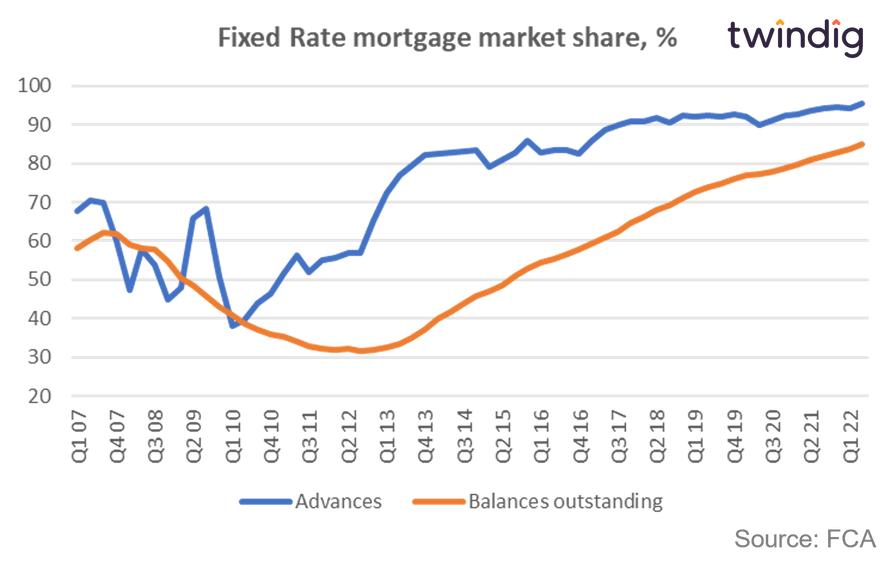

If you have recently arranged a new fixed rate mortgage you are in good company. The latest data from the FCA revealed that in Q2 2022 (April to June) 95.5% of mortgage advances were for fixed-rate mortgages.

Across the whole population of mortgages, 85% are fixed-rate mortgages.

Why are so many choosing fixed-rate mortgages?

Mortgage rates are rising, and each time the Bank of England raises the Bank Rate, we can expect to see the increase passed on to mortgage rates. The Bank of England's Bank Rate is the underlying interest rate that impacts all other rates.

However, those on fixed rates will not see their mortgage payments increase. The number of households on fixed-rate mortgages has never been higher.

What do rising interest rates mean for me?

Nothing, if you have a fixed-rate mortgage, because your mortgage payments will be fixed for the term of your fixed-rate mortgage, typically two to five years.

However, a rising Bank Rate will mean increased mortgage payments, if you have a floating rate mortgage. When the Bank of England raises the Bank Rate, most lenders increase their floating mortgage rates in the following month. If Bank Rate is increased next Thursday (22 September) floating rate mortgage payments are likely to rise in October.

To see how your mortgage payments may change you can use our mortgage calculator

Why is the Bank of England raising Bank Rate?

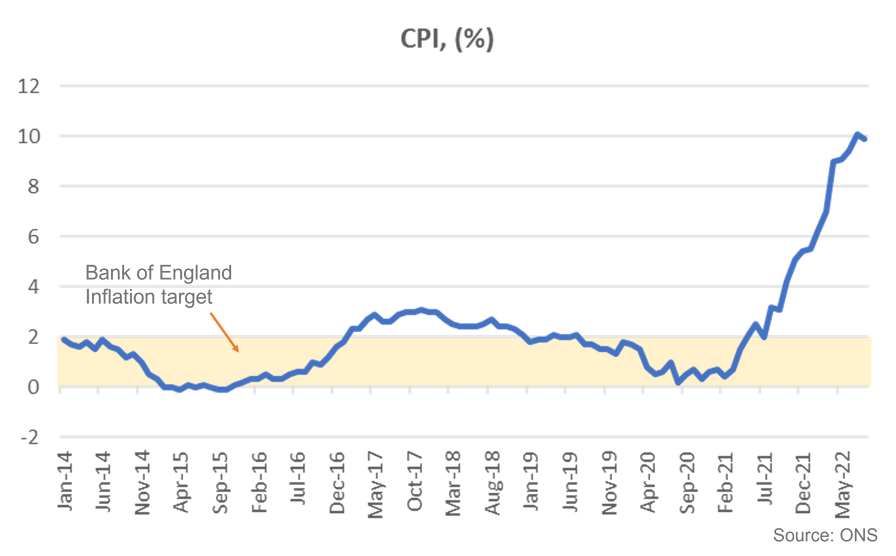

The Bank of England has a problem. It is tasked with keeping inflation below 2%, but inflation is currently somewhat higher than 2%.

The Bank of England believes that raising interest rates will help to bring inflation back under control and return it to the desired 0-2% range.

How will higher interest rates lower inflation?

The Bank of England is hoping that as interest rates rise and increase the cost of borrowing, the additional costs will make consumers and businesses think twice before spending or borrowing more money. The interest charged on bank loans and credit cards will also rise as Bank Rate increases

They also believe that as interest rates rise, there is more incentive to save money rather than spend it.

If the Bank's plan works, demand for goods and services will fall, and shops and businesses may reduce prices to encourage more people to buy and use their services. If prices fall, or stop increasing, the level of inflation will fall.