Today’s Summer Statement needs to plan for the long term, not just a season

The COVID induced social experiment of Working From Home (WFH) ushers in the possibility to turn the Information Age into an Informational Revolution. If Mr Sunak is serious about doing ‘Whatever it takes’ to rebuild and rebalance our nation, he must use today’s Summer Statement to plan for the long term. However, a man with a plan can only go so far on his own, for any long term plan to be successful we will all need to join with Mr Sunak in doing whatever it takes.

It is easy to see why the UK Government is keen to Build Build Build, Get Britain Moving and to help First Time Buyers on the UK housing ladder

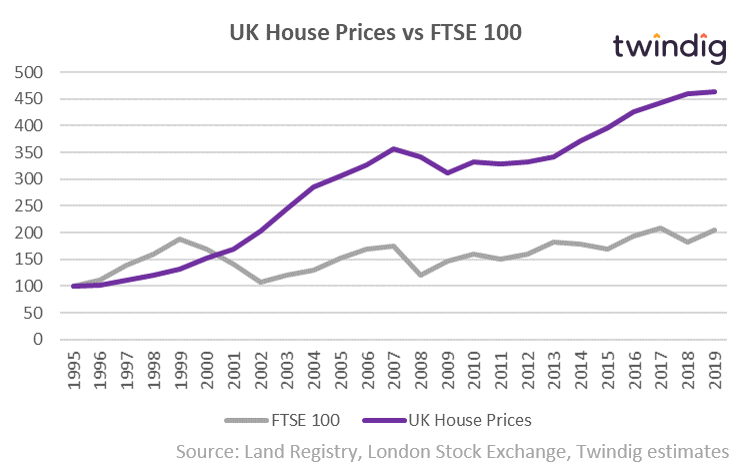

The FTSE 100 index doubled between 1995 and 2019, but average UK house prices increased by more than 4.5 times… Housing not only provides shelter but us also, historically at least, has been a significant source of wealth creation.

If the Tories are keen to hold on to the Red Wall at the next election, rising house prices and increasing homeownership in the labour heartlands would certainly help. Our homes are typically our biggest asset and rising house prices often leads to rising consumer confidence. But to benefit from rising house prices one has to be able to step onto the housing ladder.

The barrier to homeownership is not the level of Stamp Duty but the lack of deposits

In my mind if left unchecked the deposit issue will soon lead to a reality where ‘if your parents do not own their home, then neither will you.’ Without access to the Bank of Mum and Dad, the dream of homeownership for many will not become a reality.

The Government could step in, it has before and it can again, but being true to their call of ‘Doing whatever it takes’ will require deliberate actions to accompany those comforting words.

If this or any future UK Government falls short we risk creating a modern-day housing rich bourgeoisie and a housing poor proletariat and if left unchecked inequality of any kind ultimately hurts us all.

How do you solve a problem like deposits?

Well, it's easy, it already been done: Help to Buy (HTB), and it worked. More homes were built and more families were ‘helped’ onto the housing ladder. What we need to do now is take it to the next level and open it up to the whole UK housing market and not just the new build sector. By all means:

- have regional price caps

- means test applicants so that the policy is based on needs rather than wants and

- use a combination of equity, low-interest loan and mortgage indemnity guarantee

but if we broaden the reach of help to buy we can level the housing playing field and increase the wealth of all.

Yes, it will be costly now, but look to the future, capital typically grows at a faster rate than income. An injection of capital now leads to wealth creation tomorrow and the day after that and the year after that and the decade after that… by seeding nest eggs now we will reduce the call on the public purse tomorrow and given our ageing population that is probably not a bad thing.

Yes, putting more money into the housing market may well lead to house price inflation, but the bank of mum and dad coupled with inherited or gifted housing wealth has already largely divorced house prices from incomes and put homeownership out of reach of many. However, with a responsible needs-based policy and a responsible attitude to lending, we can re-link house prices to incomes.

Could WFH rather than BTO provide HTB?

It is often said that ‘Rent Money is Dead Money’ but the COVID induced Working From Home (WFH) experiment has raised new opportunities for change.

Many business leaders are questioning their need for big offices. Perhaps rent savings from office reorganisations could be diverted employees to either help them get on the housing ladder (deposit assistance) or provide the funds to make their homes more energy-efficient and more suitable for WFH home. Maybe Mr Sunak could nudge business leader’s behaviour down this path via tax breaks.

WFH probably the best infrastructure investment we can make

If we take location out of the working equation, housing wealth has the opportunity to rebalance. If we don’t need to live half an hour from a certain location, we could reverse the trend of urbanisation.

If we invest in high-quality broadband and fibre networks then the information age could lead to the ‘Informational Revolution’ which could have a bigger impact on our society than the industrial revolution which preceded it. Wealth would spread to the regions. This transfer of wealth raises the possibility of increasing affordability in London, South East and other property hot spots whilst enhancing housing and economic wealth across the rest of the country.

A ‘broadband superhighway’ would reduce the need for investment in new roads and railways. WFH reduces the need for travel and we all noticed the benefits during lockdown of air quality whilst we left our cars in the garage.

Plan and act for the long term

Perhaps ‘Doing whatever it takes’ is having the courage to plan and act for the long term rather than the shorter-term electoral cycle.

If we are truly on the cusp of an Informational Revolution we need to plan for the next 100 years rather than the next five.

The Information Age offers us huge opportunities to change how we work, where we live and how we use our homes. The societal shifts could be seismic but they will come at a cost we must all act in the interests of future generations and not ourselves. We must all join Mr Sunak in doing whatever it takes.