UK housing market: Two speed ahead?

At first glance this week’s housing market news makes for pleasant reading, house prices up, mortgage approvals up, mortgage rates down, another housebuilder returning the furlough funds it had received and one building more homes and buying more land. However, once passed the headlines is this good news hiding the emergence of a two-speed housing market comprising the COVID rich (the haves) and the COVID poor (the have nots) and would a two-speed housing market be a good or a bad thing?

It seems to us that for those with money getting access to more money is getting easier, whilst for those without getting more is getting harder. Whilst overall mortgage rates are ticking down, so are lending income multiples, whilst high LTV mortgage rates are rising. The housing market appears to be operating well for the ‘haves’ but not for the ‘have nots’, but those climbing the higher rungs of the property ladder will only be able to get so far without the help of those behind them.

Bank of England

Bank Stats for July 2020 – the compendium of key mortgage market data

What they said

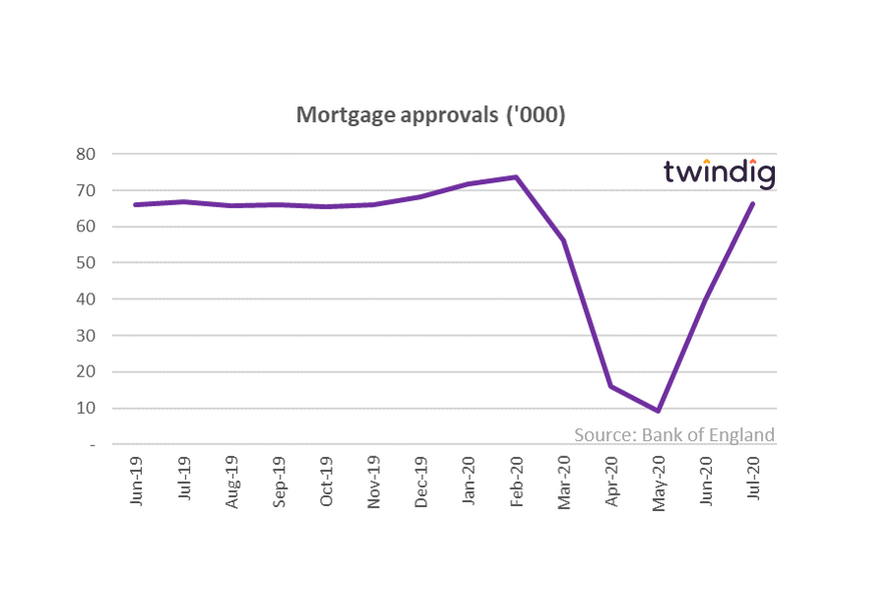

- Mortgage approvals in July 2020 were 66,281 up 66% on June 2020 and down 1% on July 2019

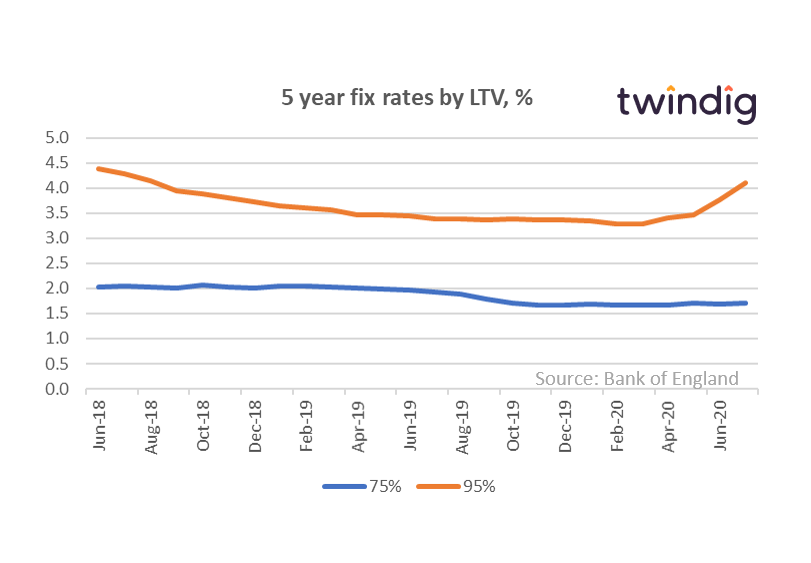

- Mortgage rates High LTV going up lower LTV stable

Twindig Take

UK Mortgage approvals

Bank of England Mortgage approvals for July 2020 were 66,281, just 616 fewer than in July 2019, it appears that when it comes to housing the UK is over COVID-19 and wants to get moving and the housing market recovery is starting to look V-shaped.

UK Mortgage rates

Whilst mortgage rates towards the lower end of the Loan-to-Value (LTV) scale are stable or falling, at the higher end of the scale mortgage rates are increasing at quite a pace LTV. Since March mortgage rates for 2-year fixed-rate mortgages have fallen by 1.5% at the 60% LTV level but increased by 37% at the 90% level products. Turning to 5-year fixed-rate mortgages, mortgage rates have increased by 2% for 75% LTV products but increased by 25% for 95% LTV products. This is perhaps the clearest evidence that a two-speed housing market may be emerging as those with money have easy access to more whilst for those without getting more is getting harder.

Mortgage income multiples – harder access for those who need it most

To illustrate the ‘two-speed’ income multiple we show below mortgage lending guidance from Barclays

What they said

- For single applicants earning more than £75,000 and joint applicants earning more than £100,000 borrowing up to 85 per cent loan-to-value on a repayment basis, Barclays will consider lending up to 5.5 times income.

- For those with a joint income over £60,000 borrowing up to 85 per cent LTV, the loan-to-income ratio will be capped at 5 times income.

- Applicants requiring an LTV over 90 per cent with joint income below £60,000 will be subject to an LTI capped at 4 times income.

Twindig Take

Whilst, for logical and commercial reasons, credit is always easier to get hold of the less you need it, the mortgage market is facilitating the emergence of a two-speed housing market with the COVID rich pitched against the COVID poor, those hardest hit economically by COVID (typically the young, the renters, the would-be first-time buyers) are seeing reduced availability of credit. Again we ask, without a healthy functioning first-time buyer market supporting the higher rungs of the UK property ladder, how long can the current boom last?

Nationwide House Price Index

Bank Stats for July 2020 – the compendium of key mortgage market data

What they said

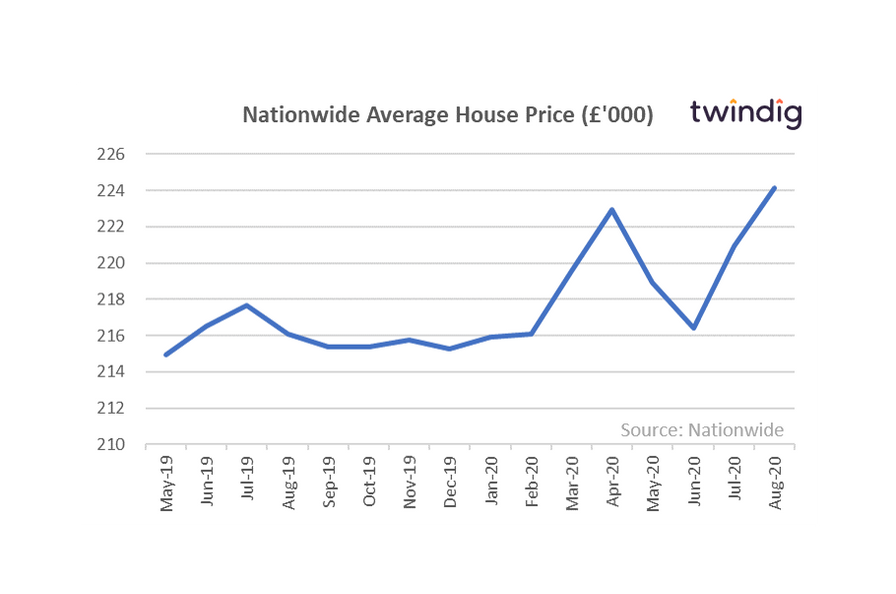

- House prices recover from recent dip to reach new all-time high

- Average UK House Price now £223,123 up 2.0% in the month at 3.7% in the last year

- The biggest monthly increase since February 2004

Twindig Take

It appears that the outworking of the post lockdown pent-up demand shows no signs of letting up in the short term.

BUT. We must not look at house prices in isolation, they should always be considered alongside the context of housing transactions, where transaction levels are low, it could be a case of a lack of supply causing a short term supply and demand imbalance rather than a reflection of a normally functioning housing market. (we comment on housing transactions in the Land Registry section below).

The increase may reflect also reflect a problem, a growing divide in the housing market between the COVID rich and the COVID poor, with the financially secure being able to move as usual whilst others (the deposit poor and first-time buyers) are unable to either secure a foothold on the housing ladder or climb up it. This two-speed housing market theme is echoed, in my view, in recent commentary from Barratt Developments one of the UK’s biggest housebuilders.

Land Registry

The gold standard of house price and housing transaction data

What they said

- Housing Sales volumes in England March 2020: 46,908 (March 2019: 65,206)

- UK House prices: May 2020: £235,673 (annual price change up 2.9%, monthly price change up 0.3%)

Twindig Take

Provisional Land Registry transaction data shows 46,908 housing transactions in March 2020 (the first month of lockdown), which may increase to around 55,000 as more data becomes available. Housing transactions in March 2020 were therefore between 15-30% lower than March 2019.

This suggests a healthy market before lockdown started. Transactions are likely to have troughed in April 2020 and then all eyes will be on the pace of recovery from May onwards as the UK housing market re-opened for business, only time will tell if the recovery is ‘to V or not to V’

The Land Registry House Price index is very accurate, but the price for this whole of market accuracy is time, whilst Nationwide and the Halifax are reporting house prices for August 2020 the Land Registry is reporting prices for May 2020. The good news is that the Land Registry data trends are very similar to those of the other two indices although the Land Registry the prices differ slightly at £235,672 compared to £237,855 and £218,902 from the Halifax and Nationwide respectively for May 2020.

Lloyds Banking Group

First Time Buyer Report

What they said

- First Time Buyer property prices increased 69% in the last 10 years from £142,473 to £241,025

- Total number of first-time buyers at a seven-year low

- Average deposit £47,059 rising to £109,146 in London

Twindig Take

Unfortunately, it is no surprise that first-time buyer numbers are falling, one only has to look at the relative increase in house prices compared to wages and the size of deposits (the average deposit is 25% higher than it was in 2010).

This is our view is further evidence of the two-speed housing market, separating the market between the COVID rich and the COVID poor. For first time buyers unfortunately it is increasingly the case that without access to Bank of Mum and Dad their chances of stepping onto the property ladder are very slim indeed. As a first-time buyer, if your parents don’t own their home you are unlikely to either…

The Lloyds report is further evidence in our view that Help to Buy should be extended as a means-tested benefit to the whole market not just for new build homes.

Barratt Homes

Full-year results year to 30 June 2020

What they said

- Number of homes sold down 29.4%

- Revenue down 28.2%

- Forward order book up 20% by volume up 22% by value

- Concerns about changes Help to Buy and availability of high loan to value mortgages

Twindig Take

Barratt’s results today show the huge scale of the short term negative impact of COVID on the UK housing market, but also highlight the resilience of it with the speed of the bounce back in demand with the forward order book up 20% in volume and 22% in value. The Group is also returning the £26.0m it received under the furlough scheme and this also highlights the strength of the underlying business.

However, Barratt cautions that the housing market needs increased availability of high loan to value mortgages and/or an extension of Help to Buy if the short-term recovery is to be sustained.

In our view, Barratt shares our concerns about the risks of a two-speed housing market comprising the financially secure COVID winners for whom the main impact of lockdown has been lower spending and higher savings and the COVID losers where incomes and savings have fallen.

Berkeley Homes

Trading update

What they said

- House building volumes better than anticipated

- House prices robust and above business plan expectations

- Net cash more than £1bn (before paying £134.3m of dividends to shareholders later this month)

Twindig Take

Whilst the UK Government is struggling to convince workers to get back to the office, housebuilder Berkeley Group is having no such problems as it builds more homes than it initially anticipated, opens more sites and is operating at efficiency levels of around 90%. With demand for homes robust and house prices firm Berkeley is also looking to buy more land. It seems that for Berkeley at least the housing market recovery is starting to look v-shaped and with more than £1bn of cash sitting on the Balance Sheet even if that ‘V’ turns into a ‘U’ Berkeley has the resources to ride out the storms.