UK housing market: The Market is strong for those who can get a mortgage

The theme of this week's housing news was if you can finance it, you can buy it. Housebuilders MJ Gleeson and Redrow reported strong sales through Help to Buy. Gleeson’s price point is in the sweet spot of Help to Buy and is confident about its future, whereas Redrow, which sells a more aspirational product raised concerns about how the upcoming changes to Help to Buy may temper housing supply. The Building Societies Association reported that whilst housing market confidence was at a four-year high, worries about job security were the biggest barrier to buying a home followed by mortgage availability. With the furlough scheme drawing to a close and mortgage rationing becoming ‘a thing’ the current housing market recovery has some challenges ahead.

MJ Gleeson

The low cost / affordable new homes builder focusing on brownfield sites in the North of England and Midlands published its annual results this week

What they said

- Number of homes sold down 30% to 1,072 homes

- Profit Before Taxation down 86% to £5.6m

- Average selling price £130,900 (2019: 128,900)

- 84% of sales to First Time Buyers

- 66% of sales used Help to Buy

Twindig take

MJ Gleeson is focused on the affordable end of the first-time buyer market, a market under served by the majority of participants in the UK housing market. In a world where many cannot secure a foothold on the housing ladder MJ Gleeson provides a soothing tonic.

First time buyers take note, the company believes that it is substantially cheaper to buy a Gleeson home than rent with a typical three-bed in the same area. A Gleeson home can cost as little as £76 per week with a Help to Buy mortgage compared to renting a three-bed home which costs around £138 per week in the private rental market. The Company also points out that a working couple on the Minimum Wage can buy a home on any Gleeson Homes development site.

The closure of the UK housing market severely impacted Gleeson’s performance in the year to 30 June, but as the market re-opened orders started to grow. Gleeson started the new financial year with an order book up 52% on the prior year. In a world where mortgage supply appears to be rationed the demand for help to buy qualifying first time buyer homes is high and Gleeson is placed firmly in that market sweet spot.

Redrow

National Housebuilder publishes full year results

What they said

- Legal completions (home sales) down 37% to 4,032

- Profit Before Taxation down 66% to £140m

- Total order book £1.42bn up 39%

- Clouds on the horizon due to looming changes to stamp duty and help to buy

Twindig take

Redrow’s results had three clear messages: COVID had a profound negative impact on the results in the year to June. Underlying demand is strong and it starts the current financial year in a strong position with a record forward orderbook (up 39%), BUT reduced availability of high loan to value mortgages and future changes to Help to Buy and the end of the Stamp Duty holiday may pour cold water on the housing market recovery.

Redrow pointed out that whilst underlying demand for new homes is strong, it is also dependent on the availability and affordability of high loan to value mortgage products and these are becoming increasingly scarce.

The Group’s average selling price is £330,400 rising to £386,700 excluding affordable housing against the UK national average house price of £237,834 (as reported this week by the Land Registry). Redrow’s products are at a higher price point and less focused on first time buyers than MJ Gleeson’s. Redrow’s sales therefore are more reliant on a smoothly operating second-hand market as many of Redrow’s customers are trading up and more of their homes will fall outside the remit of Help to Buy when the Help to Buy rules change. The negative implication of the change in Help to Buy rules is that it may lead to a reduction in new homes being built

Land Registry

The gold standard of house prices and housing transaction data

What they said

- UK house prices rose in June 2020 to £237,834 up 3.4% in the last year and up 2.7% in the last month

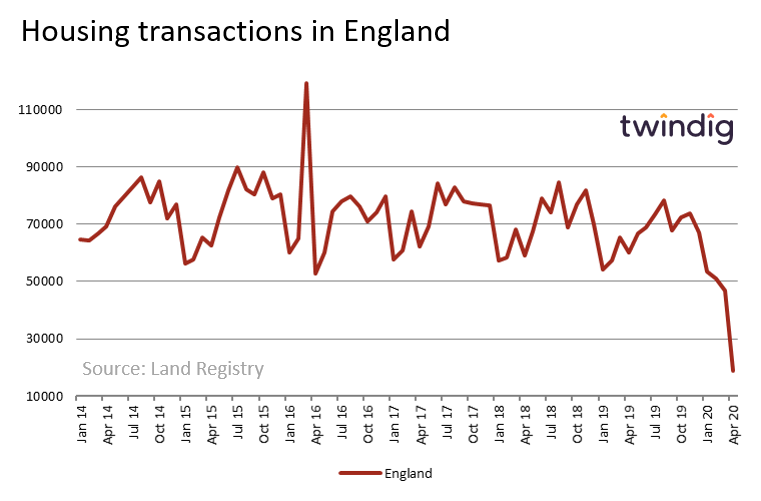

- Housing transactions in April 2020 were just 18,917 a fall of 68% from April 2019 (60,107) and a fall of 60% from March 2020

Twindig Take

The UK is not short of house price indices. The Land Registry’s is in our view the most accurate, but the accuracy comes with a time lag and this week’s house price data is in-line with that from the Halifax and Nationwide house price indices. It therefore adds little new to the debate, rather it underpins the growing weight of evidence that house prices are rising.

The transaction data is new and this points to why house prices are rising, it is not due to a strong economy (no surprises there), but rather an imbalance of supply and demand. In April 2020 the UK housing market was shut and only 18,917 housing transactions were completed – those nearing completion as lockdown came into force.

A decline in housing transactions shields house prices from large falls, but it is housing transactions rather than house prices which make the housing market go round. If we want the UK housing market to return to good health it is more important that for housing transactions to rise than house prices.

Building Societies Association

Publication of their latest Property Tracker

What they said

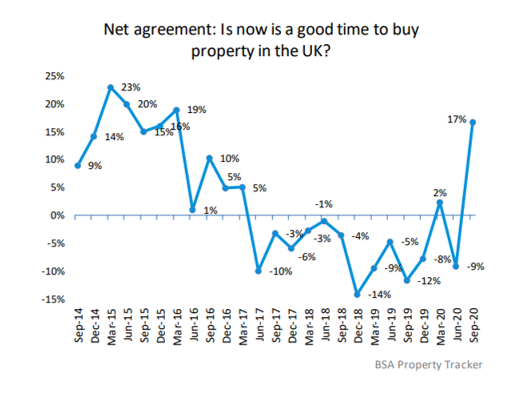

- Housing market sentiment rebounds – now at highest level since March 2016 (before the EU Referendum)

- Stamp Duty Holiday savings likely to lead to rising house prices

- Housing transactions may fall as Stamp Duty Holiday ends

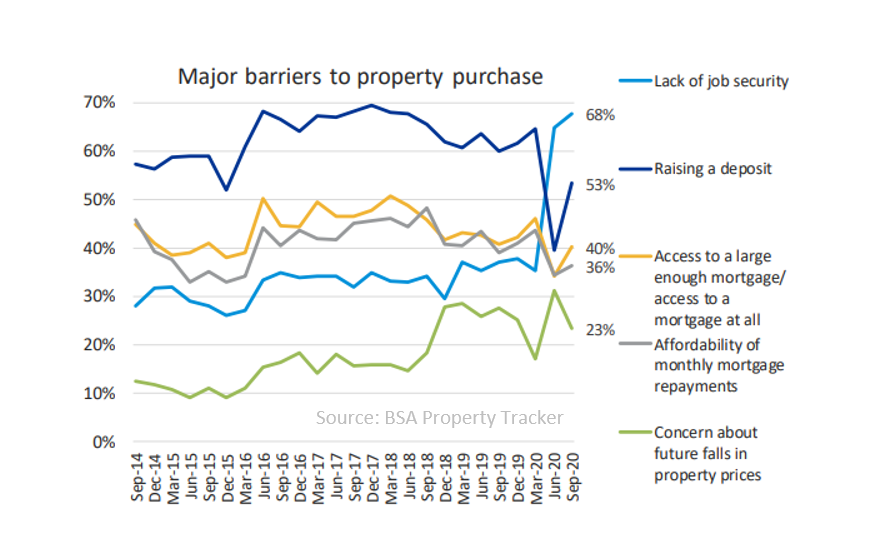

- Lack of job security biggest barrier to property purchase

Twindig Take

Housing market sentiment often goes hand in hand with house prices, much like investors in the stock market, all is well if prices are rising. There is also a sense that pent up demand, not just from lockdown, but also the demand which has been building since the EU Referendum has been unleashed by the end of lockdown and the start of the Stamp Duty Holiday. This is good news, however, the confidence on which the housing market recovery is being built may be on shaky ground...

...The Building Societies Association (BSA) also reports that fear of unemployment or lack of job security is the biggest barrier to property purchase and with the furlough scheme ending soon these fears may be realised and the mini-housing boom may also end with it. They also report that securing mortgage deposits and mortgage availability are the second and third largest barriers to buying a home. Issues likely to be exacerbated by mortgage rationing and rising unemployment. If we through in the prospect of a wave of local lockdowns the outlook for the UK housing market may not be as rosy as the BSA data suggests.