UK housing market: All rise: House Prices, mortgage approvals and mortgage rates

This week we learned that house prices, mortgage approvals and unfortunately mortgage rates all went up. Whether or not this is good news depends on which rung of the property ladder you are on. It is good news for those on the ladder, but not so good for those trying to get on it. The pace of mortgage rate growth accelerates as the loan to value ratio (LTV) of the mortgage sought increases. This penalises the deposit poor and suggests that although house prices are currently rising, lenders continue to see house price falls on the horizon.

Bank of England Mortgage approvals

Mortgage approval data for August 2020

What they said

- There were 84,715 residential UK Mortgage approvals in August 2020

- This is 28% higher than during July 2020

- This is 29% higher than during August 2019

Twindig take

We were genuinely surprised that mortgage approvals increased so much in August 2020, an increase was expected, but not of this size. Mortgage approvals in August 2020 were at their highest level since October 2007, which was almost 13 years ago... The chart below put this figure in historical context.

Time will tell if we are seeing just the outworking of housing transactions put on hold during the lockdown, a rush to move before the next lockdown or the start of a prolonged recovery in the number of housing transactions. Are these figures too good to be true..?

It will be interesting to see how many of these ‘approved’ transactions actually complete. Our market intelligence suggests that this large wave of transactions is flooding the engine rooms of conveyancers across the country and the desire to move may be higher than our ability to process all of the necessary legal paperwork.

A mortgage approved today typically leads to a housing transaction in three months time. We will keep a keen eye on what’s going on and keep you updated in future editions of our Market View.

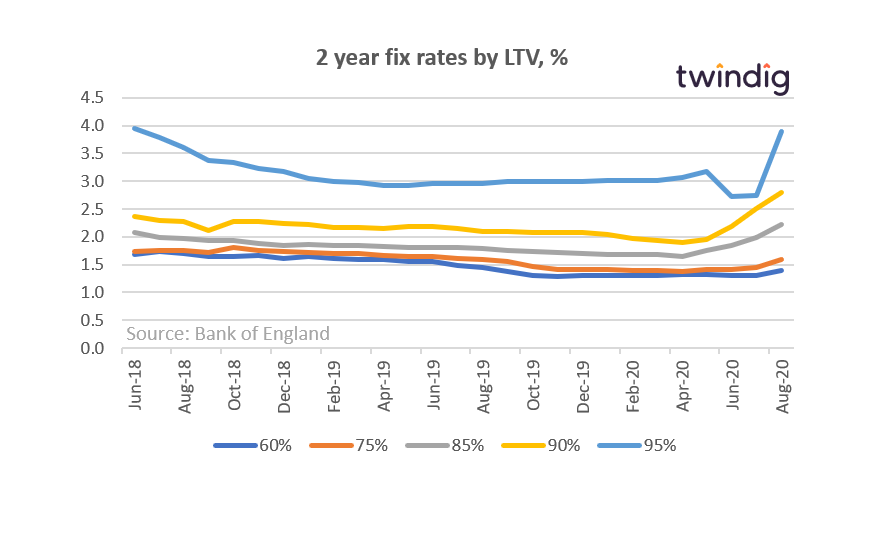

Average mortgage rates

Bank of England data on mortgage rates for August 2020

What they said

- Average mortgage rates for 2-year fixed-rate 95% LTV mortgages rose by 116 basis points from 2.74% to 3.90% an increase of 42%

- Average mortgage rates for 2-year fixed-rate 60% LTV mortgages rose by nine basis points from 1.30% to 1.39% an increase of 7%

Twindig take

We are continuing to see an emerging trend of a two-speed housing market between the equity rich and the equity poor. The cost of entry to the UK Housing market for those with small deposits is rising at a much faster rate than for those with large deposits.

First Time Buyers, especially those without access to the Bank of Mum and Dad will be finding it increasingly difficult to get a foot on the housing ladder and the Stamp Duty Holiday only compounds their problems by ‘levelling’ the playing field against them.

We must continue to ask why mortgage rates are increasing in a period of very, very low underlying interest rates. There are two possible answers: either lenders are overwhelmed by demand and can therefore seek to increase their profits or they fear that house prices may be lower in the future than they are today. The increases in mortgage rates reflect the increased risk of mortgage lending into a UK housing market where lenders expect house prices to fall in the future.

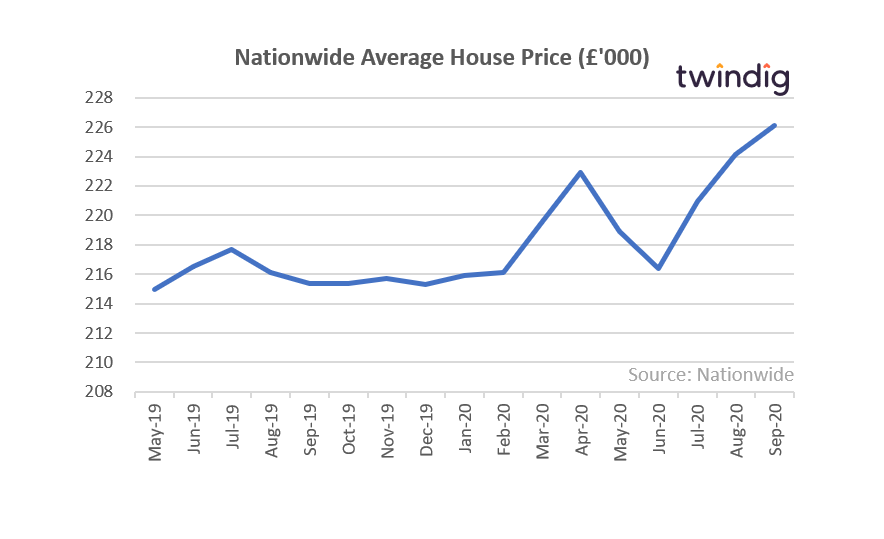

Nationwide House Prices

The UK’s largest building society and provider of the long-running Nationwide House Price Index

What they said

- House prices rose by 0.9% in September 2020

- Annual House Price Inflation running at 5.0% the highest since Sep 2016

- The pandemic is spurring more people into action than it is putting off people moving home with older households more likely to be considering a move than younger ones

Twindig take

The Nationwide data comes hot off the heels of record August mortgage approvals and is further evidence that housing demand is much stronger than we had thought it would be.

COVID has certainly given people time to take stock and many established households have reassessed their housing needs. Whereas pre-COVID most people home moved within a five-mile radius of their existing home, now according to Nationwide, 35% are looking to move to a different area and not surprisingly nearly 30% are looking to move to gain access to a garden or outside space. There is also a shift away from urban areas, especially among older age groups.

House price growth in large cities and close to town centres may therefore lag house price growth in smaller towns and village/rural locations. London may experience house price falls. This shift in house prices may work in the favour of younger and first-time home buyers who are more likely to want to buy in urban centre locations than older households who are wanting to move out.

As already noted mortgage availability and mortgage costs are growing issues for first time buyers and if the first time buyer pool shrinks so will the pool of potential housing transactions, especially those reliant on the sale of a home to a first time buyer.

The elephant the room remains transaction levels. We believe that house price growth is underpinned by a shortage of supply. As the furlough scheme comes to an end, rising unemployment may take some of the heat out of the UK housing market. Should we return to a full lockdown then the music will stop, and the housing market merry go round will come to an abrupt halt.