UK housing market: A fragile recovery?

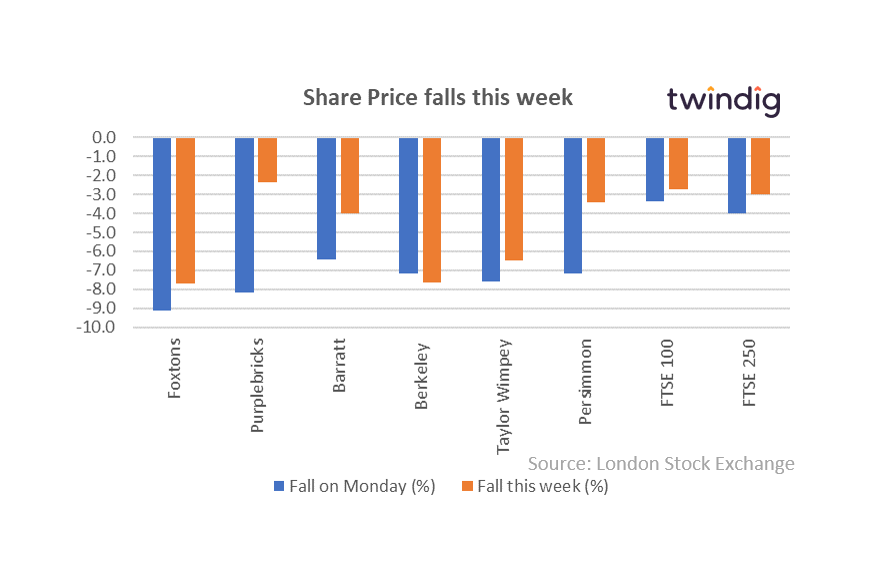

The general thrust of UK Housing market data over recent weeks has been positive, house prices are rising and the volume of housing transactions is building. However, this week did we get a glimpse of how fragile the UK housing market recovery is? When word of second waves and tightening lockdown restrictions hit the news wires on Monday the stock market saw the share prices of housing-related stocks fall significantly. They have recovered a bit but still finished the week down around twice as much as the FTSE 100 and FTSE 250 suggesting that the foundations of the housing market recovery may be being built in the sandpit rather than on bedrock.

HMRC Housing Transaction Data

Provisional housing transaction data for August 2020

What they said

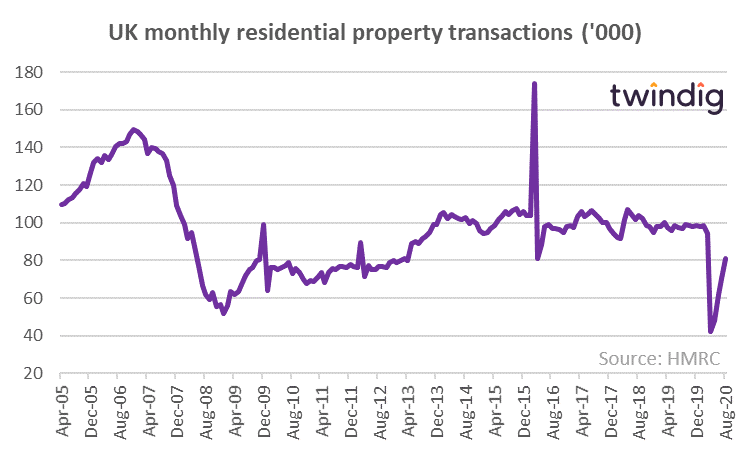

There were 81,280 UK residential transactions in August 2020, This is 16.3% lower than August 2019 and 15.6% higher than July 2020

Twindig take

We have now seen UK residential housing transactions increase for four months in a row, which is very good news for the UK housing market and in particular for those looking to move home.

Housing transactions are still around 20% lower than their pre-lockdown levels and whilst it is still too early to assess the full impact of the Stamp Duty Holiday estate agents and housebuilders alike are reporting it has supported a recovery in housing transactions.

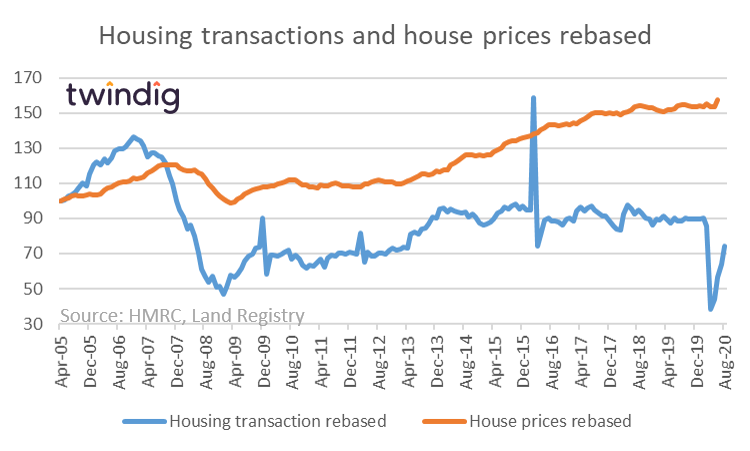

However, we continue to believe that the Stamp Duty Holiday is also supporting house prices with stamp duty ‘savings’ allowing homebuyers to offer a higher purchase price. The second chart below shows the relative performance of house prices and housing transactions, the former appears to us to be unaware of the global pandemic. We also expect to see a spike in housing transactions as the Stamp Duty Holiday draws to a close next year.

The minor tweak in social distancing rules is unlikely to have a major impact on the UK Housing market, however following the UK Government’s change in advice about working from home (moving in short order from good to bad to good again…) we could see further increase in demand for homes outside of city and urban centres, with outside space, fast broadband and suitable spaces from which to work from home.

A fragile recovery?

The chart below shows the share price moves for a selection of UK estate agents and housebuilders alongside the performance of the FTSE 100 and FTSE 250 stock market indices. What is striking is how much larger the falls were for the residential stocks than the market as a whole.

The large falls on Monday (the blue bar) were a reaction to the news that the UK Government was considering tightening lockdown restrictions in the light of the significant rise in the number of Coronavirus cases.

These falls suggest that investors believe that the UK Housing market will be hit harder by a second wave of Coronavirus than the economy as a whole, which itself has been hit pretty hard. The Stamp Duty Holiday may not be enough to get Britain moving...