Twindig Housing Market Index 9 July 23

In the week that saw the Halifax House Price Index fall by 0.1% and 'market' expectations of Bank Rate rise to 6.5% the Twindig Housing Market Index fell by 2.1% to 63.7 this week.

House prices stable

This week the Halifax reported that average house prices in June fell by 0.1% to £285,932, the third consecutive monthly fall. Whilst several newspapers picked up on the fact that the annual fall of £7,575 is the largest since June 2011, few mentioned that house prices at the end of June were up by more than £4,200 since the start of the year.

Average house prices remain more than £45,000 higher than their pre-Covid lockdown levels and we continue to believe that house prices will not fall significantly this year.

Mortgage rates continue to rise

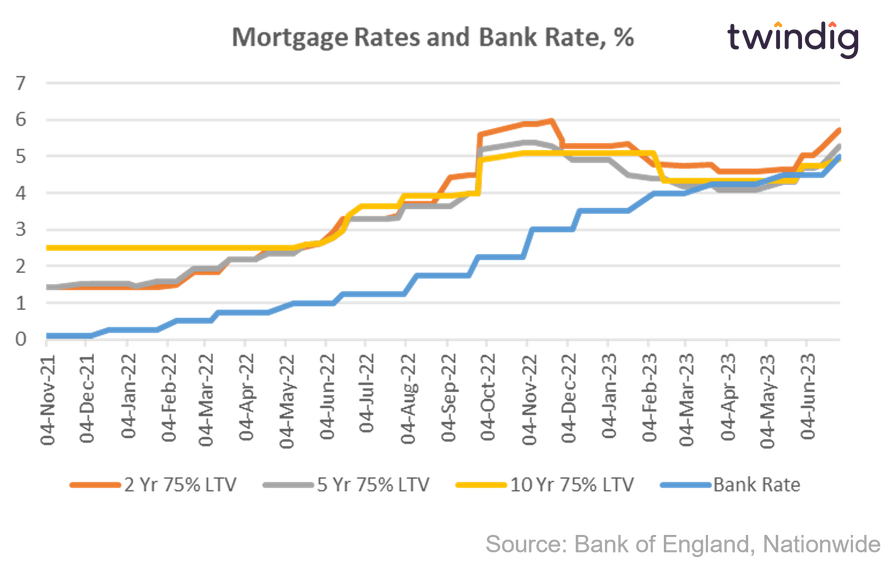

We show in the chart above the quoted mortgage rates for 2-year, 5-year and 10-year fixed-rate mortgages at Nationwide for First Time Buyers with a 25% deposit (75% LTV mortgages). Mortgage rates have been quick to rise as Bank Rate increased.

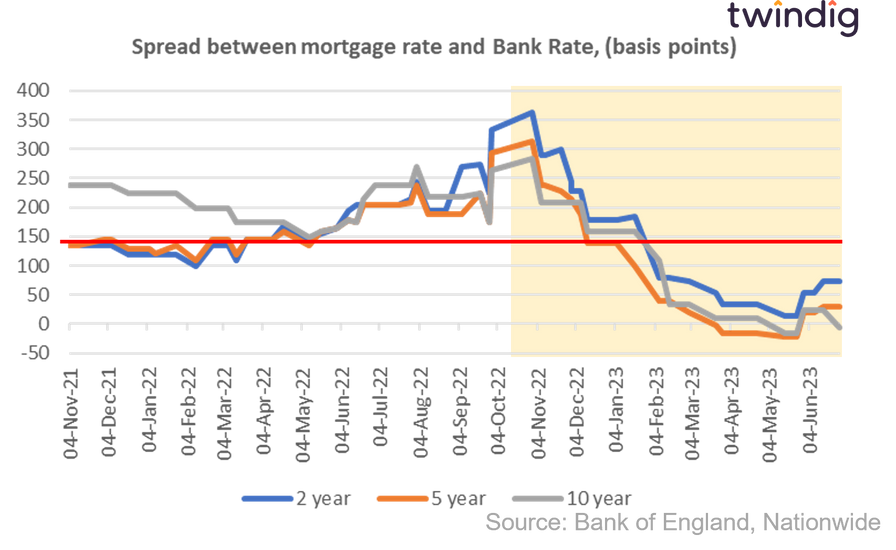

However, although mortgage rates have been on a generally upward trajectory since the first increase in Bank Rate, the spread (or gap) between the mortgage rates and Bank Rate has narrowed. This means that mortgage rates have not increased as much as Bank Rate has. We show the narrowing spread in the chart below:

Perhaps the silver lining in the mortgage rate cloud is that rates could have been higher today if they followed the same path as Bank Rate.

There has been much chat among residential investors this week about how high mortgage rates may go, and whilst we don't know, we take heart that in November, and December last year and January, February, March and April this year mortgage rates did start to fall as it appeared that inflation was under control. Our take here is that although mortgage rates are rising again, those increases may soon be reversed if inflation starts to fall and the level of economic uncertainty starts to reduce.