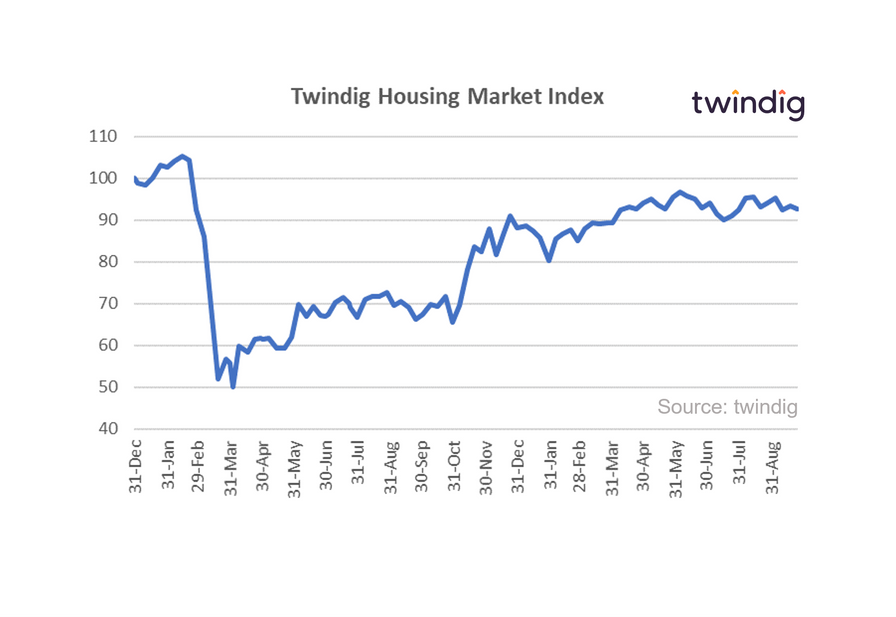

Twindig Housing Market Index (HMI) - 25 September 21

The Twindig Housing Market Index nudged down by 0.8% this week to 92.5 as the latest housing market data revealed that housing market transactions bounced back in August and the Bank of England unanimously decided to keep Bank Rate at 0.1%.

The minutes from this month's MPC meeting reveal a mixed picture for the UK economy. The pace of global economic recovery slowed during the last month and the Bank of England has revised down its Q3 2021 GDP expectations to reflect the growing level of constraints in the supply of goods. However, although official estimates of retail sales have weakened somewhat, other indicators of spending have generally remained at strong levels, as has consumer confidence.

Mortgage market indicators continue to improve, the spreads on mortgages of loan to values of 75% and lower are similar to their pre-pandemic levels and the number of mortgage products available continues to rise. However, the availability of higher loan to value mortgages remains contained and their cost higher than before the pandemic.

The furlough scheme is due to close at the end of the month raising the level of uncertainty in the labour market. However, so far there have been few signs of any increase in redundancies, and the stock of vacancies has increased further, as have indicators of recruitment difficulties. The Bank of England also estimates that underlying pay growth has picked up, to above its pre-pandemic rate.