Twindig Housing Market Index 1 July 23

In the week that saw house prices firm, mortgage approvals ticking up and the UK narrowly avoiding recession the Twindig Housing Market Confidence Index increased by 1.1% to 65.1, as residential market investors saw more reasons to be cheerful than unhappy.

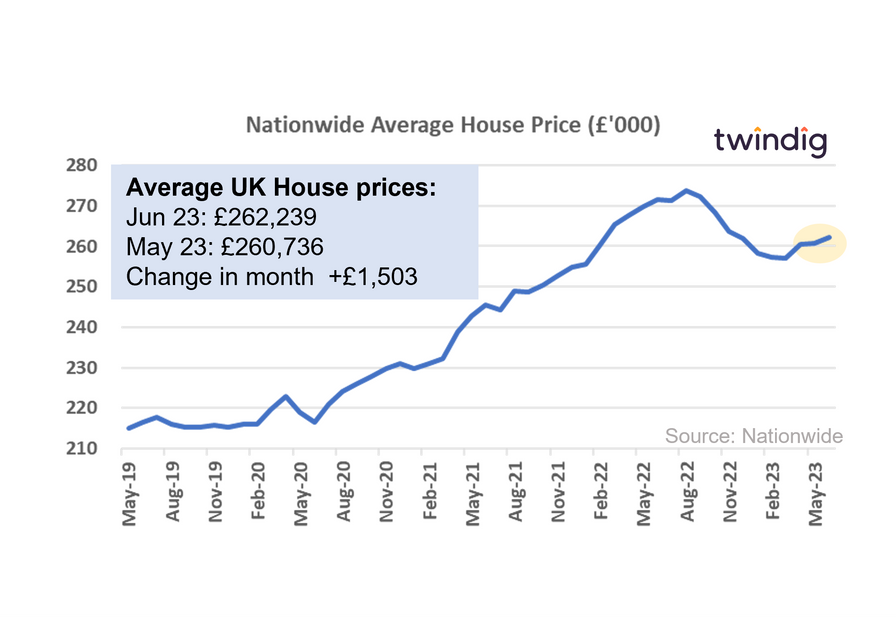

House prices reassuringly robust in June

UK house prices continue are proving to be incredibly firm against the backdrop of the cost of living crisis and rising mortgage rates.

Many would have expected larger falls in house prices by now, as Bank Rate hit its highest level since September 2008 in June this year.

Our own view is that the impact of rising mortgage rates will be seen more in a reduction in the level of housing transactions themselves rather than house prices themselves. We appreciate that rising mortgage rates make homes less affordable, and increase the level of deposit required to buy a home, but in our view, this is not a new problem. Deposits were a barrier to entry before mortgage rates started to rise, the recent increases have just heightened an existing barrier.

Mortgage approvals on the up

It seems to us that mortgage approvals are finding a new equilibrium at around (or just above) 50,000 (the three-month average is 50,500), this is somewhat below the 10-year average of 66,448 and the 20-year average of 71,900, but the market prefers stability to volatility.

At 50,000 mortgage approvals per month and assuming that cash buyers remain at current levels we currently have a run rate for housing transactions of around one million, which is c.16% below the 5-year average.

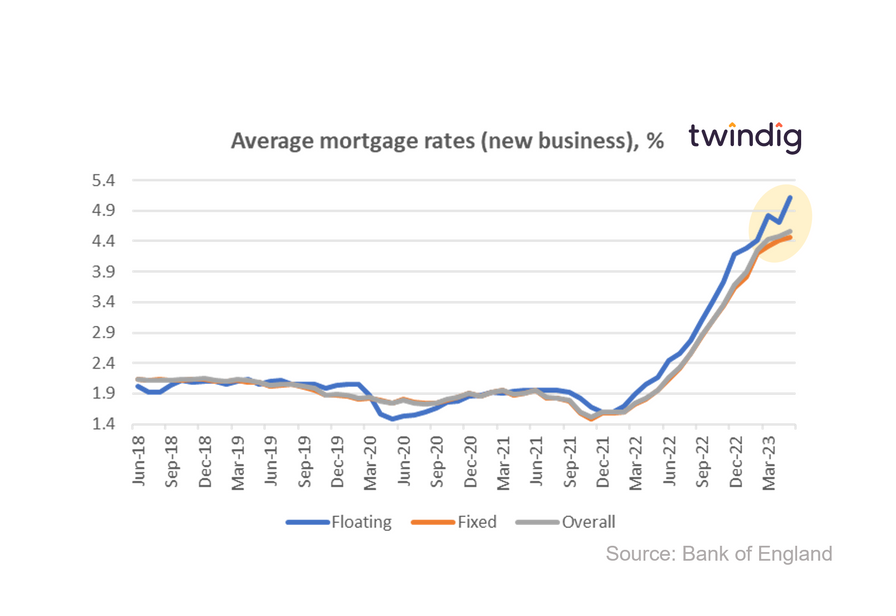

Mortgage rates on the up

The latest data from the Bank of England revealed that overall average mortgage rates for new business increased again in May 2023, with a particularly big leap for floating-rate mortgages

The average floating mortgage rate for new business was 5.11%

The average fixed mortgage rate for new business was 4.47%

The average overall mortgage rate for new business was 4.57%