How much stamp duty do I have to pay?

The COVID-19 Stamp Duty Holiday is now officially over and Stamp Duty rates have returned to their pre-pandemic levels. This article tells you the new stamp duty rates and links to the twindig stamp duty calculator

Post pandemic stamp duty rates

In England and Northern Ireland, Stamp Duty is paid on the cost above £125,000 if buying a primary residence.

However, if you are a first-time buyer AND you a buying a home costing less than £500,000 there is no Stamp Duty to pay on the first £300,000

BUT if you are a first-time buyer buying a home costing more than £500,000 you will pay Stamp Duty on the cost above £125,000

The Stamp Duty payable on Additional Homes remained at three percentage points above the rates charged for a primary residence.

Use the Twindig Stamp Duty Calculator to calculate the specific stamp duty tax for the property that you are looking at buying in England, Scotland, Wales and Northern Ireland.

Who are the Stamp Duty Holiday Winners?

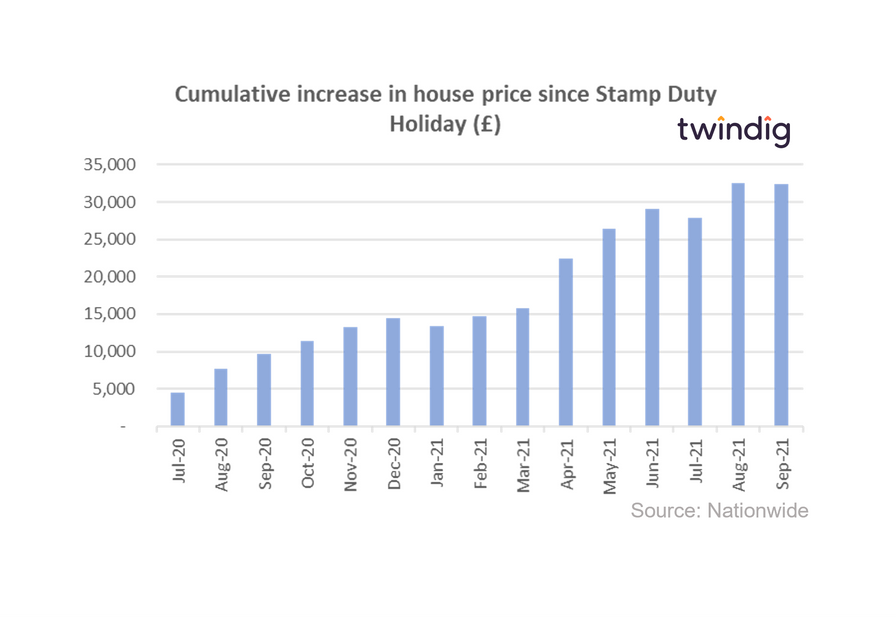

It appears to us that the Stamp Duty Holiday helped home sellers more than it did homebuyers. Since the start of the Stamp Duty holiday in July 2020, the average UK house price has increased by more than £32,000, more than £2,000 per month.

How much stamp duty was saved?

On average at the start of the Stamp Duty Holiday, a homebuyer saved £1,828 which rose to £2,475 by the end of the COVID-19 Stamp Duty Holiday. These are significant savings, but they pale into insignificance when we consider that, on average, house prices have increased by almost £30,000 more than the stamp duty 'saved' and now without the saving homebuyers are needing to find an additional £32,000 to buy their home and an additional £650 for the extra stamp duty.